Plus, why did Trump keep the documents in the first place?

I’m Isaac Saul, and this is Tangle: an independent, nonpartisan, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

Are you new here? Get free emails to your inbox daily. Would you rather listen? You can find our podcast here.

Today's read: 11 minutes.

From today's advertiser: Tangle's Founder Isaac Saul is a huge sports fanatic, but even he doesn't always have time to catch up on ALL the sports headlines. That's where The GIST comes in, a sports media brand that is leveling the playing field by providing equal coverage to men's and women's sports. Yes, you read that right. Recent coverage includes:

- The PGA Tour and LIV Golf’s merger madness

- NCAA president Charlie Baker said he sees “major opportunity to get into the sports betting space.”

- How women wrestlers in India fueled the nation’s #MeToo movement

Bite-sized, entertaining and funny. The Gist is shaking up the sports industry. Whether you catch their newsletters, podcasts, or social posts — their content is fun and digestible for all types of fans.

Get "the gist" of what's going on and join the more than 600,000K subscribers. You can sign up here for FREE!

Tomorrow.

Ok, for real this time... tomorrow, in our subscribers-only Friday edition, we are going to publish a piece about the 2024 election, and one thing I think we should all demand of both Republicans and Democrats. We were going to publish this piece last week, and then Trump got indicted. Keep an eye out, and be sure to share it when it’s live! We’re off on Monday for the Juneteenth bank holiday, so we’ll be back with our normal newsletter on Tuesday.

Quick hits.

- A fishing boat carrying migrants from Libya to Italy sank off the coast of Greece, killing at least 79 people. 104 were rescued, but more are still feared missing. (The tragedy)

- U.S. senators Elizabeth Warren (D-MA) and Ron Wyden (D-OR) asked Congress to open an antitrust investigation into the PGA Tour's proposed deal with Saudi-backed LIV Golf. (The push)

- Miami Mayor Francis Suarez (R) launched a 2024 bid for president. (The bid)

- The Southern Baptist Convention voted to keep two churches expelled after they were voted out for having women pastors. The Southern Baptist Convention is the largest Protestant denomination in the U.S. (The expulsion)

- President Biden vetoed a Republican-led resolution that would have repealed new limits on emissions from heavy-duty vehicles. (The veto)

- BREAKING: The Supreme Court upheld a 1978 law aimed at keeping Native American adoptees with their tribes. You can find our coverage of the case here.

Today's topic.

Inflation. On Tuesday, the Department of Labor reported that inflation has risen at 4% year-over-year in May, meaning it was at its lowest annual rate in more than two years.

Reminder: Inflation is measured by the Consumer Price Index (CPI), which is designed by the Bureau of Labor Statistics to measure price fluctuations for urban buyers, who represent the vast majority of Americans. The CPI tracks 80,000 items in a fixed basket of goods and services, representing everything from gasoline to apples to the cost of a doctor's visit.

The CPI went up 0.1% for the month, bringing the annual inflation rate down from 4.9% in April to 4% in May. That is the lowest annual rate since March of 2021, when inflation first began rising and shortly thereafter hit its highest level in 41 years.

Core inflation, which excludes more volatile food and energy prices, rose 0.4% on the month and was still up 5.3% from this time last year. Those numbers left economists a little less optimistic about the picture of inflation, but the latest numbers still represent a milestone for the economy.

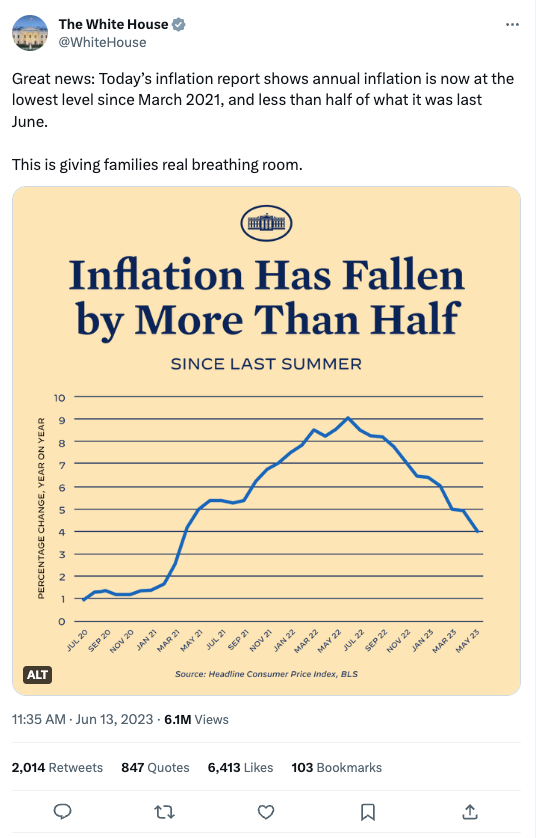

The White House shared this chart celebrating the latest numbers, which drew a lot of criticism and praise:

