How bad will it get?

I'm Isaac Saul, and this is Tangle: an independent, ad-free, non-partisan politics newsletter that summarizes the best arguments from across the political spectrum — then my take. First time reading? Sign up here.

Today's read: 11 minutes.

We're covering the rising inflation and how it might impact Joe Biden's plans. Plus, a reader asks about Mark Zuckerberg's influence in the 2020 election, and whether his money changed the outcome.

Inflation might be rising, but the cost of Tangle isn't. We keep our work affordable because we want to be available to as many people as possible. If you haven't yet, please consider becoming a subscriber to support what we're doing — in return, you'll get our special edition newsletters + access to over 500 posts in our archives, the comments section and much more. Just click the button below:

Quick hits.

- The Supreme Court upheld qualified immunity, the legal doctrine that often insulates police from civil liability, in a pair of cases brought before the court. (The ruling)

- The gang in Haiti that kidnapped 17 American and Canadian missionaries has asked for $17 million in ransom for their freedom. (The demand)

- The FDA is planning to allow the "mixing and matching" of Covid-19 vaccine booster shots. (The story)

- Three activists protesting human rights abuses in China sneaked into the site of the flame lighting ceremony for the 2022 Beijing Olympics with a banner that read "no Genocide games." (The protests)

- President Biden is planning to host separate meetings with progressives and moderates today in order to negotiate his legislative agenda. (The talks)

Today's topic.

Rising inflation. Last week, we got the September numbers for consumer prices, and they reflected another month of rising inflation. Consumer prices jumped 5.4% from a year ago, matching the largest single year increase since 2008. U.S. consumer prices rose 0.4% in a month between August to September, with the costs of cars, food, gas and restaurant meals all leading the way, according to the Associated Press.

Note: Inflation is measured with the The Consumer Price Index (CPI), which is designed by the Bureau of Labor Statistics to measure price fluctuations for urban buyers who represent the vast majority of Americans. The CPI tracks 80,000 items in a fixed basket of goods and services, representing everything from gasoline to apples to the cost of a doctor's visit.

The federal reserve has said it expects inflation to be transitory (i.e. temporary), but steady increases have sparked concern from economists. The Fed is also responsible for setting things like interest rates, which can be used to mitigate inflation. If inflation is high, for example, the Fed could increase interest rates, which would dissuade certain spending by contracting the monetary supply — thus slowing inflation (For a simple explanation on this, go here).

“Price increases stemming from ongoing supply chain bottlenecks amid strong demand will keep the rate of inflation elevated, as supply (and) demand imbalances are only gradually resolved,” Kathy Bostjancic, an economist at Oxford Economics, told the Associated Press. “While we share the Fed’s view that this isn’t the start of an upward wage-price spiral, we look for inflation to remain persistently above 3% through mid-2022.”

The higher costs of goods are now outstripping wage gains made by workers who are operating in a tight labor market where they can demand more pay and better benefits. For some, however, inflation is actually good news in the short-term: Last week, the government announced a 5.9% increase in monthly social security checks, effective next month, for the elderly. Benefits will also increase for veterans to keep up with inflation.

Below, we'll take a look at some commentary about inflation from the left and right, then my take.

What the left is saying.

The left is worried about inflation, but has argued that it's not bad enough to halt Biden's agenda and that his policy prescriptions should help.

In The New York Times, Paul Krugman said he is "basically" on "team transitory," but he conceded the data is ambiguous and he might be wrong.

"Yet policymakers can’t just shrug their shoulders; they have to, um, make policy. So what should they do in the face of uncertainty? The answer, I’d argue, is to make decisions that won’t do too much damage if their preferred take on inflation is wrong,” Krugman wrote. “In the current context this means that the Federal Reserve should ignore calls for a quick tightening of monetary policy. Why is it so hard to make a call on inflation right now? Because the current economy, still very much shaped by the pandemic, is, to use the technical term, weird. In particular, the standard measures economists use to distinguish between temporary price blips and underlying inflation are telling different stories.

"Fiscal policy is pretty much off the table: Whatever the fate of President Biden’s spending plans, they aren’t likely to have much impact on short-run economic developments,” he said. “So the question is about Fed policy. Should the Fed raise interest rates soon, to head off inflation, or wait and see whether recent inflation proves transitory? There are risks both ways. If the Fed waits, inflation might become embedded, and bringing it back down again could be painful — though doable. On the other hand, if the Fed raises rates to head off an inflation problem that proves exaggerated, it could damage the economic recovery in ways that are hard to reverse. (Interest rates are still very low, so there would be little room for cuts if the economy weakens.) So wait-and-see looks like the prudent thing to do."

