What will the bill do?

I’m Isaac Saul, and this is Tangle: an independent, ad-free, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

First time reading? Sign up here. Would you rather listen? You can find our podcast here.

Today's read: 13 minutes.

The Inflation Reduction Act. Note: this is one of the largest bills passed by Congress in recent memory. In order to give this story proper space, we are skipping today's reader question.

Quick hits.

- The Biden administration declared Monkeypox a public health emergency. More than 6,600 cases have been reported, with zero deaths. (The emergency)

- Alex Jones, the founder of Infowars, was ordered to pay $4.1 million in damages and $45.2 million in punitive damages to the parents of children killed in the 2012 Sandy Hook school shooting. (The damages)

- U.S. employers added 528,000 jobs in July, and the unemployment rate fell to 3.5%. (The numbers)

- Israeli forces and the militant, Iran-backed group Islamic Jihad continued to clash in the Gaza Strip, with Israel carrying out multiple airstrikes after the group launched 100 missiles into Israel. A tentative cease-fire was called yesterday. (The clashes)

- Indiana Governor Eric Holcomb signed a law banning most abortions after 10 weeks, with exceptions for rape, incest, health risk to the mother and lethal fetal abnormalities. (The ban)

Our 'Quick Hits' section is created in partnership with Ground News, a website and app that rates the bias of news coverage and news outlets.

Today's topic.

The Inflation Reduction Act. After a year of negotiations between Democrats' progressive wing and their more conservative flank, the Senate passed the Inflation Reduction Act 51-50, with Vice President Kamala Harris casting the tie-breaking vote. The measure passed through a special process called reconciliation, which allows bills to move forward with a simple majority rather than the 60 votes usually required. However, the process mandates legislation be strictly related to the budget, which limits what can be done in such bills, and it must undergo an open-ended amendment process.

In order to win over every Senate Democrat, the bill — which began as a $3.5 trillion social spending plan last year — had to be whittled down, amended and adjusted until the very final vote to appease the entire caucus. Sens. Joe Manchin (D-WV) — who agreed to the bill just last week — and Kyrsten Sinema (D-AZ) drove several significant changes in the final hours (more on that below). The bill received no Republican votes.

In the end, the legislation will spend about $430 billion, including $369 billion on energy and climate initiatives and $64 billion on federal subsidies for health insurance through the Affordable Care Act for another three years. It will raise new revenue through taxes on large and profitable corporations as well as increased IRS enforcement.

What is in the bill: First, and primarily, the bill is the largest climate change legislation ever enacted. It invests hundreds of billions of dollars in tax credits and subsidies to drive both consumers and domestic manufacturers toward electric vehicles and wind and solar energy. Many of these tax credits will go to accelerate manufacturing of solar panels, wind turbines, batteries and critical minerals processing, including $30 billion for domestic manufacturing. Consumers can also receive subsidies for special windows, heat pumps and other energy-efficient products, including a $7,500 tax credit for buying electric vehicles. There are also new fees to penalize certain petroleum and natural gas facilities for excessive emissions of the greenhouse gas methane.

On top of tax incentives and subsidies, the bill includes millions of dollars in climate resiliency funding for tribal governments and Native Hawaiians and $60 billion to help disadvantaged areas disproportionately impacted by pollution and climate warming.

Rhodium Group, an independent research firm, estimates that these investments will cut U.S. greenhouse gas emissions 31% to 44% from 2005 levels by 2030. Estimates based on current policy range from 24% to 35%. President Biden aimed to cut emissions 50% by 2030.

Second, for the first time, the bill allows Medicare to negotiate the cost of as many as 10 drugs beginning in 2026 and caps out-of-pocket drug costs for Medicare recipients at $2,000 a year beginning in 2025. It also gives seniors access to free vaccines and extends pandemic-era health care subsidies to purchase insurance through the Affordable Care Act for three more years. The New York Times called it "the largest change to national health policy" since the passage of the Affordable Care Act.

Finally, to pay for the bill, Democrats included a new 15% corporate minimum tax on about 150 large, profitable companies and a 1% excise tax on companies’ stock buybacks, and they invested an additional $80 billion in the IRS to bulk up tax enforcement. While the bill does not raise taxes directly on middle class Americans, higher business taxes can result in smaller profits for shareholders, lower wages to paid workers or layoffs. Economists are deeply divided on how much corporate tax increases impact shareholders, workers and consumers.