Meanwhile, the Federal Reserve declined to raise interest rates yesterday for the first time in the 15 months since its fight against inflation began.

Reminder: Interest rates represent the cost of borrowing. When the Federal Reserve raises its interest rate, that makes credit card debt, mortgages and loans more expensive. The Fed uses interest rate hikes to slow spending and investment in order to tamp down inflation.

The Fed's decision means the benchmark federal funds interest rate will remain between 5% and 5.25%. Its decision came on the heels of the latest inflation numbers, though Fed officials made it clear more interest rate hikes could be coming if things did not continue to trend in the right direction. The Fed's target is to get year-over-year inflation under 2%.

We have covered inflation and interest rate hikes 15 times before. You can find our previous coverage here.

Today, we're going to take a look at some commentary from the left and right about inflation, the Fed's decision, and the state of the economy as a whole. Then, my take.

What the right is saying.

- Many on the right criticize Biden for celebrating inflation numbers that are still hurting Americans.

- Some argue that until inflation is fully resolved, Biden will struggle to convince Americans the economy is strong.

- Others suggest this economy is reminiscent of 2008.

In The Wall Street Journal, William A. Galston said inflation will be Biden's headwind.

"According to a recent Economist/YouGov survey, only 18% of voters think the economy is improving, while 53% think that it is getting worse. Twenty-one percent say the economy is growing, while twice as many—42%—say that it is shrinking. More than half believe that the U.S. is in a recession. Standard economic measures tell us the economy is growing at a modest pace." But when asked to name the best indicator to measure the state of the economy, 54% said "the prices of the goods and services they buy." For most voters, "the negative effects of inflation outweigh all the economic improvements" that Biden touts.

"Most Americans’ perceptions of the economy are shaped by experience, not statistics, and some parts of experience stand out from the rest... My wife and I have an above-average income, but we suffer sticker shock every time we go to the grocery store, and we’ve made some changes in our purchases." The consequences are "more severe" for households earning less. Meanwhile, airline ticket prices "have soared" and housing "has become much less affordable." If I were Biden, "I would acknowledge that rising prices are now the electorate’s core economic concern, and I would put my determination to bring prices under control at the center of my economic message."

In The Daily Wire, Zach Jewell mocked the White House for bragging about a chart showing inflation skyrocketing after Biden took office.

The White House celebrated with a graphic showing inflation at 4%, but the "chart may have not been the clear victory sign the Biden administration was going for... as it showed the massive increase in inflation from January 2021 to May 2022 when it reached 9% under the current president’s watch." Inflation reached "a 40-year high of 9.1% under Biden's presidency, while the inflation rate under former President Donald Trump hovered around 2% and even hit an average of 1.2% in Trump’s last full year in the White House."

"The slight inflation rate decrease in May came as a result of lower gas prices and increases in grocery prices and other items, POLITICO reported. The recent decrease in inflation isn’t likely to convince policymakers at the Federal Reserve that the U.S. is out of the woods because 'core' prices, which the Fed mainly focuses on, rose for the sixth straight month in May," Jewell wrote.

In Newsweek, Philip Pilkington says that it's beginning to "look like 2008."

"The American economy is in a rough spot," Pilkington said. "For the last 18 months the economy has been mired in stagnation. Since the fourth quarter of 2022, it has only grown 1.2 percent in inflation-adjusted terms." For context, the average five-quarter growth rate during the 2010s "was around 2.7%." And though headline inflation is now under 5%, "core inflation—that is, inflation with food and energy stripped out—has barely fallen at all and remains higher than headline inflation at 5.5 percent." Taken together, this means the Federal Reserve "may have to hike rates further."