Peter Coy entered the inflation debate by urging people not to blame workers.

"The classic inflation story is that when the labor market is tight, workers demand higher pay, which forces employers to raise their prices, which makes workers want even higher pay, and so on in a vicious circle," he wrote. "Part of that story is true: There are more than 10 million unfilled jobs in the United States, according to the Bureau of Labor Statistics. The percentage of people quitting their jobs — a measure of confidence in being able to find work — hit a record high in August.

Coy presents two charts that show "that workers’ output per hour has risen faster than their pay," he wrote. "That’s reflected in a decline in the unit labor cost, which is an index of the output of goods and services divided by the cost of labor required to produce that output. It shouldn’t come as a surprise that labor productivity remains strong. The U.S. gross domestic product has bounced back to above its prepandemic peak, while the number of workers employed remains millions below the prepandemic level. That simply says that output per worker has grown. Which is great for employers. It means that they don’t need to raise prices to cover higher labor costs."

In The Washington Post, the editorial board said the inflationary threat means Democrats must ensure they pay for their big climate change and infrastructure bills.

"Sen. Joe Manchin III (D-W.Va.), a crucial vote Democrats must get to advance their 'reconciliation' bill, has said that he fears large new federal spending programs would stoke inflation," the board said. "Advocates for the bill have been able to respond, reasonably, that it is not stimulus legislation, in which the government injects borrowed money, much of it from abroad, into the economy to boost flagging demand. Rather, it is a set of structural social and environmental reform programs that Democrats plan to finance with new taxes and savings from prescription drug negotiations. The goal is to make the country fairer and more efficient in the long term. Harvard economist Jason Furman points out that President Biden’s spending plans would net out to provide essentially no added fiscal stimulus.

"But this works only if the bill is paid for as advertised," they wrote. "There is more riding on the Democrats getting this right than whether the nation’s debt will grow larger. For the first time in more than a generation, lawmakers have the serious threat of inflation to consider. Washington’s usual pattern, in which big legislation passes once everyone agrees to load up on more debt, is not an option this time."

What the right is saying.

The right says Biden’s policies are making inflation worse, and should make us reconsider passing trillions of dollars more in government packages.

The Wall Street Journal editorial board said "real hourly wages have declined 1.9% since Biden took office."

"Is inflation still 'transitory,' as the Federal Reserve and White House like to say? Not if you’ve been visiting the grocery store, gas pump, online retailer, or anywhere else across the U.S. economy," the board said. "And not judging by Wednesday’s report on consumer prices for September, which showed the same rapid rate of inflation that has been apparent this year... Remember when used-car prices popped in the spring, and various progressive sages said inflation would vanish when those prices stopped rising? Well, in September used-car and -truck prices fell 0.7%, but the increase in the cost of other goods and services more than made up the difference.

"The debate over transitory or persistent inflation boils down to whether the cause is monetary or pandemic-related supply-chain shortages," the board said. "The supply shortages are real, and the pandemic has obviously played a role. The bond market has until recently been remarkably complacent, which is another argument for the transitory camp. But we learned from Milton Friedman that inflation is always and everywhere a monetary phenomenon. And there’s no question the Fed has been pursuing one of the most radical monetary experiments in history since April 2020. The actions were warranted in the early pandemic days to offset the damage when the government shut down the U.S. economy. But the Fed has kept the same policies for some 19 months even as the economy has regained its pre-Covid level of GDP."

The Washington Examiner said the Biden administration is throwing fiscal accelerant on the inflation fire.

"Biden's apologists try to downplay inflation worries by noting that it's largely confined to specific goods such as used cars," they wrote. "But the latest report shows inflation spreading to every sector of the economy, particularly where inflation can harm people of low income. Gasoline, for example, is up 42% from last year. Bacon, beef, pork, and eggs are all up by double digits. Children’s shoes are up 12%; electricity 5%; rents 2.9%. Inflation is outpacing hourly wage gains, which have risen 4.6% compared to inflation of 5.4%, which means real paychecks are falling, not rising, under Biden.

"Maybe this is why voters tell pollsters they don't support making Biden’s cash giveaways to parents permanent," they said. "Voters are smarter than Democrats think. They know that despite what Democrats say, free money is not really free. Even the Biden administration is forced occasionally to admit this. On a conference call with reporters about the nation’s supply chain crisis, Biden officials acknowledged that March's $1.9 trillion spending bill drove up prices and made matters worse. But despite this admission, congressional Democrats are determined to pour $3.5 trillion worth of fiscal gasoline onto the inflation fire."