Recent changes: The Senate passed the bill on Sunday afternoon after an all-night session where amendments were voted up and down. Over the 15 hours, Republicans attempted to amend the bill with immigration restrictions, changes to the tax policies, and energy provisions, none of which made it into the bill.

However, at the request of Sen. Sinema, Democrats did scale back a corporate minimum tax to shield companies operating under the umbrella of a single owner, which will protect private-equity firms that own those companies. They also relaxed the corporate tax measure allowing companies to accelerate depreciation for tax purposes, then added the 1% excise tax on stock buybacks to make up for the lost revenue. Sinema also got a $4 billion addition to help the Bureau of Reclamation tackle drought remediation in the West.

Sen. Manchin, for his part, insisted the package provide subsidies and credits for oil, gas and coal, as well as nuclear power, which it does. Democrats also agreed to take up legislation to streamline permitting for energy projects later this year, and Manchin fought to include tax credits for carbon capture technology and new oil drilling leases in Alaska's Cook Inlet and the Gulf of Mexico.

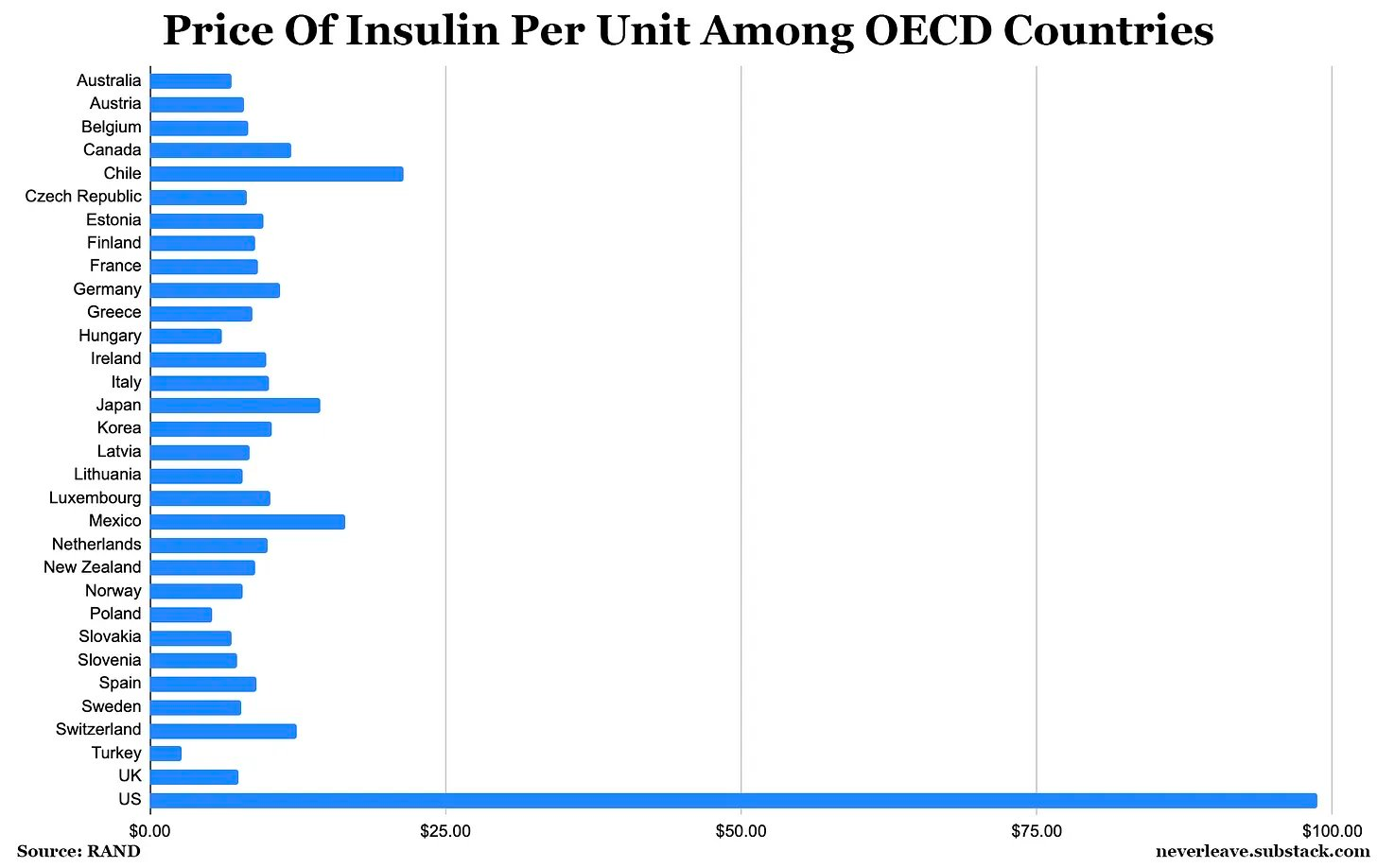

Finally, the Senate parliamentarian (who rules on what can and cannot be included in the reconciliation process) ruled earlier this week that a $35 price cap on the cost of insulin could not be included in the bill through reconciliation. That meant such a cap needed 60 votes to make it into the legislation. On Sunday, seven Republicans — all of whom opposed the bill as a whole — joined Democrats to include the cap, but the rest of the caucus voted against it. That left the measure with just 57 votes, failing to hit the 60-vote threshold, and it was stripped from the bill.

A budget estimate said an earlier version of the bill would raise $740 billion and spend $430 billion over a decade. However, the last-minute amendments meant the Congressional Budget Office (CBO), Congress's nonpartisan scorekeeper, couldn't produce a final analysis before the bill was passed. Previously, the CBO said 90% of the promised deficit reduction would come after 2026. It also estimated that the bill would have a negligible impact on inflation in 2022, and inflation would be between 0.1% higher and 0.1% lower in 2023 due to the measure. A group of 230 economists warned that the bill could increase inflation, not reduce it.

The Democratic-controlled House is expected to break its summer recess on Friday to clear the bill and send it to President Biden for his signature.

Reminder: We covered the rough outlines of this bill last Monday, when Sen. Manchin announced he would vote for it.