Outside of the interest rate, "other pressures are making themselves felt. The commercial real estate market has all but collapsed,” while “the residential market is not looking too hot either." Mortgage applications peaked at "8.5 percent in Q2 2022", and fell to "6.1 percent in Q1 2023," which is remarkably similar to what happened in 2006-2007. "Good forecasters do not claim to have a crystal ball, however. It is less important to try to put an exact date on when the economy will start to crack up than it is to understand its weaknesses. Those weaknesses are now severe in the American economy. Surveying the current economic landscape, it would take something resembling a miracle to pull the economy out of its current stagnation and avoid a recession."

What the left is saying.

- Most on the left are celebrating the numbers, saying the inflation scare could be just about over.

- Some suggest we never needed to cause higher levels of unemployment to contain inflation, as some popular economists suggested.

- Others caution not to let up the fight too soon.

In Bloomberg, John Authers said the "Great Inflation Scare" is reaching its final phase.

"The great post-Covid inflation scare appears now to be decisively entering its final stage," he wrote. "The big question now is how long that stage will last. It’s good news for most of us, although arguably not quite as positive as it might at first appear." Core inflation "barely changed," in fact it actually "ticked up a little." Still, shelter inflation, "roughly a third of the index, is what keeps it at a politically and economically unpalatable level.” He adds that “this is encouraging, because the shelter index tends to be a lagging indicator," and it doesn't inform "the latest trends." Zillow's data on new leases suggests that the "spike in rental inflation is over."

"There is more positive news in the technical statistical measures developed by different teams at the Federal Reserve, which show that the trend is now clearly in the direction of lower price rises," Authers wrote. "And if there’s one startlingly positive news item buried in the data, it concerns the highly politicized but extremely important business of health insurance. Thanks largely to being driven so much by shifting political tides, premiums have had periods of extreme inflation in the decade since ‘Obamacare’ came into effect. The latest data suggest that premiums are down more than 20% over the last 12 months. That might just be a handy spur to consumers’ disposable income if it continues."

In New York Magazine, Eric Levitz argued that "Larry Summers was wrong about inflation."

Summers warned that Biden's $1.9 trillion American Rescue Plan would cause inflation, and then consumer prices shot up and his "stature within the business press rose." From his "newly elevated platform" he suggested we needed five years of unemployment above 5%, or two years of 7.5% unemployment, or one year of 10% unemployment to control inflation. "In the Harvard professor’s estimation, U.S. policymakers had no choice but to deliberately throw millions of Americans out of work or else accept a steadily deepening inflationary crisis. It is now clear that Summers was wrong."

"His call for austerity was premised on the notion that only a sharp increase in unemployment could prevent a ruinous wage-price spiral. In reality, both wage and price growth have been slowing for months, even as unemployment has remained near historic lows. Summers’s failure to anticipate this outcome should lead us to reconsider just how prescient his analysis of the post-COVID economy ever was," Levitz wrote. Even core inflation is overstated, as "outdated" shelter costs are the biggest service-sector component of inflation. "As economist Adam Ozimek notes, if you replace the CPI’s estimate of housing costs with the Bureau of Labor Statistics’ estimate of real-time rent growth, you’d see that core inflation has fallen 'substantially' since last fall."

Bloomberg’s editors, meanwhile, argued that "doing nothing" on inflation is still the greater risk.

"Advocates of a pause argue that the Fed’s tightening is already bearing results. The steepest series of interest-rate increases in more than four decades, from near zero to more than 5% in less than 14 months, has taken down several poorly prepared regional banks, which might in turn curtail credit and economic growth. Also, some inflation indicators have been easing: Goods prices have settled down after spiking during the pandemic; decelerating rents and home values should soon flow through to official measures," the editors wrote. "This progress, though, is no assurance of success."

Banking turmoil only impacted a "small fraction of the industry," and at 3.7%, "the unemployment rate remains near its lowest point since 1970, and below the level that Fed officials consider sustainable without overheating the economy," the editors said. "No wonder some measures of annual wage growth remain as high as 6%, and core consumer-price inflation — at 5.3% in May — far exceeds the Fed’s 2% target. If one adjusts for that level of inflation, it’s not even clear that short-term interest rates are high enough to restrict growth.” Unrelenting interest-rate increases could trigger a deeper recession than needed, inflicting unnecessary pain. “But the alternative is far worse.” Allowing inflation expectations to become entrenched will ultimately force the Fed "to take rates much higher — and cause much greater hardship — to compensate and restore its credibility."

