I'm Isaac Saul, and this is Tangle: an independent, nonpartisan, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

Are you new here? Get free emails to your inbox daily. Would you rather listen? You can find our podcast here.

Today’s read: 13 minutes.

Here's how to stop Google and ChatGPT from sharing your private info

With a quick search, you’d be shocked to find out what anyone can find out about you on Google or ChatGPT. Your phone number, home address, and what you owe on your mortgage are just the beginning.

Anyone deeply researching can access details about your family members, health records, financial accounts, employment history, and even your Social Security number.

When you remove your sensitive data with Incogni, you reduce the risks not just from targeted marketing spam but also identify theft, financial manipulation, and insights into your most private circumstances.

And it's easy and cheap with Incogni’s Unlimited plan. It will remove all that data for you, so that you’re safe from being found by simple Google search results or AI conversations.

Use code TANGLE today to get an exclusive 55% discount on unlimited removals from anywhere that exposes your data.

The roots of travel nightmares.

If you’ve flown commercially in the past decade, you’ve probably noticed an uptick in irritants — delays, cancellations, shrinking seats, and, broadly, a system that seems built to exhaust customers rather than help them. In our latest YouTube video, we break down the source of these problems, why they’re so persistent, and why recent efforts to solve them have failed. It’s one of our most in-depth investigations yet, and we’d love for you to check it out.

Quick hits.

- The United States withdrew some personnel from bases in the Middle East following comments from a senior Iranian official that the country would target U.S. bases in the region in retaliation for any airstrikes. President Donald Trump said that he believes the Iranian regime has stopped killing protesters, but he is monitoring the situation as he weighs potential strikes. (The latest) Separately, Middle East Envoy Steve Witkoff said that the Israel–Hamas ceasefire in Gaza is moving to its second phase, which will involve disarming Hamas, beginning the rebuilding of the strip, and establishing a transitional Palestinian administration. (The announcement)

- The Federal Bureau of Investigation searched Washington Post reporter Hannah Natanson’s home in search of alleged classified information, seizing a phone, two laptop computers, and a Garmin watch. The Justice Department says the search was part of an investigation into a defense contractor charged with unlawful retention of national defense information. (The search)

- A federal officer shot a man in the leg during an immigration enforcement operation in Minneapolis, Minnesota. Federal officials said the shooting victim was a Venezuelan national who fled arrest and attacked the officer with a snow shovel and a broom handle. (The incident)

- Vice President JD Vance cast the tie-breaking vote to defeat a war powers resolution in the Senate that would have blocked President Trump from using military force “within or against” Venezuela. Sens. Josh Hawley (R-MO) and Todd Young (R-IN) voted to defeat the measure after previously supporting it; the senators said they received assurances from the Trump administration that U.S. troops would not deploy to the country. (The vote)

- The State Department announced it will indefinitely pause immigrant visa processing for 75 countries starting January 21, and will also stop issuing visas to people from those countries looking to immigrate to the U.S. permanently. (The pause)

Today’s topic.

Trump’s housing affordability efforts. Last week, President Donald Trump announced a pair of actions to address rising homeownership costs. On January 8, the president directed Fannie Mae and Freddie Mac — government-sponsored mortgage-finance companies — to buy $200 billion in mortgage bonds to bring down mortgage rates. On January 7, Trump said he was “taking steps to ban large institutional investors from buying more single-family homes” and would ask Congress to codify those rules. The president said he will share more details about his housing affordability plans in a speech at the World Economic Forum in Davos, Switzerland, next week.

Back up: The Federal National Mortgage Association (Fannie Mae) and the Federal Home Loan Mortgage Corporation (Freddie Mac) are companion organizations created by Congress to provide liquidity, stability, and affordability to the mortgage market. The organizations buy mortgages from lenders to enable banks to continue offering loans to new homebuyers. Fannie Mae and Freddie Mac hold these mortgages or package them into securities that investors can buy. After the 2008–09 housing crash and financial crisis, the government limited the amount of mortgage-backed securities the organizations could hold to $225 billion each; as of November 2025, they held a combined $247 billion.

In announcing the order to buy $200 billion in bonds, President Trump blamed the Biden administration for rising homeownership costs and said the bond purchases would “drive Mortgage Rates DOWN, monthly payments DOWN, and make the cost of owning a home more affordable.” The U.S. 30-year fixed-rate mortgage average is 6.16% as of January 8, more than double the rate in January 2021.

