Plus, a question about the "recon tour" of the Capitol.

I’m Isaac Saul, and this is Tangle: an independent, ad-free, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

First time reading? Sign up here. Would you rather listen? You can find our podcast here.

Today's read: 12 minutes.

We're covering the Fed's rate hike and inflation. Plus, a question about the alleged "recon tour" of the Capitol.

See you tomorrow?

Tomorrow, in our subscribers only edition, I'm going to be writing about Ray Epps — the man at the center of many theories around January 6. Epps has been accused of being everything from an FBI informant, to a provocateur who pushed people to storm the Capitol, to a regular old Trump supporter who organically showed up on Jan. 6 in D.C. to object to the election. He has been featured on Fox News and invoked by Republican members of the Senate and House as proof that Jan. 6 was a “false flag” operation. In the last few weeks, I've gotten dozens of emails asking me to write about his story. Be sure to check your inbox tomorrow around noon EST.

Quick hits.

- President Biden announced another $1 billion in funding for weapons that will be sent to Ukraine. (The funding)

- Dr. Anthony Fauci tested positive for Covid-19. The 81-year-old director of the National Institute of Allergy and Infectious Diseases said he had mild symptoms and was being treated with Paxlovid, an antiviral medication. (The virus)

- An FDA advisory panel approved the use of Pfizer and Moderna Covid-19 vaccines for children between the ages of six months and four years old. (The approval)

- The Buffalo, New York, shooter has been charged with 26 counts of federal hate crimes and weapons violations for allegedly killing 10 people in a grocery store. (The charges)

- President Biden signed an executive order aimed at protecting LGBTQ people from conversion therapy and expanding access to mental health resources for LGBTQ people. (The order)

Our 'Quick Hits' section is created in partnership with Ground News, a website and app that rates the bias of news coverage and news outlets.

Today's topic.

The Federal Reserve rate hike. Yesterday, the Federal Reserve approved the largest interest rate increase since 1994 and signaled it would continue lifting interest rates as it attempts to slow the economy and combat inflation. The rate hike was 0.75 percentage points, and The Fed expects to raise rates four more times this year.

Reminder: Interest rates represent the cost of borrowing. When the Federal Reserve raises interest rates, it makes borrowing money more expensive. Banks will pay more to borrow money, then charge customers more to borrow the money they have borrowed. When interest rates go up, fewer people can afford mortgages, fewer businesses can borrow money to expand, and the economy slows down. It can make the borrowing costs of credit cards and auto loans higher, too. In short, interest rates impact many Americans by making credit card debt, mortgages and loans more expensive.

Inflation: Inflation is measured with the Consumer Price Index (CPI), which is designed by the Bureau of Labor Statistics to measure price fluctuations for urban buyers, who represent the vast majority of Americans. The CPI tracks 80,000 items in a fixed basket of goods and services, representing everything from gasoline to apples to the cost of a doctor's visit. There is also the core CPI, which is a basket of prices that excludes energy and food, which are the most volatile.

Right now, inflation is high, so the Fed is raising interest rates in hopes of cooling off the economy — while trying not to set off a recession (a period of time when the U.S. economy shrinks, which causes higher rates of unemployment). The Fed also revised upward its expectation for inflation rates to 3.4%, an increase of 1.5 percentage points. And it cut its 2022 economic outlook from a 2.8% growth in Gross Domestic Product (GDP) to 1.7% growth.