In The New York Post, David Harsanyi said this issue could most impact the elderly and the poor.

"Biden has waved away inflation concerns on numerous occasions, once arguing that 'no serious economist' was suggesting that 'unchecked inflation' was on the way," Harsanyi wrote. "This was four months ago. We are now in our sixth month of historic spikes. I’m not sure if Biden considers Larry Summers, former Treasury secretary for Bill Clinton and Barack Obama’s National Economic Council director, a serious economist. But Summers seems to believe runaway inflation and bottleneck supply-chain problems pose a serious risk to the economy.

"For retirees, inflation means instant wealth destruction. For everyone else, it means immediate hikes in the cost of living," Harsanyi said. Gas is up 42 percent over last year, as well — the cost of which is embedded in nearly everything (and counterproductive anti-gouging policies will surely make the situation worse, but that’s another story). This week, the US Energy Information Administration said it expects households to see their heating bills jump as much as 54 percent compared with last winter... This is all quite confusing, as, even now, Democrats are campaigning to pass policies designed to increase the cost of energy by limiting the availability of fossil fuels. Perhaps Biden, unmoored from economic reality, will tell us that higher energy costs are actually good for the economy. But it’s hard to think of anything more unpopular with the electorate than paying a lot for gas or food, high-class problem or not."

My take.

I'm not qualified to tell you whether inflation is going to be transitory or not. And after following this story for the last few months I can confidently say that I have no idea who is. Even the best economists seem to be wrong as often as they are right, and in my reporting career I've found few classes of experts who are more wrong as often as they are. I was heartened to see Paul Krugman, who has been right and wrong about a lot, concede that he really didn't know the answer and approach his thought process from that starting point. But even he couldn't offer much in the way of clarity.

Best I can tell, the experts — regardless of their political persuasion — seem to agree on a few basic things. One, inflation is rising in part due to the absolute chaos taking place in the supply chain. Biden has seemingly tried to address this by calling on some major ports in the U.S. to stay open 24/7. Pandemic fueled supply chain constraints are a global issue, just like inflation, from which we can deduce that this is not just about the U.S. or a U.S.-centric problem.

Two, things are very weird, unprecedented, previously unseen, and hard to parse. There is no historical precedent for this. The global populace just spent a year locked inside, people lost their jobs in droves, and in America, at least, somehow a lot of us came out better off financially on the other end. Huge government spending made that happen, so when the doors cracked open to life as it used to be, we flooded the zone with spending, overwhelming restaurants, factories, gas stations, and all the other conglomerates that supply us with the things we want.

In Bloomberg, economist John Authers pooled what seems to be every inflation indicator known to man and came away with this maddeningly simple conclusion: "The indicators that follow offer our best attempt to sum up the evidence on either side of the debate, and it remains finely balanced." Great.

What I do feel comfortable opining on is the politics of it all. And it's bad news for Biden. Historically speaking, Americans haven't proven themselves keen on understanding the intricacies of supply side demands or Keynesian economics. But here's a simple story: The government is flooding the zone with cash, which is allowing people not to return to their old jobs and inflating the price of goods. That's why your local bar is understaffed and it's why gas prices are so high. Is that the full story? No. But it's not a lie either. And it's the story Republicans are going to tell voters heading into 2022. And it's probably going to work.

When voters go to their local stores for Christmas shopping and encounter empty shelves, who do you suppose they're going to blame? If gas prices break $5 per gallon in your neighborhood, do you think people will loathe Mitch McConnell for it? Of course not. Why would they? Republicans understand this, obviously, and even if Biden's infrastructure plans or child care proposals won't make the problems measurably worse, the state of things only bolsters their point that the Biden administration is flailing.

For the president, that means trouble. Given the ambiguity about what is causing the problem or if there even is one, the response from the Fed will be slow, and there's approximately zero chance Biden backs off the two legacy-defining bills he's trying to land in Congress. So far the president has failed to educate voters about what those bills will do or who they might help. Now he's got one of the most volatile political issues imaginable being dropped into his lap: Everything is getting more expensive. It's going to be a rocky road ahead, and it's tough to imagine it ending well for Democrats (or, for that matter, for us).

Your questions, answered.

