I'm Isaac Saul, and this is Tangle: an independent, nonpartisan, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

Are you new here? Get free emails to your inbox daily. Would you rather listen? You can find our podcast here.

Today’s read: 15 minutes.

The Heart Health Conversation America Needs to Have

Let's be honest: most of us aren't proactively thinking about our cardiovascular health.

But it matters. Your cardiovascular system relies on nitric oxide—a molecule that supports healthy circulation and blood flow. Better circulation means better oxygen delivery, which supports energy, performance, and longevity.

The Tangle team recently tried Humann SuperBeets Heart Chews. They feature clinically studied grape seed extract shown to support healthy blood pressure nearly two times more effectively than diet and exercise alone.

It's not a magic pill, but it's a science-based approach that actually fits into daily life.

The Nick Fuentes interview.

Last week, Tucker Carlson released an interview with the far-right commentator Nick Fuentes. The interview has caused a firestorm on the right, dividing the MAGA base over how Carlson handled the interview — and bringing up questions about who should be platformed. But when I listened to the interview, I heard something much more interesting that nobody seems to be talking about: the origin story of one of the country’s most notorious bigots. I thought that story actually offered some important insights, and in tomorrow’s members-only Friday edition, I’m going to share what I learned.

Quick hits.

- BREAKING: Former House Speaker Nancy Pelosi (D-CA) announced she will not seek reelection, bringing her nearly four-decade career in Congress to a close at the end of her current term. (The announcement)

- The Federal Aviation Administration announced that it is reducing air traffic by 10% at 40 major airports in response to air-traffic-controller staffing limitations during the ongoing government shutdown. The reduction will go into effect on Friday. (The announcement)

- The National Transportation Safety Board said that shortly after takeoff, an engine fell off the cargo jet that crashed outside Louisville International Airport on Tuesday. The death toll from the accident is now 12. (The update)

- Rep. Jared Golden (D-ME) announced he will not seek reelection in 2026, citing his concern about rising extremism in politics. Golden’s seat is expected to be a target for a Republican flip in the midterms. (The decision)

- The Department of Homeland Security is reportedly planning to end Temporary Protected Status for nationals of South Sudan after the designation lapsed on November 3. (The report)

- President Donald Trump nominated entrepreneur Jared Isaacman to lead the National Aeronautics and Space Administration (NASA). Trump had named Isaacman as his pick for the position early in his term but pulled his nomination in May. (The nomination)

Today’s topic.

The tariffs case before the Supreme Court. On Wednesday, the Supreme Court heard oral arguments in the consolidated cases of Learning Resources, Inc. v. Trump and Trump v. V.O.S. Selections, Inc., both of which challenged some of the president’s authority to unilaterally issue foreign duties. Trump has justified his broad “reciprocal tariffs” on U.S trading partners by declaring a national emergency under the International Emergency Economic Powers Act (IEEPA), which prompted the legal challenges. The court’s decision could set the precedent for presidential authority over trade and the use of emergency powers.

Back up: In April, President Trump invoked IEEPA when issuing his “Liberation Day” tariffs against most U.S. trading partners, claiming that their trading practices posed “an unusual and extraordinary threat to the national security and economy of the United States.” The 1977 law allows presidents to regulate international commerce during declared national emergencies to address “unusual and extraordinary threats” related to “the national security, foreign policy or economy” of the United States.

Learning Resources, a small business that makes educational toys and depends on outsourced manufacturing, and V.O.S. Selections, a wine importer, sued separately to challenge Trump’s authority to impose the tariffs. In May, the U.S. Court of International Trade ruled that IEEPA did not grant Trump this authority, and the administration appealed to the U.S. Court of Appeals for the Federal Circuit, which upheld the lower court’s ruling. The Trump administration then appealed that decision to the Supreme Court.

After a coin toss to determine the main challenger in the consolidated suit, Learning Resources’s attorney Neal Katyal was appointed to represent the litigants. If IEEPA were to permit Trump’s use of tariffs, Katyal argued, “There would be no meaningful boundary left between emergency powers and ordinary trade regulation.”