Back up (again): Many private-equity companies, such as Blackstone, entered the single-family home market in the wake of the 2008–09 housing crisis and remain active buyers and sellers in the market. Some economists and lawmakers have argued that these purchases have crowded out individual homebuyers and increased housing costs. In 2023, Brookings estimated that these large institutional investors owned approximately 3% of single-family rental stock in the U.S., though that share was significantly higher in certain markets.

President Trump did not share further details about how he would implement his ban on new large institutional investor purchases of single-family homes, but Treasury Secretary Scott Bessent said that these firms would not be forced to sell their current holdings. Federal Housing Finance Agency Director (and Fannie Mae and Freddie Mac Chairman) Bill Pulte praised the plan, saying, “People should live in homes, they shouldn’t be on corporate balance sheets.”

Today, we’ll offer perspectives from the left and right on the president’s housing plans, followed by Managing Editor Ari Weitzman’s take.

What the left is saying.

- The left is skeptical of Trump’s proposals, arguing they misidentify the root of the issue.

- Some say that housing affordability can only be addressed by increasing supply.

- Others suggest Trump should work with Congress to pass meaningful reform.

In The New York Times, Binyamin Appelbaum wrote “the landlords are not the problem.”

“President Trump relishes a handy scapegoat and, on Wednesday, he picked one to blame for the nation’s housing crisis: investors that are buying large numbers of single-family homes and operating them as rental properties,” Appelbaum said. “The crisis is a simple problem with a complicated solution. The problem is that the United States does not have enough housing. The hard part is building more. It is certainly easier, and perhaps better politics, to talk about barring investors, or imposing rent controls, or kicking immigrants out of the country, but none of that is going to do the trick.”

“A ban might have some benefits. Less competition from investors could push sellers to accept lower prices; buyers might be more likely to reside in the houses, rather than renting out the properties,” Appelbaum wrote. “But it would punish renters. The rise of institutional investment in single-family houses is best understood as a post-crisis replacement for subprime mortgage lending. Tighter credit standards mean that millions of Americans can no longer obtain loans to purchase homes. Institutional landlords allow people to live in the same places but as renters.”

In CNN, Allison Morrow suggested that Trump has “the wrong guy” in casting blame for housing prices.

“Real estate has been a lucrative institutional investment since the collapse of the housing market in 2008. The finance industry swooped in to desirable neighborhoods to buy up suddenly cheap housing stock and started collecting rent on those properties… But the large investors still amount to a tiny portion of the overall market,” Morrow said. “The vast majority of real estate investment purchases come from so-called ‘mom-and-pop’ landlords — people who own one or two additional homes that they rent out to supplement their income.”

“Trump’s other housing pitch… would involve the federal government, through Fannie Mae and Freddie Mac, buying up a boatload of mortgage-backed securities — something the Fed has traditionally done in times of turmoil to keep interest rates from spiking,” Morrow wrote. “Certainly, many economists have said, ramping up purchases of mortgage bonds would help bring mortgage rates down, offering some relief to homebuyers. But, once again, doing so does nothing to increase the housing supply. And it probably won’t spur people to sell the homes they live in now and look for something else.”

In The Los Angeles Times, Fred P. Hochberg proposed a “concrete step to cut housing costs.”

“At the Small Business Administration, where I once served as the deputy and acting administrator, a little-known initiative called the Home Disaster Loan program has been in operation since the 1960s, providing long-term home loans at a low, fixed interest rate for people whose homes or businesses have been damaged by natural disasters,” Hochberg said. “These loans have served as a lifeline for Americans experiencing disasters, and versions of this program have been expanded during broader moments of crisis, including in the early days of the COVID-19 pandemic. Americans today are in a crisis of affordability — so why not expand the program to reach them?”

“Would this one quick fix solve the housing crisis? Of course not. But by lowering the financial barrier to homeownership for many, it could help take the pressure off the housing market in much the same way America did a century ago with the advent of the 30-year mortgage — a simple innovation that helped lift homeownership from under half of American families to nearly two-thirds,” Hochberg wrote. “The president’s recent openness to cracking down on high home prices — an issue long popular with Democrats — suggests that there may be a political opening for Congress and the White House to get something done.”

What the right is saying.

- Many on the right support Trump’s proposals but say they are only a first step.