Below, we're going to look at some arguments from the right and left on the bill, then my take.

What the right is saying.

- The right is deeply critical of the bill, saying it doesn't do any of what it claims to do.

- Many argue the bill will make inflation worse and increase the prices of energy and health care.

- Some say the bill's limited benefits, like deficit reduction, won't be seen for years.

In The Daily Caller, RNC co-chair Tommy Hicks said the bill was "seriously deceptive and out-of-step with the economic reality" of Americans.

"The Democrat-led bill would without a doubt raise taxes on Americans," Hicks wrote. "According to the Joint Committee on Taxation, Americans making as little as $30,000 would pay more, with over half of the estimated new tax burden in 2023 paid by Americans making under $400,000. To help collect, the bill would double the size of the IRS and further expand the already gargantuan federal government. Obviously, more taxes is the last thing 58% of Americans who are currently struggling to live 'paycheck to paycheck' need. But it’s also the last thing small businesses can stand right now.

"According to the National Association of Manufacturers, in 2023 alone the bill would kill over 218,000 jobs, shrink the economy by $68 billion, and reduce workers’ wages by over $17 billion. Crushing American manufacturing during a Democrat-created recession is a bad idea. Instead, our country needs to be building out our made-in-America infrastructure and creating jobs – not hollowing them out," he continued. "The very title Democrats gave the bill — 'Inflation Reduction Act of 2022' — is a boldfaced lie, and should be reason enough to view the bill as a scam. According to the Penn Wharton Budget Model, the bill would have no impact on inflation. In fact, it would 'very slightly increase inflation until 2024' (emphasis added)... The methane tax in the bill, for instance, would increase natural gas costs by 17% — or $100 a year for the average American family.

The Wall Street Journal editorial board said the bill would make drugs more expensive.

"Democrats who passed the Schumer-Manchin bill on Sunday voted to raise drug costs and health premiums for 220 million privately insured Americans," the board wrote. "That isn’t hyperbole. It’s the inevitable economic result of Medicare drug price controls after the Senate parliamentarian this weekend struck the bill’s inflation rebates. Democrats know their Medicare take-it-or-leave-it drug 'negotiations'—i.e., price controls—could have spill-over effects on the commercial market. This was one argument they made to the Senate parliamentarian for keeping the bill’s requirement that drug makers pay Medicare rebates if they raise prices in the commercial market higher than inflation.