Representing the Trump administration, U.S. Solicitor General D. John Sauer told the justices that IEEPA “confers major powers to address major problems on the President, who is perhaps the most major actor in the realm of foreign affairs.”

On Wednesday, a majority of justices appeared skeptical of the government’s argument that the tariffs were a “measured response” to an economic threat that fell well within statutory limits. In addition to the court’s three liberal justices, conservative Justice Amy Coney Barrett was notably skeptical that the IEEPA justified the president’s ability to issue broad and sweeping tariffs. While Justice Alito appeared sympathetic to some of the government’s arguments, the other conservative justices all asked probing questions that left Trump’s tariff agenda in doubt.

Conservative Justice Neil Gorsuch pressed Sauer on the implication of his argument. “What would prohibit Congress from just abdicating all responsibility to regulate foreign commerce, for that matter, [or] declare war to the President?” Gorsuch asked, adding that the argument supported a “one-way ratchet toward the gradual but continual accretion of power in the executive branch.” In another notable exchange, Gorsuch asked Sauer whether a president could claim climate change constituted a national emergency to impose tariffs on gas-powered vehicles. “It’s very likely that that could be done,” Sauer replied.

The court would ordinarily issue its decision by summer of 2026, but it has indicated that it will expedite its review of the case, which could produce a ruling by the end of the year.

Below, we’ll get into what the left and right are saying about the oral arguments. Then, Executive Editor Isaac Saul gives his take.

What the left is saying.

- The left expects the court to rule against Trump, suggesting the government’s arguments revealed the weakness of its position.

- Some say the court’s conservatives will draw the line at imposing taxes without Congressional approval.

- Others argue the court needs to rule against Trump to maintain legitimacy.

In Vox, Ian Millhiser wrote “the Supreme Court might actually stand up to Trump on tariffs.”

“The strongest argument against the tariffs involves the Supreme Court’s ‘major questions doctrine,’ a limit on presidential power that was recently invented by the Court’s Republicans, and that is so new that it has only ever been used against one president: Joe Biden. V.O.S. Selections and its companion case potentially give the Republican justices a chance to legitimize this doctrine by applying it to one of their fellow Republicans — potentially in an opinion joined by all three of the Court’s Democrats,” Millhiser said. “Based on the questions the justices asked on Wednesday, it at least seems more likely than not that Trump’s tariffs will fall.”

“Gorsuch has historically been one of the Court’s most vocal skeptics of laws giving expansive policymaking authority to the executive branch. And he appeared deeply troubled by the scope of the power Trump is claiming in this case,” Millhiser wrote. “Roberts appeared to share those concerns. At one point, he told Sauer that the major questions doctrine appears to be ‘directly applicable’ to this case, pointing out that IEEPA has never been used before to justify tariffs… If any two among Roberts, Gorsuch, and Barrett hew to these views, it is almost certain that the tariffs will fall.”

In Slate, Mark Joseph Stern called the arguments “a bloodbath for Trump.”

“We have spent 10 months waiting to see if, and when, this court would set a limit on Trump’s power. Perhaps we should’ve guessed that its extraordinary deference to this president could be outweighed only by its hatred of taxes,” Stern said. “[Gorsuch had] a straightforward query: ‘Could the president impose a 50 percent tariff on gas-powered cars and autoparts to deal with the unusual and extraordinary threat from abroad of climate change?’ Sauer admitted that he probably could, though he added that Trump would not because he rejects the ‘hoax’ of climate change. ‘I think that has to be the logic of your view,’ Gorsuch said sharply.”

“Justice Brett Kavanaugh emerged as, at a minimum, tariff-curious early on, and grew increasingly active in his defense of Trump’s plan. He kept citing Nixon’s tariffs — a precedent that Barrett so deftly deconstructed — as evidence that Congress did intend to let the president tax imports all on his own,” Stern wrote. “Still, it’s hard to see how this case comes out as anything less than a 6–3 loss for the administration… It sounded as if [Roberts, Gorsuch, and Barrett were] trying to figure out how they’ll rule against Trump: Must they invoke the major questions doctrine, as Gorsuch suggested to Katyal? Or can they rest a decision on the plain text alone?”