- Some view the attack on institutional investors as misguided.

- Others propose additional measures to complement Trump’s plan.

In The Daily Signal, Peter St. Onge and EJ Antoni welcomed Trump’s “solution to [the] housing crisis.”

“Banning institutional [buyers]banners will lower prices. But not by much considering they make up just a couple percent of home purchases. So going by price elasticities you might get a 3-5% drop in home prices — possibly closer to 10% in sunbelt cities where institutions are most active,” St. Onge and Antoni wrote. “Buyers need a lot more. Since he took office in January 2025, Trump’s been trying everything. He’s tried to cut closing costs, promoted simplified local building codes, removed tariffs on construction materials, [and] proposed opening federal land to housing.”

“What’s missing is the two biggest drivers of house prices: inflation, which is driven by federal deficits. And mass deregulation in home-building, including environmental mandates, zoning, and rent control the National Association of Homebuilders estimates can add $94,000 to the cost of a home. For these, [Trump] needs Congress,” St. Onge and Antoni said. “Given Congress won’t meaningfully cut inflationary spending or regulation in areas like healthcare and insurance, housing costs are the last man standing. Trump’s doing what he can, but Congress has to do the heavy lifting.”

In City Journal, Brad Hargreaves offered a “defense of institutional homeownership.”

“The image of a family bidding against Blackstone or Cerberus for a starter home strikes many people as fundamentally un-American, and few politicians from either party will want to be seen as pro-Blackstone in an election year,” Hargreaves said. “[But] going after institutional owners is the wrong way to pursue the goal of boosting homeownership. Though less than 1 percent of all U.S. single-family homes — a tiny slice of the housing market — are institutionally owned, single-family rentals provide meaningful benefits, particularly to families seeking access to high-quality public schools. Banning or severely restricting institutional ownership will harm renters, do little to increase homeownership, and risk reviving exclusionary patterns in American housing.”

“While mom-and-pop landlords may be more sympathetic, protecting them from market competition should not be a public-policy objective. Unlike small investors, institutions invest on behalf of pension funds, endowments, insurance companies, and public retirement systems,” Hargreaves wrote. “Small landlords, by contrast, invest on their own behalf. The tax code provides numerous advantages to long-term real estate ownership, from like-kind exchanges to stepped-up basis. There is no compelling public interest in using state power to protect these investors from competition.”

In Breitbart, Rep. Pat Harrigan (R-NC) wrote “when Wall Street becomes your landlord, families lose.”

“President Trump announced he’s moving to ban large institutional investors from buying single-family homes. He’s right. Housing has become unaffordable, and Wall Street buying up neighborhoods is making it worse. Congress needs to back him up with legislation that sticks,” Harrigan said. “That’s why I introduced the Families First Housing Act with Congressman Josh Riley (D-NY). The bill targets properties controlled by federal entities like FHA, Fannie Mae, Freddie Mac, and USDA. When these federally backed homes go on the market, families get an exclusive 180-day window to buy them. During that period, only families purchasing a primary residence, nonprofits, local governments, and community land trusts can buy.”

“The bill also requires properties to be priced at fair market value based on independent appraisals, mandates quarterly public reporting on all sales, and imposes real penalties on federal employees who try to bypass these protections,” Harrigan wrote. “[The bill] is a critical first step. But it’s just one piece of the puzzle. We also need more housing supply, zoning reform, and broader restrictions on institutional ownership… When the same corporations that manage your 401(k) are bidding against the house you’re trying to buy, something is fundamentally wrong.”

My take.

Reminder: “My take” is a section where we give ourselves space to share a personal opinion. If you have feedback, criticism or compliments, don't unsubscribe. Write in by replying to this email, or leave a comment.

- I applauded this proposal at first, but cooled on the idea as I read more.

- Making housing affordable requires cutting regulations and building more housing.

- I also have another proposal: Local governments should increase taxes on second homes.

Managing Editor Ari Weitzman: After a crescendo of concerning maneuvers from the White House, I got to experience what it’s like when President Trump gives me a taste of something I’m personally hungry for.

Banning institutional investors from owning homes? Yes — hell yes. I know how hard it is to get your foot in the door to home ownership today, and how easy it is for the rich to get richer. When Trump announced this plan, before we even decided to cover it, I volunteered to write the take. Trump picked one of the problems I care about the most and chose a villain I’d like to see antagonized.