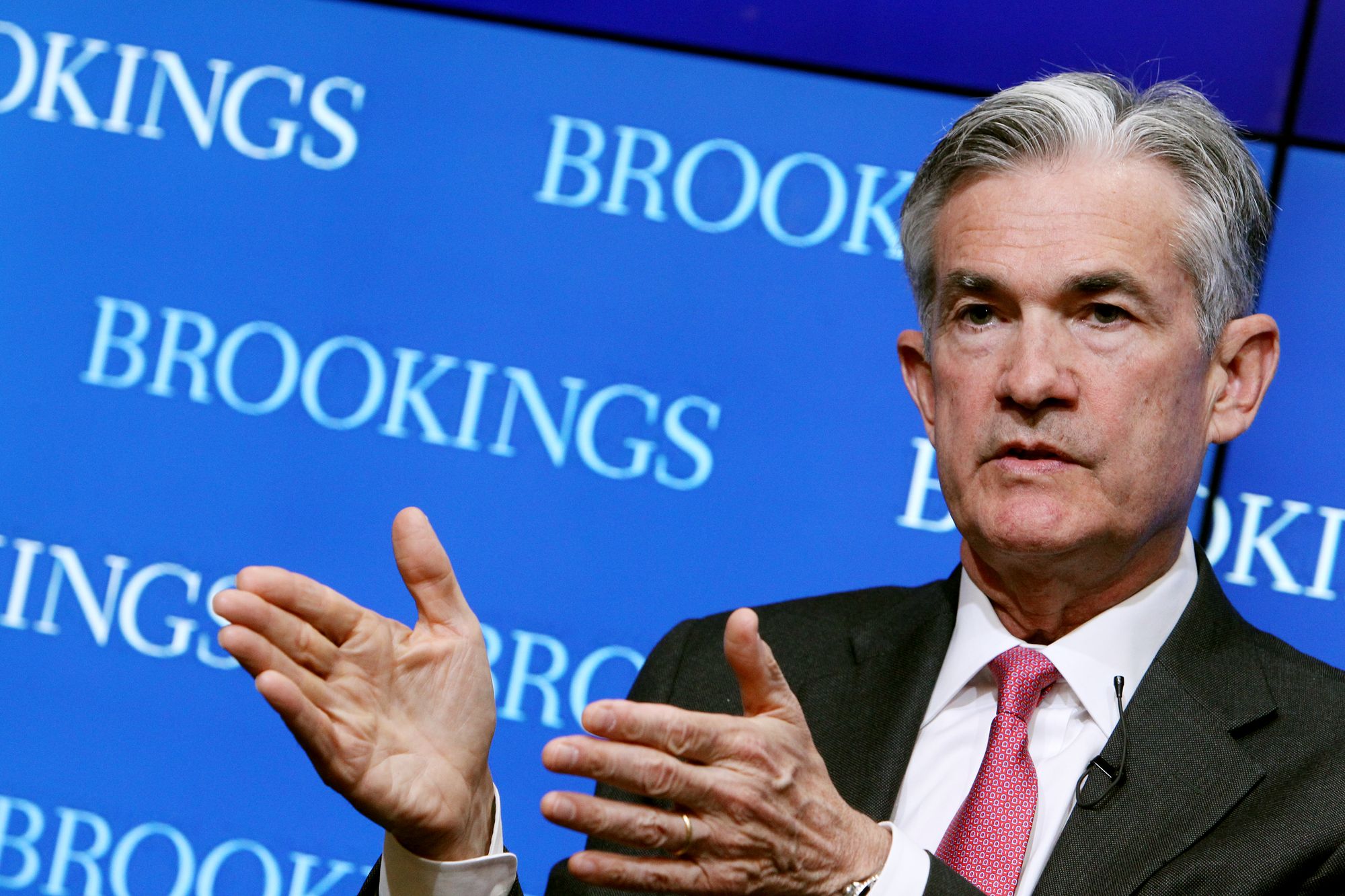

“Clearly, today’s 75 basis point increase is an unusually large one, and I do not expect moves of this size to be common,” Fed Chair Jerome Powell said. “We want to see progress. Inflation can’t go down until it flattens out. If we don’t see progress ... that could cause us to react. Soon enough, we will be seeing some progress.”

Below, we'll take a look at some reactions from the right and left, then my take.

What the right is saying.

- The right is unsure if the hike was enough.

- Many say the Fed's outlook is "fantastical" and a recession is coming.

- Others argue the blame lies with Biden and Democrats' fiscal policy.

The Wall Street Journal editorial board asked if this will be enough.

"The media and market chatter is that the Federal Reserve finally took out the anti-inflation bazooka with a 75-point rate increase on Wednesday, and there’s no doubt Chairman Jerome Powell sounded hawkish rhetorical notes," the board said. "But the overall message still looked more like a central bank slouching toward inflation reality, but not yet convinced it has to do all that much to get prices under control. The 75-point increase at a single meeting was supposed to signal shock and awe, and it was the Fed’s first move of that magnitude since 1994. Mr. Powell also said an increase of between 50 and 75 basis points is likely at its next meeting in July.

"But if you look at the Fed’s median forecast, the fed-funds interest rate is expected to rise only to 3.4% by the end of this year. That means increases will taper off through the rest of the year, and the Fed predicts a peak of only 3.8% in 2023. The Fed is front-loading its rate increases, but it’s still not anticipating that it has to go all that high to beat inflation," the board said. "Will this really be enough to get consumer-price inflation down from 8.6% today to the Fed’s target of 2%? Perhaps, but at this rate it’s going to take a while."