"If drug makers must give Medicare steep discounts on certain drugs, they will compensate by increasing prices in the commercial market. As Connecticut Sen. Chris Murphy told Politico, 'You can’t untangle the private sector from the public sector—one doesn’t work without the other.' This is what has happened in healthcare more broadly," it added. "Medicare has long paid hospitals and physicians below the cost of treating patients. To compensate, hospitals and physicians charge private insurance plans more. Private insurers on average pay about twice as much as Medicare for hospital services and 43% more to physicians... It’s worth noting that overall prescription drug prices have increased a mere 2.5% over the past year and have been flat over the past four thanks to generic competition."

In National Review, Philip Klein criticized the bill for how long its benefits will take to be seen.

"A closer look at a fresh analysis of the bill from the Congressional Budget Office shows that over 90 percent of the promised deficit reduction in the bill would come after 2026 — meaning it would do absolutely nothing to help reduce the current inflation problem," Klein wrote. "The basic mechanics of Manchin–Schumer is that it spends hundreds of billions of dollars on green-energy initiatives and an Obamacare expansion, which is then offset by tax hikes, claimed savings from having Medicare fix drug prices, and increased IRS enforcement. Taken together, CBO expects these measures will reduce deficits by about $305 billion, of which $204 billion would come through the expected boost in revenue from the enforcement provisions.

"But the way the bill is structured, the spending increases occur immediately, while the claimed savings take time to take effect — exactly the sort of 'shell games' Manchin warned about last year when he blasted Democrats for not considering the permanent cost of expanding government programs (as this bill does with Obamacare)," Klein said. "Of the $305 billion in promised deficit savings over the next decade, CBO says just $21 billion will be coming over the next five years, when we’re in the midst of a historic inflation crisis, while the remaining 93 percent of the claimed savings won’t come until after 2026. Whatever else may be said about the bill, the idea that it will help address the current inflation problem is absurd."

What the left is saying.

- The left is supportive of the bill, though they criticize some last-minute changes and concede it may not reduce inflation.

- Others call out the direct help consumers will get on top of long-lasting climate change benefits.

- Some claim the bill will immediately help reduce health care costs in lower income communities.

In The Washington Post, EJ Dionne Jr. said Senate Democrats and Biden struck a blow against cynicism and hopelessness.

"On a straight partisan vote, Democrats approved the largest investment in history to fight climate change married to first steps toward controlling prescription drug costs and helping Americans buy health insurance," Dionne Jr. wrote. "The bill also raised corporate taxes and increased tax enforcement to begin what should be a sustained effort to reform the tax code by way of bringing revenue closer to long-term alignment with spending. Pause for a moment to consider what the world would look like if this bill — expected to pass the House later this week and go to President Biden for his signature — had failed.

"Of course, a lot of good was negotiated away, including, to get Sinema’s vote, a much-needed reform in how hedge-fund millionaires and billionaires are taxed," he said. "Sen. Bernie Sanders (I-Vt.) was entirely right in insisting that this bill falls short of the hopes Biden and his party once had of constructing a sturdier platform of public support for families, children and Americans without health coverage. The measure would have been better had it extended the poverty-fighting child tax credit; built a robust child-care and paid-leave system; and included money for the 2.2 million mostly low-income Americans who lack health coverage because they live in states that refused to expand Medicaid under the Affordable Care Act. But Senate rules are what they are, Democrats have only 50 votes to work with, and Republicans put up a solid wall of resistance."

In CNN, Van Jones and Jessie Buendia wrote about the five ways the bill will help Americans.

"The bill includes tax credits for consumers to buy energy-efficient appliances, switch to clean vehicles, install rooftop solar panels and improve their home's efficiency — all of which add up to lower utility costs. Government research has shown that energy efficiency improvements alone can reduce energy costs by $670 per year for the average household. It is well-documented that low-income Black and Brown communities are impacted the most by the negative effects of pollution and climate change... That's why this bill drives $60 billion in investments to disadvantaged communities with grants and tax credits," they wrote. "To help more working families cut down on transportation costs, this legislation provides a $4,000 tax credit specifically for lower- and middle-income individuals to buy a used clean vehicle — and up to $7,500 in tax credits to get a new one off the lot.