In The Atlantic, Idrees Kahloon said “the court must decide if the Constitution means what it says.”

“The Trump administration argues that it can set tariffs however it likes by relying on a maximalist reading of the International Emergency Economic Powers Act. That 1977 law… has been the underlying justification for many American sanctions,” Kahloon wrote. “But no president had ever used IEEPA to impose tariffs before. The only precedent is Richard Nixon’s imposition of a 10 percent ‘import surcharge’ for less than five months after America went off the gold standard and the first Bretton Woods exchange-rate system collapsed. Trump imposed his tariffs by simply declaring America’s trade deficit to be a national emergency.”

“Many other laws explicitly authorize the president to impose tariffs based on national-security concerns, generally after the fuss of a formal investigation… One of them, Section 338 of the Smoot-Hawley Tariff Act, would allow Trump to slap retaliatory tariffs of 50 percent against countries with unfair trade practices,” Kahloon said. “Even so, it matters that the president pursues his agenda through legal and constitutional means. Roberts is a conservative jurist, yes, but he is also an institutionalist who wants to preserve the Court’s independence and legitimacy.”

What the right is saying.

- Many on the right say the arguments did not go well for Trump, and that his case appears to be on shaky legal footing.

- Some argue stopping Trump from exercising a power delegated by Congress would be judicial overreach.

- Others argue Trump can still levy tariffs through different justifications if and when he loses this case.

In National Review, Dan McLaughlin said “Trump’s tariffs are in serious legal trouble.”

“The argument did not go well for Solicitor General John Sauer. That’s not Sauer’s fault; he is a talented oral advocate, and the government’s brief did the best it could to focus the case away from the congressional taxing power and the thin reed of vague statutory language that connects IEEPA’s authority to ‘regulate’ the ‘importation or exportation’ of goods to the tariffs,” McLaughlin wrote. “His problem was twofold. First, he was claiming extremely broad and unprecedented presidential authority, to the point where he acknowledged that Trump’s position could be used by a Democratic president to declare a global climate change emergency.

“Second, his argument depends upon the justices not asking too many close questions about whether the power to tax is really part of the traditional foreign policy powers of the commander-in-chief. After Justice Neil Gorsuch fretted that ‘It’s inherent authority all the way down, you say,’ Sauer was compelled to concede that presidents have no inherent tariff powers,” McLaughlin said. “Chief Justice John Roberts, while naturally sympathetic to executive power and to arguments for judicial deference, was nonetheless (and perhaps predictably) concerned that Sauer was over-reading past precedents.”

In The New York Post, Daniel McCarthy wrote that the case “tests the limits of presidential power.”

“Critics argue the legislation doesn’t authorize tariffs — tariffs are taxes, they say, and the Constitution gives only Congress power to tax. Yet obviously it’s the president who collects taxes, and by giving the president emergency economic powers to deal with international problems, Congress may logically have given the president power to collect tariffs at whatever rate he deems necessary,” McCarthy said. “The law allows the president to go so far as to suspend trade with a foreign country and impose crippling economic sanctions at his discretion. If a president can do that much under IEEPA, he must be able to take the less drastic step of regulating trade through penalties — tariffs — on foreign producers.”

“The IEEPA lets the president — not the courts — make the call about emergencies emanating from abroad. To rule IEEPA itself is unconstitutional would be a breathtaking intervention by the Supreme Court, seizing power not only from the president but from Congress itself,” McCarthy wrote. “If voters don’t like how presidents use emergency powers under IEEPA, they can elect a Congress that will change the law. Two branches have to cooperate to give the president this power, and the people have to stand behind them. To countermand the president, the legislature and voters themselves would damage the court’s own legitimacy.”