Judy Shelton said the Fed's moves could have unintended consequences.

"Given the negative effect pending interest rate hikes are expected to have on employment and economic growth—not to mention the devastating consequences for financial markets and 401(k) retirement plans—this seems a good moment to ask: Does the Fed’s approach to managing the money supply facilitate the productive use of financial capital?" Shelton asked. "Should the Fed be encouraging financial institutions to keep money idle in depository accounts? How does that contribute to increasing the supply of goods and services? This could be precisely the wrong way to carry out the Fed’s mandate to promote stable prices and maximum employment.

"People may be starting to question the wisdom of wholly discretionary monetary policy as they are asked to accept a punishing sequence of rising interest rates. But a punishing sequence of rising interest rates seems to be the Fed’s only feasible option for addressing the latent inflation it enabled, which was triggered by fiscal stimulus," she wrote. "All of this should cause us to rethink how the Fed intervenes in the economy. Neither artificially high interest rates nor artificially low interest rates are most conducive to productive economic growth. What a market economy needs is meaningful price signals—real interest rates."

The New York Post editorial board said Biden's denials ensure more pain for Americans down the road.

"Even President Joe Biden now admits, 'We’re gonna live with this inflation for a while.' Yet he won’t acknowledge his own role, and fellow Democrats’, in fueling the crisis. Or that Dem ideology precludes them from taking key steps to tame the beast," the board wrote. "Economists all cite the same basic cause of higher prices: rising demand and shrinking supplies. Dems recklessly fueled demand by showering $1.9 trillion on an already hot economy via Biden’s American Rescue Plan. They added to that with a $1.2 billion infrastructure bill and pushed to spend another $5 trillion in Biden’s Build Back Better legislation. All on top of the extra $3 trillion spent in 2020 when COVID erupted.

"Nor did they lift a finger to deal with supply-chain issues driving shortages — many caused by lockdowns they pushed and bonuses they gave to workers who refused to return to their jobs," it added. "Now, even as inflation soars (the Consumer Price Index hit 8.6% last month, a 41-year high), they want to shell out even more: Biden is eyeing billions in student-loan forgiveness and subsidies for housing and day care, for instance. That won’t curb inflation; it’ll drive it higher... That leaves the fight against runaway prices to the Federal Reserve, which might trigger a recession in the process. Meanwhile, Biden blames Vladimir Putin, Donald Trump and Republicans for inflation and hurting the economy."

What the left is saying.

- The left is encouraged by the rate hike, saying it is the right step.

- Some worry inflation is going to lead to a red wave in the midterms.

- Others say inflation may stay for a little while, but we're not returning to the 1970s.

Sebastian Mallaby said the inflation fight has begun in earnest.

"For anyone who wanted proof that this is not the inflation-battered 1970s, Fed Chair Jerome H. Powell just provided it," Mallaby said. "By delivering the biggest interest-rate hike in almost three decades, Powell has gone a long way to restoring the Federal Reserve’s inflation-fighting reputation — and provided a lesson in how government functions when presidents respect institutions. With the House committee on Jan. 6 reminding us of Donald Trump’s attempt at institution-wrecking, the contrast should be a boon for President Biden. Sadly, this is politics. Responsibility won’t be rewarded.

"Powell’s move is all the more impressive because investors were already running scared," Mallaby said. "As of last Thursday, the S&P 500-stock index was down 16 percent from its peak, with the tech-heavy Nasdaq down even more. Then Friday’s horrible inflation news — the consumer price index is up 8.6 percent from a year earlier — caused investors to begin anticipating additional Fed tightening. That was enough to wipe a further 3 percent off the value of the S&P 500 by day’s end... Given that reaction, the Fed might have concluded that it could leave the dirty work to investors themselves. The slump in the markets, which has come with a rise in long-term interest rates, means that financial conditions were tightening without the Fed having to change course. But the Fed refused to take this easy path."

In The Washington Post, EJ Dionne Jr. said inflation could leave us with "election deniers in charge of democracy."

"The Fed’s decision to raise interest rates by three-quarters of a point — the largest single increase since 1994 — put the economy smack in the news cycle while underscoring how little control President Biden has over what happens to costs between now and November," he wrote. "Meanwhile, the House committee investigating Jan. 6 continued its effective work in calling attention to just how off-the-charts dangerous and egregious Donald Trump’s efforts to overturn the 2020 election were. Its hearings have shown how close we came to a democratic meltdown, how complicit — often through their silence — many Republicans were with Trump’s schemes, and how the threat to our democracy is ongoing.