I got a minute or two to ride the high of that feeling.

After going through the Tangle process and learning more about the plan to ban large investors from owning single-family homes, I found that the pattern remains the pattern: Trump picked a real problem but chose a terrible tool to solve it — one that grabs headlines, leaves the root problem unsolved, and seems to have been motivated by the personal suggestion of someone in his circle (this time, Vice President JD Vance).

Anytime I want to learn more about a particular housing issue, the first name I pull up is Jerusalem Demsas, who has been all over the housing beat for years. Writing in The Argument, Demsas notes that institutional investors only make up a small share of owners of single-family homes (she says it’s “roughly 0.65%”) and that they provide a market need (managing properties for rent to low-income tenants). Ultimately, she argues that banning this class of investors from owning single-family homes wouldn’t meaningfully impact housing affordability, and the impact from such a rule would likely send prices in the wrong direction. Demsas cites a white paper that found that removing institutional investors from accessing the market would also remove their rental properties from the market, causing prices to increase by 2.4%. Now, Trump’s proposal wouldn’t force those investors to sell, it would only prevent new purchases, but this marginal and opposing effect indicates that this kind of prohibition wouldn’t help the national housing affordability problem. As Demsas states bluntly, “It’s impossible to solve the problem that young people, low-income people, and people without great credit can’t access homeownership by going after institutional investors. You have to actually build more housing, reform credit standards, and push up wages.”

Demsas, an abundance liberal, is not alone in her opinion. In The Free Press, conservative economist Judge Glock also said that institutional investors only make up a small share of owners of single-family homes and serve a market need. Glock argues, “The alternative to corporate purchases often wasn’t a locally owned house — it was a decaying husk filled with rats and cobwebs. Institutional investors helped protect both the housing they purchased and the neighborhoods where that housing was located.”

As ready as I was to enthusiastically line up my support for Trump’s policy, those counterarguments are just far too convincing. Yes, housing affordability is an enormous problem in our country; I’d rank it among our top problems. Housing comprises a full third of median household spending, according to the Bureau of Labor Statistics — in the 1970s, anything over 25% was a red flag. This economic strain causes a host of cascading issues. It tightens a family’s budget, making sensitivities to inflation and interest rates higher. It forces people to live in areas farther from their workplaces, raising transportation costs for individuals and for governments. It prevents many people in my generation (and subsequent ones) from building wealth. It is one of the main causes, if not the main cause, of homelessness. It degrades public health, it slows economic growth… the list truly does go on.

However, and again, Trump’s proposal doesn’t solve this problem. I’m more persuaded by proposals from people on the left like Demsas, that the solution is more housing and easier entryways into home ownership, and from people on the right like Glock, that the industry needs more investors and less regulation.

Ultimately, I think the solution to this problem has to be all of the above — and more. In addition to cosigning the ideas from Demsas and Glock, I have my own idea; and it’s one that my good friend — Tangle Executive Editor Isaac Saul — is going to hate: We should increase the tax burden on owning second homes.

I don’t want to create a false impression of this idea up front, so I want to start with two important clarifiers: First, the primary target of such a policy would not be people like Isaac, who rent their primary residences and own homes in parts of the country where squeezing people out of a short supply of desirable housing is not a problem (in Isaac’s case, rural west Texas). Rather, it would be very wealthy people who already own and live in a primary residence but also own vacation properties that are often vacant in areas with housing shortages, like the Lake Champlain shoreline near where I live in northwest Vermont.

Second, this would not be a federal policy. Local governments collect property taxes, so I’m calling for a set of local policies (maybe with some facilitation from the federal government to help share consumer data and prevent fraud). How high should the tax rate on second homes go? Well, England passed a law that will allow town and village councils the ability to increase tax rates for second homes in their municipalities by up to 100%. That might be too high here in the U.S., and it would certainly be too high in most places, but local governments can make that determination for themselves.

The goal is simple: Don’t make owning first homes harder; make vacant homes less common. The theory is simple, too: One family can’t live in two residences simultaneously, so one of these residences will always be vacant (a problem that compounds for third homes, and fourth homes, and so on). If owning that second property becomes more costly, then we encourage one of two behaviors: more local ownership of properties, or more owners of second homes renting them out to recoup their costs.