Q: Will you be reporting on the story that Zuckerburg donated over six hundred million dollars to a bipartisan organization that went to finance ballot harvesting in the swing states on behalf of Joe Biden. I think it is an important story to get out to help us understand how Biden won the election. I heard this story from Bill O'Reilly. He is one of my trusted sources. BTW, I appreciate your newsletter! I think you are an awesome and honest writer.

— Cindy, Cypress, California

Tangle: So, there are two framings of this story. One came out immediately after the election, when NPR framed Zuckerberg's spending as "what saved" the election. Election officials had an incredibly difficult job in 2020, with more voters to process, more precautions to take, more hoops to jump through, and a much higher budget was needed. Federal and local governments didn't step up, so Zuckerberg did. He gave hundreds of millions of dollars to "non-partisan" organizations who then moved that money to election officials and helped pull off what was an incredibly difficult election to manage.

The second narrative came recently from The New York Post, and is probably where Mr. O'Reilly got his story. In this narrative, Zuckerberg's money bought the election for Democrats by ensuring that counties with high rates of left-leaning voters could handle the massive mail-in surge, help voters cure ballots, perform outreach to get people to the polls, and manage the surge in demand for mail in ballots. The nonprofits Zuckerberg's money went to spent it disproportionately in urban areas in swing states like Pennsylvania, Arizona and Wisconsin, and potentially facilitated the margin of difference in the election.

I think both of these narratives have some merit. What is indisputable is that Zuckerberg's money made a huge difference. In a perfect world, we wouldn't need private donations to be passed through nonprofits and on to local governments just to make sure people's votes are counted. But we live in a world where a pandemic, partisan fighting among state legislators and a dysfunctional Congress left election centers severely underfunded, understaffed, and overwhelmed. Democrats pushed for more funding in nearly all of these places but were rejected by Republicans, who said Democrats attached too many strings (like increased mail-in voting) to the funding. So private actors like Zuckerberg stepped in and filled the gaps.

All this taken into account, I think both things can be true: Yes, Zuckerberg's money definitely ended up helping Democrats. But that‘s because there were just more Democratic voters in areas that were the most underfunded. It's not as if this money produced votes for Biden out of thin air — though it certainly may have helped facilitate them being counted. Again, in my ideal world, everyone who wants to vote would vote without needing the CEO of Facebook to ensure there is enough staff to count their votes. I don't think this news means the election was somehow illegitimate so much as it means our infrastructure for running elections is in dire need of more funding and better support.

Want to ask a question? You can reply to this email and write in (it goes straight to my inbox) or fill out this form.

A story that matters.

The Biden administration announced a three-year initiative to regulate toxic human made "forever chemicals" that experts say pose severe, long-term health risks to millions of Americans. PFAS, or Per- and polyfluoroalkyl compounds, have shown up in water supplies across the country and are found in many commercial products like cookware and food packaging. PFAS do not break down naturally and can remain in the bloodstream indefinitely, and they've been linked to certain cancers and liver damage. Thousands of communities have found PFAS in their water supplies, including more than 400 military bases, and the plan's rollout was met with cheers from environmentalists. The Associated Press has the story.

Numbers.

- 52%. The percentage of Americans saying the government is doing too many things that should be left to individuals and businesses, according to a new Gallup poll.

- 43%. The percentage of Americans who want the government to do more to solve the country's problems.