"Yet none of this could matter on Election Day," Dionne Jr. wrote. "If Republicans up and down the ballot win this fall because so many voters choose to punish Biden and the Democrats for high prices, the GOP sweep would carry into office outright election deniers as well as politicians too timid or too opportunistic to challenge them. As Amy Gardner and Isaac Arnsdorf reported in The Post, more than 100 GOP primary winners backed Trump’s false claims of election fraud."

Former Fed Chair Ben Bernanke said we're not going to go back to the 1970s.

"Although the inflation of the 1960s and ’70s had higher peaks and lasted much longer than what we have seen recently, it’s true there are some similarities to what we are going through now," Bernanke said. "The inflation of a half-century ago, like today’s, began after a long period when inflation was generally low. In both cases, heavy federal spending (on the war in Vietnam and Great Society programs in the 1960s, on the response to Covid in 2020 and 2021) added to demand. And shocks to global energy and food prices in the 1970s made the inflation problem significantly worse, just as they are doing now. But there are critical differences as well.

"First, although inflation was very unpopular in the ’60s and ’70s, as it (understandably) is today, back then, any inclination by the Federal Reserve to fight inflation by raising interest rates, which could also slow the economy and raise unemployment, met stiff political resistance," he wrote. "Besides the Fed’s greater independence, a key difference from the ’60s and ’70s is that the Fed’s views on both the sources of inflation and its own responsibility to control the pace of price increases have changed markedly... Nevertheless, today’s monetary policymakers understand that as we wait for supply constraints to ease, which they will eventually, the Fed can help reduce inflation by slowing growth in demand. Drawing on the lessons of the past, they also understand that by doing what is needed to get inflation under control, they can help the economy and the job market avoid much more serious instability in the future."

My take.

As I've said many times before in this newsletter, economic news is where I often feel most out of my depth. I've seen actual economists be wrong so consistently and so often that having any faith in my own outlooks or predictions based simply on reading their work seems fanciful. Suffice it to say, I really don't know what is going to happen. I hope inflation comes down, because the reality of what happens if it doesn't is ugly and terrifying. There seems to be widespread agreement that the Fed took a solid step here, though some believe it should have been even more shocking (that is, a higher rate increase).

What I can confidently opine on is the politics of it. And they are bad — for Biden, for Democrats, for anyone who wants more funding for government projects. A month ago, Americans said inflation was the top issue facing the country. It has only gotten worse since then. What we're seeing in the polling (and primary results) so far portends a red wave coming in November's midterm elections.

The how and why of inflation are probably not simple. Some combination of massive government relief bills under Biden (and Trump) and his administration’s loose monetary policy, paired with supply chain shocks, on top of huge consumer saving during Covid-19, all spun up by Russia’s war in Ukraine and lockdowns in China that have their own distinct economic impacts. Regardless of what you think, there are many millions of Americans who are too busy struggling to afford groceries and gas to be interested in the intricacies of how we got here — or even have the time to parse the talking points. They're going to know that one party controls the White House and Congress and view that party as responsible.

On a personal note, I'm anxious. I run a small business with people on payroll. We make revenue on subscribers. People who are feeling the economic screws tightening may think twice about shelling out $50 a year to support a politics newsletter. Elderly Americans on fixed incomes are seeing inflation outpace their social security checks, even after the latest cost of living bump. Kids coming out of college looking for work may struggle if we go from a tight labor market to a recession. It's a tenuous time.

Still, I'm holding out hope. Unemployment rates remain low and wage growth, while being outpaced by inflation, is happening nonetheless. This rate hike was at a level economists were expecting. Those are good signs. In many sectors, it's still a great time to be looking for a job. Again, I'm no economist, but Jerome Powell seems like a competent leader supported by people from across the political spectrum. Sometimes you have no option but to trust the folks and institutions in charge. My hope is they have enough experience and steel will to make the tough decisions that can guide us to the so-called "soft landing" — that is, slowing inflation without ushering in a major recession. But we could really use some strong signals in the monthly data. Let’s all hope they come soon.

Have thoughts about "my take?" You can reply to this email and write in or leave a comment if you're a subscriber.

Your questions, answered.