In The Washington Examiner, James Rogan argued that the ruling “will matter for the Constitution, not tariffs.”

“If Congress intended to give presidents the kind of sweeping authority Trump claims, it would have said so explicitly. The nondelegation doctrine, a bedrock principle of constitutional law, forbids Congress from transferring its core powers, such as taxation, to the president,” Rogan said. “The authors of the Constitution gave Congress control of the purse for a reason: to prevent any one person from wielding too much power. A Supreme Court ruling in Trump’s favor would effectively gut this constitutional safeguard. Trump will very likely lose this fight.

“Still, that does not mean he is out of options. Congress has already provided the executive branch with other legal tools to impose tariffs under specific conditions. Under Section 232 of the Trade Expansion Act of 1962, Trump can impose tariffs to protect strategic industries,” Rogan wrote. “The real significance of this case lies not in its short-term economic impact but in its constitutional implications. Upholding Trump’s claim would hand future presidents near-total discretion to impose taxes under the guise of emergency powers.”

My take.

Reminder: “My take” is a section where I give myself space to share my own personal opinion. If you have feedback, criticism or compliments, don't unsubscribe. Write in by replying to this email, or leave a comment.

- I already thought the court would strike down Trump’s tariffs, and now I’m all but certain it will.

- The court moves so slowly that unraveling the impacts of the existing tariffs will be difficult.

- The policy has raised more revenue with less inflationary impact than critics predicted, but it was still enacted illegally.

Executive Editor Isaac Saul: Yesterday’s oral arguments went about as I expected.

If you take a step back and look at how each justice approached Trump’s argument, you see broad skepticism. That skepticism reveals just how hard it would be for the Supreme Court to thread the needle on this issue, even if the court were in the tank for Trump (which it isn’t). During Biden’s term, the court struck down his student debt cancellation program and his Covid-era eviction moratorium because of the ‘major questions doctrine,’ a relatively new legal principle. According to this doctrine, the executive branch can’t enact programs that have “vast economic and political significance” without explicit authorization from Congress.

Trump’s tariffs have not been approved by Congress, and they inarguably have larger economic and political consequences than either Biden-era program the court struck down under that doctrine. It would be totally, utterly, completely incompatible with precedent to let Trump’s unilateral tariffs pass that test.

To illustrate the implications of the power Trump is seeking to use, Neil Gorsuch asked whether a future president could “impose a 50-percent tariff on gas-powered cars and auto parts to deal with the unusual and extraordinary threat from abroad of climate change.”

Solicitor General Sauer then argued that yes, a future administration could probably impose tariffs under such an emergency. It was a remarkable argument to hear a Republican administration put forward before the Supreme Court — all to preserve these tariffs.

Here’s what I wrote a couple months ago when we covered the legal battle over the tariff fight for the second time:

There is no national emergency on trade. To me, this story is as simple as that. Our trade policy is the product of decades of Congressionally approved decisions made by a succession of past presidents (including Trump!) from both sides of the aisle. While it’s fair to question if these policies have hollowed out American manufacturing, made us more reliant on foreign countries for essential goods or offshored jobs, saying the current state of affairs — the strongest economy in the world — constitutes a “national emergency” is absurd. Full stop.

I stand by my prediction from a few months ago: If this ends up before the Supreme Court, Trump will lose. I do not see how the court could possibly decide a president has the unilateral power to tariff hundreds of nations without Congress, after this same court has ruled that presidents cannot unilaterally cancel student loans or regulate greenhouse gas emissions (as it did under Biden). And, for what it’s worth, I think it’s a good thing for the courts to reject all of these executive power grabs.

Yesterday’s arguments affirmed that read: There is no emergency. Trump’s “reciprocal tariffs” are unconstitutional. I think (and hope) the court will stop him. Consider the events of the last few weeks alone: Trump slapped a 10% border tax hike on Canada in retaliation for the government of Ontario running a television ad quoting Ronald Reagan’s criticism of tariffs. What emergency was Trump addressing here, a snarky political ad?