My take.

Reminder: "My take" is a section where I give myself space to share my own personal opinion. If you have feedback, criticism, or compliments, don't unsubscribe. Write in by replying to this email, or leave a comment.

- I'm never sure about how to view inflation.

- Biden is getting a gift: A sunny story he can start telling about the economy.

- This is the most confident I've been in the last two years about our economic outlook.

Inflation still makes my head spin.

As we wrote in our piece exploring whether we were wrong about greedflation, none of this is particularly simple. I am on record in our numerous pieces on inflation saying that "the right" has mostly been right on inflation. Many conservative columnists warned that inflation was coming, many were ignored, and many were correct that it wasn't going to simply pass through but would instead remain entrenched for months and perhaps years. So far, that's all been true. And there's no doubt that lower-income and middle-class families are hurt by it the most.

I do think, though, that there is a much sunnier economic story that the Biden administration can now tell. It goes something like this:

We did everything we could to prevent the economy from tailspinning because of Covid-19. We probably threw a little too much money at the problem, but that was better than not doing enough. And the result has been mostly good: Unemployment has been around or below 4% since 2022, and is still historically low. Wages are still rising, also at a historic pace. Housing costs are now down, and once the lagging data catches up, the inflation numbers will go down even more. Gas prices are falling. Health insurance prices are falling. Food prices are coming down, though there is more work to do.

Now, we did face historic inflation numbers. But we trusted the Fed to address this problem, and so far the path they charted has worked. Inflation is cooling, and getting closer and closer to their 2% target. We've accomplished this without setting off an economic crisis or another recession, and the light at the end of the tunnel is now visible.

I think that’s a pretty good story, and a pretty fair one, too. Of course, the Biden administration won't tell it quite this way — it still seems resistant to saying that anything it did from a fiscal policy perspective made inflation worse. But I do think it is worth saying that the Fed seems to have the economic situation (mostly) under control. A few bank scares aside, it's staying on the tightrope without falling. In August 2022, I wrote this:

I don't know what the answer is. I'm hoping smarter people do. But it seems increasingly likely that the Fed is either going to have to shock the system with a large, unexpected rate hike, or it's going to have to slowly grind the economy to a halt with continued incremental rate hikes.

It’s unlikely that more than a decade of near-zero interest rates and monetary stimulus will be undone with a few months of interest rate hikes. Yes, we may have seen peak inflation. But we also may keep experiencing that peak inflation for many months to come.

Today is the most optimistic I've been over the last two years that those "smarter people" are in control.

I'm not sure what's next, but here's hoping it stays that way.

Your questions, answered.

Q: I have read everything you’ve written about the Trump charges, as well as a few articles from other sources. But what I have seen zero speculation about, and what I am dying to know, is WHY he did it. What is the most likely motive? Is it just carelessness? Too lazy to handle them properly? Is it that he wanted to boast about them? To use them as leverage in some sort of future negotiations between powerful parties? To destroy America? Some of those speculations seem far more likely than others, but I’m puzzled as to why this hasn’t been discussed in articles even a little bit. Also, presumably, Mar-a-Lago has plenty of room for garages and storage sheds. Why bathrooms and ballrooms? Why were they even at the Florida estate in the first place?

— Karen Field from Santa Barbara, California

Tangle: First, I think there are definitely people writing about this. Jonathan Chait did a whole New York Magazine piece on this very question, and plenty of conservative pundits are talking about it too (more on that below).

So, let me start by sharing two ideas I've generally seen from the right and left, just to be fair. On the left, some folks have shared what I think are far more outlandish ideas, like Trump was planning to sell the documents to foreign adversaries or use them for personal leverage. I always thought this notion was ridiculous, and there is so far no evidence anything like that has happened.

On the right, I think the argument has mostly been that he took them because he can. He is (or was) the president, and these classified documents can be declassified by him; and it’s fairly normal for a president to be forced to return things to the National Archives after leaving office (again: Biden is currently under a separate special counsel investigation for mishandling classified documents). This take, I think, is pretty out-of-touch with the reality of the situation.