"And there's also $1 billion for communities to invest in clean versions of heavy-duty vehicles like buses and garbage trucks. Even better, with up to $20 billion earmarked for building clean vehicle manufacturing facilities, this bill will create new, high-paying jobs that help even more working families," they wrote. "Smart investments in new technologies also bring new jobs and opportunities, and we want to see those jobs in the communities that need them most.That's precisely what this bill will do by including $27 billion for a clean energy technology accelerator to turn new ideas into thriving businesses with a focus on disadvantaged communities."

In Vox, Ellen Ioanes wrote about what the bill means for you.

"The IRA may not immediately push prices down to pre-Covid levels, and it’s a far cry from the Democrats’ initial Build Back Better plans, but it represents some significant steps forward for dealing with crushing health care costs and the existential threat of climate change," she said. "In addition to cementing Medicare’s new negotiating power, the bill also holds insurance subsidies for the Affordable Care Act through 2025, making health insurance more affordable for the millions of people who are insured through the health care marketplace. The initial subsidies were supposed to end this year, which would have meant increased premiums for the millions of people who qualified for free health insurance when Congress eliminated the income cap to qualify for federal assistance paying premiums.

"While much of the financial incentives for pursuing clean energy and climate change mitigation are geared toward companies, there are rebates and tax credits available for people buying clean energy sources like heat pumps and rooftop solar panels," Ioanes added. "Those measures are aimed at making clean energy more available to more people, although solar panels, for example, cost about $11,000 in 2021 for a household setup. The legislation also offers a $4,000 tax credit for low- and middle-income drivers to buy a used electric vehicle, and up to $7,500 for a new electric vehicle. Additionally, a study by the Rhodium Group estimates that the bill’s provisions will save households an average of $1,025 per year by 2030... the legislation sets out $1 billion in grants to improve energy efficiency in affordable housing. It also provides at least $60 billion in grants for projects like improving air quality monitoring, improving transportation, and deploying clean energy in poor and vulnerable communities, as well as enhancing climate resilience in public housing and for tribal and Native Hawaiian communities."

My take.

Reminder: "My take" is a section where I give myself space to share my own personal opinion. It is meant to be one perspective amid many others. If you have feedback, criticism, or compliments, you can reply to this email and write in. If you're a paying subscriber, you can also leave a comment.

It's a remarkable turn of events for President Biden.

Of course, roughly half the country doesn't support Biden and the Democrats, and his approval ratings are still below 40%. But if you're a member of the Democratic base, the last six weeks have been a pretty stunning turn of events.

Biden signed a bipartisan $280 billion semiconductor chips bill to compete with China, a bipartisan expansion of veterans' benefits (the largest in twenty years), and a bipartisan gun control bill. In Kansas, Democrats got encouraging signs about the midterms, with huge turnout and the rejection of an attempt to remove abortion rights from the state constitution. Gas prices are down for 51 straight days, 86 cents off their record high. Friday's jobs report smashed expectations, Al Qaeda leader Ayman al-Zawahri was killed in Afghanistan, there was a near-unanimous Senate vote to welcome Sweden and Finland to NATO, and now the Inflation Reduction Act is almost law. On top of all that, there are some positive signals on inflation easing.

Will it help Biden’s approval rating? I have no idea. I think that largely depends on how effectively the administration can promote this run to his base, and so far they've been pretty inept at that. But there is no doubt he is getting tangible wins on the agenda he campaigned on.

The politics aside, the bill is decidedly a mixed bag to me. First, it's horribly named. The reality is that Democrats are passing a massive spending bill to address climate change and health insurance, and they've proposed reasonable ways to cover the cost. It's expansive but yet fiscally responsible, in that the revenue raised is clearly laid out and has a reasonable shot of working.

That does not mean it will reduce inflation, and it definitely doesn't mean the deficit is coming down in the near-term (even liberal-friendly economists are skeptical or measured). I said last week the jury was still out on the inflation measures, but now we've got basically all of the independent analyses that we're going to get, and each estimates the inflation benefits will be somewhere between negligibly positive and negligibly negative, both in the near-term and the long run.

My biggest concern about the bill is that a huge chunk of the revenue raised ($124 billion) is purportedly going to come from increased IRS enforcement — enforcement that requires an $80 billion investment. But the image of a super-IRS going after wealthy corporations and rich billionaires who skirt tax laws is not the reality. Instead, the IRS usually spends its money where it is most efficient: Auditing the middle class and the most economically vulnerable taxpayers who can't afford teams of lawyers. According to The Washington Post, More than 4 in 10 of its audits in 2021 targeted recipients of the earned income tax credit, one of the country’s main anti-poverty measures.