The most frustrating aspect of this entire tariff debacle is just how slowly the court moves, and how much leeway that pace gives the administration. It’s good that the court is patient and deliberate, but it can also be problematic because much of what it rules the government can’t do has already happened. And, given how the court tends to deliberate, this policy could remain in place for months. But if the court does strike down the tariffs, what happens then? Will the federal government have to pay this tariff revenue back to the parties suing? What about all the lawsuits this will invite? Could Congress be invited to retroactively ratify the already enacted tariffs before the court stops them from continuing? Several justices wondered about these possibilities aloud, and none seemed to have a great answer.

Of course, this is not the court’s mess to clean up; it’s Trump’s. Yet the potential complications of a decisive ruling against him may lead the court to issue a more limited, narrow ruling. These are the knots that form when the president tries to unilaterally impose an economic policy onto every nation in the world without Congressional approval. This is the blowback. It has the potential to be an albatross around the neck of everyone who forged and pushed for and enacted these tariffs — which is why you don’t rest your whole economic policy on a faulty foundation.

But remember: This challenge doesn’t consider all of Trump’s tariffs, and the president will still have other options to pursue his tariff agenda. For instance, he can impose levies on specific industries based on a national security authority, and I’m sure the administration will find new justifications to expand those kinds of levies. That’s all well and good because that would be legal — and even though they may face some court challenges, industry-specific tariffs would, obviously, be more targeted and less broad.

In some ways, the court’s sluggishness has been fortunate, because the tariff program has yielded some interesting results. So far, it has been both less harmful and less fruitful than critics (including me) or supporters of the policies predicted. The U.S. Treasury was on pace to collect $34 billion in October, which would equal about $400 billion over a full year (the administration predicted $750 billion to $1 trillion in new revenue by next June). At the same time, the domestic manufacturing boom that tariffs were supposed to catalyze hasn’t come to pass and isn’t likely to, either. Instead, companies are just moving manufacturing from countries like China to those with lower tariff rates like Vietnam, Mexico, or Turkey.

On the other side, inflation has been real but not catastrophic. U.S. companies paying full tariffs are passing an estimated 50–70% of those costs to consumers. Since corporate profit margins were already so high, they aren’t hitting consumers with the full burden. The result, according to Goldman Sachs, is that consumer spending has remained robust while tariffs have raised the closely watched core personal consumption expenditure by an estimated 0.44% this year. By December, the inflation reading is expected to tick up to 3%. This is not good, but it isn’t catastrophic either.

All this is to say: I’m curious how tariffs actually play out with a little more time. The policy’s implications, and the upside, have been a lot more complicated than the doomsday scenarios many economists predicted — at least so far. Maybe that economic crash is coming, and the courts are saving Trump from himself. But the tariffs are, at least, raising significant revenues without destroying the economy.

Unfortunately, it doesn’t look like we’ll get to see the long-term impacts of this policy — not because the court is overstepping, but because Trump chose an illegal path to pursue it. It’s the Supreme Court’s job to stop that, and in doing so, it would provide another example of the president’s executive overreach producing a poor policy outcome.

Take the survey: How do you think the Supreme Court will rule? Let us know.

Disagree? That's okay. My opinion is just one of many. Write in and let us know why, and we'll consider publishing your feedback.

Your questions, answered.

Q: How have things in California fared since the state passed Proposition 36, also known as “The Homelessness, Drug Addiction, and Theft Reduction Act?”

— Staff reminder, November 2024

Tangle: In last year’s election preview, we covered California’s Proposition 36, a “tough on crime” statewide ballot initiative that proposed increased penalties for some thefts and certain drug crimes. Among other provisions, Prop. 36 automatically classified a crime involving $950 or less of stolen goods by an offender with two or more prior theft-related convictions as a felony, increased the maximum prison or jail sentence for these crimes from six months to three years, and mandated drug and mental health treatment for people convicted of certain crimes.

Californians voted yes on Prop. 36, reversing aspects of 2014’s Proposition 47 that reclassified some crimes — including some drug possession — from felonies to misdemeanors.