But other notions ring more true to me. The conservative pundit Ben Shapiro put it like this:

“The rumors at the time that this broke was that he was selling off our nuclear codes to the Chinese or some such nonsense. And it turns out that was all crap. The theory I had from the beginning was correct that basically Trump was like, ‘I like that document, it’s nice,’” Shapiro said. “That was the actual reason he had documents. Not for any nefarious purpose, but because Trump likes things.”

Honestly, I think that is basically it. Of course, I don’t live in Trump’s head, so I can’t say his motives for sure. But from following him and his presidency for so long, I would guess taking the documents was mostly about vanity, and a little bit of insurance (in Trump's mind). His motivations were probably a combination of enjoying showing them off to people and also him viewing the classified documents as personal assets.

After all, if the indictment proves true, Trump was using the documents to prove to a reporter that a story floated in the news wasn't accurate. He probably took the things he thought were really cool or interesting or significant, and he took them with him when he thought it was advantageous to do so. And he wasn't very much concerned with tradition, norms, rules, or even the law.

As for why they were placed haphazardly throughout Mar-a-Lago, that is more difficult to answer. General carelessness? A lazy staff? An incompetent staff? I have no idea. I'm sure Trump wasn't the one personally lifting and moving the boxes, though it does seem like he was giving orders about where they should go. Either way, none of it looks like the work of a group of people who were deeply concerned about keeping the documents secure, which is not going to look great at trial.

Want to have a question answered in the newsletter? You can reply to this email (it goes straight to my inbox) or fill out this form.

Under the radar.

The United States and Iran have quietly restarted talks on a deal to release American prisoners and slow Iran's growing nuclear program, according to an exclusive Wall Street Journal report. While talks are ongoing, the United States approved $2.7 billion of payments from the Iraqi government to Iran for electricity and gas imports that had been frozen by U.S. economic sanctions. U.S. officials said the transfer of funds was unrelated to the negotiations and called it routine, but White House officials have reportedly traveled to Oman three times for negotiations since December. Iran is seeking billions of dollars in energy revenue trapped by U.S. sanctions in exchange for prisoner releases and accepting limits on its nuclear program. The Wall Street Journal has the story (paywall).

Numbers.

- 0.6%. The percentage increase in shelter prices last month.

- 0.2%. The percentage increase in food prices last month.

- $3.59. The average price of a gallon of gasoline in the United States right now.

- $5.01. The average price of a gallon of gasoline a year ago.

- 0.3%. The average hourly earnings increase for workers over the last month.

- $7 million. The amount of money the Trump campaign has raised since news of his indictment, according to a Trump spokesperson.

The extras.

- One year ago today we wrote about a bill to increase security for Supreme Court justices.

- The most clicked link in yesterday's newsletter was the story about Karine Jean-Pierre violating the Hatch Act.

- Let Them Fight: We asked readers who they viewed more favorably, McCarthy or the House Freedom Caucus, and 55% of respondents said they don't favor either of them, while those who took a side were essentially split: 18% favored the HFC, and 18% favored McCarthy. 7% said they favor both equally, while 2% said they have no opinion.

- Nothing to do with politics: One of Saturn's moons has the necessary elements for developing life.

- Take the poll. How is the economy affecting you, personally? Let us know!

Have a nice day.

A new drug is showing signs of success at treating a type of brain tumor. The French international pharmaceutical company Servier Group has reported the promising findings following a study of 331 adults with grade 2 gliomas. In its findings, Servier Group reports that its new drug, vorasidenib, has delayed the growth of grade 2 glioma for a median of 27.7 months, more than double the time for patients who received a placebo. Grade 2 gliomas are progressive, malignant brain tumors, and these initial findings represent the best progress in treating them in over 20 years. For those in this study, treatment with the drug "significantly improved progression-free survival and delayed the time to the next intervention," according to results published in the New England Journal of Medicine. Vorasidenib was granted fast track designation by the U.S. Food & Drug Administration (FDA) in March, and the company is currently working on timelines for submission of a New Drug Application for vorasidenib to the FDA. Reuters has the story.

Don't forget...

📣 Share Tangle on Twitter here, Facebook here, or LinkedIn here.

🎥 Follow us on Instagram here or subscribe to our YouTube channel here

💵 If you like our newsletter, drop some love in our tip jar.

🎉 Want to reach 62,000+ people? Fill out this form to advertise with us.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).

🛍 Love clothes, stickers and mugs? Go to our merch store!