The good news is that the CBO estimated the revenue from the IRS funding could be as high as $203 billion, far more than what Democrats initially thought (an unusual occurrence in Congress). That's how they get to $124 billion in revenue (from $80 billion invested). We'll see how it plays out, but a big chunk of the plan relies on this revenue tool.

Last week, I made the case for the climate change measures. And I stand by that case. If anything, it's even stronger now that several of the largest research groups who look at climate policy say it will drastically reduce emissions and lower costs in the long-term. There will be hiccups, and short-term adjustments, but climate change is an issue I feel strongly enough about addressing that I support the short-term bumps.

The health care measures are tougher to parse. You can find fairly convincing arguments that the Medicare price caps will lower or raise costs. Perhaps the simple answer is they will lower costs for people on Medicare and raise them for everyone else. What may have been the biggest win, the insulin price cap (which would have applied across the board), was stripped from the bill by Republicans. That means we'll continue to operate in this absurdity, which leaves 4 out of 5 diabetics in the U.S. who rely on it going into debt:

In the end, though, the bill truly was a compromise bill — at least among Democrats. Reporter Sahil Kapur helpfully annotated everything that hit the chopping block:

Casualties of Build Back Better agenda

— Sahil Kapur (@sahilkapur) August 7, 2022

Universal pre-K

Child care $

Elder care $

Child tax credit $

Housing $

Community college

EITC expansion

Closing Medicaid gap

Immigration

Tax RATE hikes

Millionaire surtax

Ending carried interest

These items were excluded from the new bill.

It's impossible to see into the future. But, what I feel confident in saying is that calling this bill the "Inflation Reduction Act" is silly. So is claiming it is "reckless spending" and a "tax hike on every American." None of those claims, from leaders of either party, is true.

My best attempt at an honest, straightforward description: The bill is a climate change and health care bill with very clear direct tax hikes on profitable corporations to offset the spending. It will almost certainly reduce emissions and, in the long term, bring more green energy onto the grid. Health insurance and drug prices for Medicare recipients and people on the ACA will probably come down. They may go up for others, depending on how private insurers react. Some of the new revenue will come from increased IRS enforcement, which could hit middle and lower-income people hardest. And, of course, corporations are liable to pass on tax hikes with increased prices or layoffs, along with stock shares falling.

A story that matters.

In Washington D.C., city residents are facing a problem that other major cities may soon have to grapple with: Salt in the water. Paved streets, sidewalks and parking lots that need deicing require salt. Washing machines drain sodium-containing detergents into wastewater systems. Industrial firms discharge sodium-laden water. All of these sources contribute to what environmental scientists call "freshwater salinization syndrome," where local waterways and drinking water gain higher concentrations of sodium and chloride. This can impact both wildlife and the humans who consume that water, and urban areas like D.C. are particularly susceptible to its compounding effects. The Washington Post has the story.

Numbers.

- 58%. The percentage of Americans who say they are currently living paycheck to paycheck.

- 30%. The percentage of people earning more than $250,000 per year who say they are living paycheck to paycheck.

- 23,000. The estimated number of jobs lost due to the 15% minimum corporate book income tax, according to the Tax Foundation.

- $16,000-$21,000. The average cost of setting up solar panels on a residential home, as of 2021.

- 30%. The tax credit for installing residential solar panels under the IRA.

Have a nice day.

Australia's Great Barrier reef is showing the highest coral cover it has seen in 36 years, according to a new report. The Australian Institute of Marine Sciences (AIMS) said coral cover in the northern region of the reef rose 36% in 2022, from 27% in 2021. In the central region, it rose to 33% in 2022 from 27% in 2021. After decades of damage, the report is an encouraging sign that preservation efforts might be working. While cover in the southern region of the reef decreased, and future bleaching events could reverse the growth, it was an encouraging sign for some environmentalists. The Guardian has the story.

❤️ Enjoy this newsletter?

💵 Drop some love in our tip jar.

📫 Forward this to a friend and let them know where they can subscribe (hint: it's here).

📣 Share Tangle on Twitter here, Facebook here, or LinkedIn here.

🎧 Rather listen? Check out our podcast here.

🛍 Love clothes, stickers and mugs? Go to our merch store!