Q: Today, the Jan. 6 committee released a video of Rep. Loudermilk giving a tour on January 5th where the people on the tour are taking photos. Was this a recon mission to storm the Capitol? And if so, what charges could be brought against Loudermilk?

— Eric, Findlay, Ohio

Tangle: I've seen this story going around. Yesterday, the Jan. 6 committee released footage from the tour, where tourists and Rep. Barry Loudermilk (R-GA) are seen walking around "taking pictures and video." The implication from news outlets and liberals on Twitter has been that Loudermilk was leading some kind of "reconnaissance" tour of the Capitol building the day before January 6.

Let me be clear: I think that charge is ridiculous.

For starters, there were about a dozen people on the tour. Only one of them is someone who was present at the Capitol on January 6, as far as we know, and that person has not been charged with any crime.

Second, Loudermilk has already been cleared by the Capitol police. You can read their statement, in which they say they are trained to spot surveillance and reconnaissance, have reviewed the tape, and "do not consider any of the activities we observed as suspicious." The Capitol police have footage of them throughout their entire trip and note that "at no time did the group appear in any tunnels that would have led them to the U.S. Capitol."

Alexandria Ocasio-Cortez posted images from the surveillance footage, saying Loudermilk lied when he said "I never gave a tour of the Capitol." But the images don't prove he was lying, because they are from the part of the Cannon House Office Building that houses exhibits. The group never entered the Capitol building. The Jan. 6 committee is conflating two different areas and creating a tie between the people on Loudermilk's tour and "insurrectionists" that does not exist, unless they are withholding additional evidence.

When I pointed this out on Twitter, some people asked me why they were "taking photos of entryways and staircases." The photos they were taking were probably of exhibits that exist throughout the area they were touring. Others claimed there were "no tours allowed." This is true of the Capitol building, but not true of the House office buildings or the larger Capitol complex, which are separate from the Capitol building. I do not know where this rumor started. As Loudermilk himself has pointed out repeatedly, House leadership even ordered the gift shop to open on the 5th because there were so many visitors in D.C. that day.

Unless there is some evidence we don't yet have, the entire thing smells to me like another conspiracy theory — the exact kind of conspiracy Democrats so often accuse Republicans of spreading. Allegations that Loudermilk was leading a "recon tour" would need to be backed by evidence that any of the people on his tour committed a crime, or passed on those images to someone else who organized or took part in the storming of the Capitol. There is zero evidence for that so far. And it's not as if the area they toured would have been much use strategically, anyway.

Want to ask a question? You can reply to this email and write in (it goes straight to my inbox) or fill out this form.

A story that matters.

Just weeks after reopening, Abbott Laboratories says it has paused baby formula production at its plant in Sturgis, Michigan. Recent thunderstorms flooded part of the facilities, causing another setback for the company as it tries to help alleviate the nationwide baby formula shortage. Abbott said it has stopped production so it could assess damage from the storm and clean the plant. The halt will delay distribution of its product by a few weeks, according to the company. The Wall Street Journal has the story.

Numbers.

- 5.78%. The current mortgage rate, the highest since 2008.

- 3.11%. The mortgage rate at the start of the year.

- $5.00. The average price of a gallon of gasoline today.

- $3.07. The average price of a gallon of gasoline a year ago.

- 104,153. The average number of new daily Covid-19 cases in the U.S. over the last two weeks.

- 12. The number of military assistance installments the Biden administration has sent to Ukraine.

- $5.6 billion. The total value of those military installments.

Have a nice day.

When Brody Ridder came home from school last week, his older sister noticed that he had very few signatures in his yearbook. One was his own, two were from teachers, and two were from classmates. That was it. Cassandra said seeing it broke her heart, and knowing that Brody had been bullied by kids in school, she decided to try to do something. So she got their mom to post photos of the blank yearbook page to raise awareness about bullying, and as word spread, some older students in the school decided to step up and sign Brody's yearbook. In the following days a swarm of older students came into his class and signed his yearbook. He ended up collecting 100 signatures. “Just seeing him light up, it felt really good,” one student said. “It was a small thing, but it made him so happy.” The Washington Post has the story.

❤️ Enjoy this newsletter?

💵 Drop some love in our tip jar.

📫 Forward this to a friend and let them know where they can subscribe (hint: it's here).

📣 Share Tangle on Twitter here, Facebook here, or LinkedIn here.

🎧 Rather listen? Check out our podcast here.

🛍 Love clothes, stickers and mugs? Go to our merch store!