This criminal justice reform was enacted six months ago, so we now have preliminary data on how the changes are impacting the Golden State — but not a lot. So far, roughly 9,000 people have been charged with a treatment-mandated felony, according to California’s Judicial Council. Nearly 15% of them, or 1,290 people, elected treatment. 771 have begun that treatment, and 25 have completed it. These numbers indicate that many people are still in treatment, but also that many have dropped out. More than anything, the incredibly small sample indicates that it would be premature to evaluate the program.

Furthermore, California is still developing its policy for how to execute the new laws, and different counties are adopting very different approaches. Southern California’s Orange and Kern Counties have prosecuted larger numbers of drug cases as felonies, while Alameda and Sacramento Counties are prosecuting felony theft; others, like San Francisco and Fresno Counties, aren’t prosecuting many felonies at all.

We were eagerly awaiting this early data to see how California’s new approach to drugs and theft would fare, but what we’re seeing so far is incomplete. We’ll really want to see how recidivism rates, reports of crime, and treatment completion percentages change in the coming years to get a better picture of the new policy’s impact.

Want to have a question answered in the newsletter? You can reply to this email (it goes straight to our inbox) or fill out this form.

Under the radar.

In the coming days, the Trump administration is expected to announce a deal with drug manufacturers Eli Lilly and Novo Nordisk to lower the price of their GLP-1 weight loss medications in exchange for Medicare coverage for the drugs for some beneficiaries. Under the reported terms of the deal, the price of the medications will drop to as low as $149 a month (the current list price is over $1,000 a month), although it is not known whether this price would apply across insurance types. If finalized, the deal would be one of the most significant agreements reached through President Trump’s effort to lower prescription drug prices to comparable rates with other developed nations. NBC News has the story.

Blood Pressure Support That Actually Shows Up in Studies

Most of us aren't thinking about cardiovascular health—but we should be.

Humann SuperBeets Heart Chews feature clinically studied grape seed extract that supports healthy blood pressure nearly two times more effectively than diet and exercise alone.

Science-based support that fits into daily life.

Get 15% off with code TANGLE15.

Numbers.

- $90 billion. The approximate amount that the Trump administration has collected from its tariffs through August.

- 17.9%. The overall average effective tariff rate as of October.

- 9.1%. The average effective tariff rate if the Supreme Court invalidates tariffs levied under the International Emergency Economic Powers Act (IEEPA).

- +150%. The percent change in the amount of tariff revenue collected in FY2024 vs. FY2025.

- $7 billion. Customs duties collected in January 2025.

- $30 billion. Customs duties collected in September 2025.

- 0.5%. The estimated percent that U.S. real GDP growth would slow in 2025 and 2026 with the current tariffs in place, according to the Yale Budget Lab.

- 0.1%. The estimated percent that U.S. real GDP growth would slow in 2025 and 2026 if the tariffs levied under the IEEPA are invalidated.

The extras.

- One year ago today we covered Donald Trump winning the presidential election.

- The most clicked link in yesterday’s newsletter was Rep. Marjorie Taylor Greene’s (R-GA) criticism of the government shutdown.

- Nothing to do with politics: The Scandinavian countries that don’t have a word for ‘please.’