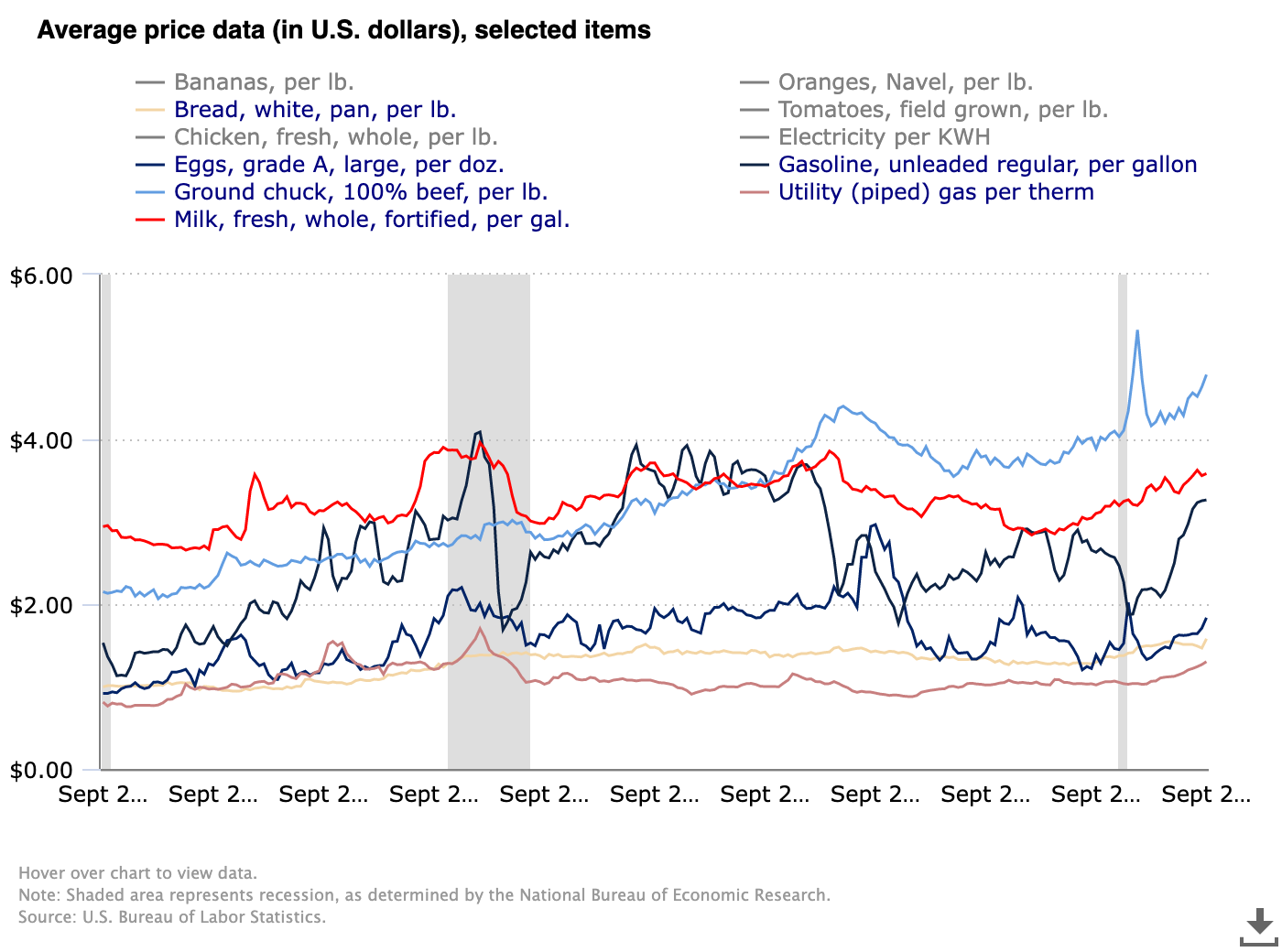

- $1.84. The average cost of a dozen large Grade A eggs in the U.S. in September of 2021, according to BLS.

- $1.33. The average cost of a dozen large Grade A eggs in the U.S. in August of 2020, according to BLS.

- $2.97. The average cost of a dozen large Grade A eggs in the U.S. in September of 2015, according to BLS.

- $3.27. The average cost of a gallon of unleaded gas in the U.S. in September of 2021, according to BLS.

- $2.19. The average cost of a gallon of unleaded gas in the U.S. in September of 2020, according to BLS.

- $2.39. The average cost of a gallon of unleaded gas in the U.S. in September of 2015, according to BLS.

Don't forget: If you want to support our work, there are a few ways to do it.

Become a paying subscriber by clicking here.

Drop something in the tip jar by clicking here.

Spread the word to your friends by clicking here.

Upgrade your subscription by clicking here.

Have a nice day.

In 1993, actor Michael J. Fox launched the Michael J. Fox Foundation for Parkinson’s Research to help research for cures and therapies for Parkinson's disease. This week, Fox announced that his organization has now raised more than $1 billion. While a cure may not be around the corner, Fox says his organization has helped fund many therapies — including some he uses to manage his own Parkinson's. “They are therapies that have made life a lot better for a lot of people,” Fox told Variety. “I enjoy life more. I’m more comfortable in my skin than I was 20 years ago. I can sit down and be calm. I couldn’t do that 25 years ago. That’s the medications, the drug cocktails and therapies that we’ve been a part of.”

❤️ Enjoy this newsletter?

📫 Forward this to a friend and let them know where they can subscribe (hint: it's here).

💵 Drop some love in our tip jar.

🎧 Rather listen? Check out our podcast here.

🛍 Love clothes, stickers and mugs? Go to our merch store!