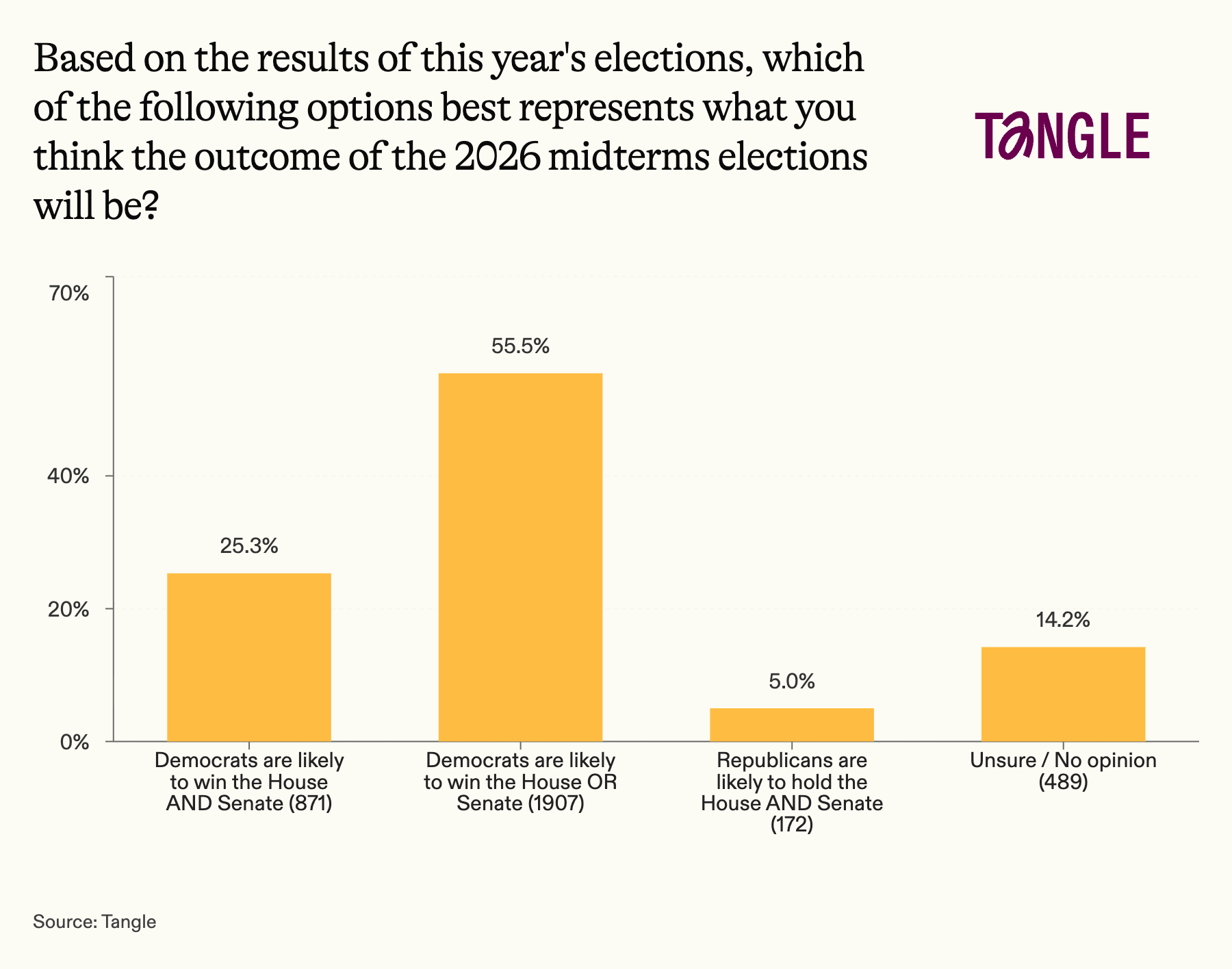

- Yesterday’s survey: 3,439 readers responded to our survey on the implications of Tuesday’s elections with 56% saying they think Democrats will take back the House or Senate in 2026. “Only IF the economy tanks. It’s the economy, stupid. Always is,” one respondent said. “Dems will win the House, not the Senate,” said another.

Have a nice day.

For over thirty years, the island nation of Sri Lanka was embroiled in civil war. When the war ended in 2009, hundreds of thousands of Sri Lankans remained displaced from their homes partly due to the dangers of unexploded bombs and land mines. But this year, the HALO Trust — a British nonprofit that works to clear landmines — announced that it had reached a milestone: 300,000 landmines removed and 120 square kilometers of land cleared. Thanks to their efforts, 280,000 displaced people were finally able to return to their lands and homes. Good News Network has the story.

Member comments