We’re already pulling some levers at the federal level, with caps on deductions from mortgage interest and tax exemptions capped for secondary residences. But we can increase the local tax rate, too. Not only would that increase housing availability, it would also provide revenue that could fund local services — like schools, streets, and infrastructure — or be used to offset taxes imposed on primary residents.

I know that lobbying for more government intervention and higher taxes is not very popular, and for good reason. In most cases I do not want the government to have more control or for citizens to pay more in taxes. However, aggressive and considerate tax policy is sometimes the best tool for the job, and I think this is one of those times.

Again: Tax policy won’t solve housing affordability on its own. I think my idea would help more than Trump’s, but housing is too big an issue for any one silver-bullet solution. This broad problem requires a broad, all-of-the-above fix: more housing, less regulation, and smarter tax policy.

Take the survey: Which do you think would be more effective, Trump’s proposal or Ari’s? Let us know.

Disagree? That's okay. Our opinion is just one of many. Write in and let us know why, and we'll consider publishing your feedback.

Your questions, answered.

Q: How can the U.S. charge Maduro, a non-U.S. citizen, with crimes in the U.S. and seemingly retroactively use that to justify his capture?

— Robert from East Norriton, PA

Tangle: Harvard Law School professor Jack Goldsmith, in his Substack “Executive Functions,” lays out the legal theory that the Trump administration could argue justifies this action. First, the administration could reference precedent from an argument advanced by then-Assistant Attorney General Bill Barr in 1989 to justify the arrest of Manuel Noriega, the military dictator who ruled Panama in the 1980s. That argument rests on the FBI’s statutory authority to issue arrests outside the U.S., claiming the statute exceeds the authority of international law.

Then, the logic to justify the use of force in executing Maduro’s capture and extradition becomes convoluted — but also, potentially, legally defensible. Under Article 51 of the U.N. Charter, the U.S. can explain the use of force as a necessary form of preemptive self-defense for the agents performing the arrest action.

Goldsmith isn’t saying that the argument is definitively sound — he’s just saying that it’s possible to make. “This is where the logic of the executive branch precedents leads,” Goldsmith wrote. “As [law professor] Rebecca Ingber has explained, unit self-defense could justify ‘the United States using force against non-state actors who do not even have the capacity to threaten U.S. territory, in a state that has not attacked the United States, providing the groundwork for a future escalation with either that non-state actor or the state itself — and all without authorization from Congress.’”

At this point, all of that is still theoretical. When Maduro’s trial begins, we’ll see how the Southern District of New York advances its argument in practice.

Want to have a question answered in the newsletter? You can reply to this email (it goes straight to our inbox) or fill out this form.

Under the radar.

The Trump administration is reportedly nearing a deal to lower tariffs on Taiwan in return for new investment in U.S.-based semiconductor chip manufacturing by the Taiwan Semiconductor Manufacturing Company (TSMC). The agreement is said to lower tariffs on Taiwanese imports from 20% to 15% — in line with current duties on Japan and South Korea — while TSMC would commit to building at least four more chip manufacturing plants in Arizona (the company has already pledged to build six factories and two advanced packaging facilities in the state). The Office of Trade Negotiations in Taipei said the U.S. and Taiwan had reached “broad consensus” in trade negotiations but did not offer a timeline for finalizing the deal. Bloomberg has the story.

Your Personal Data Is One Search Away From Anyone

A quick search reveals what strangers can find about you — phone number, home address, mortgage details, even family members and financial accounts.

Incogni's Unlimited plan removes your sensitive data from Google and AI results, protecting you from identity theft and targeted scams.

Use code TANGLE for 55% off.

Numbers.

- 21.2%. The share of mortgages with a mortgage rate above 6% as of the third quarter of 2025, according to the FHFA National Mortgage Database.

- 20.0%. The share of mortgages with a mortgage rate under 3%.

- $414,400. The median sales price of existing homes in the U.S. in 2025, according to the National Association of Realtors.

- $389,300. The median sales price of existing homes in the U.S. in 2023.

- 4,060,000. The number of existing homes sold in the U.S. in 2025.

- 4,090,000. The number of existing homes sold in the U.S. in 2023.

- 1,180,000. The total inventory of existing homes in the U.S. in 2025.

The extras.

- One year ago today we covered Pete Hegseth’s confirmation.

- The most clicked link in yesterday’s newsletter was the mass resignation at the Minnesota U.S. Attorney’s Office.

- Nothing to do with politics: The space launches and landings to look forward to in 2026.

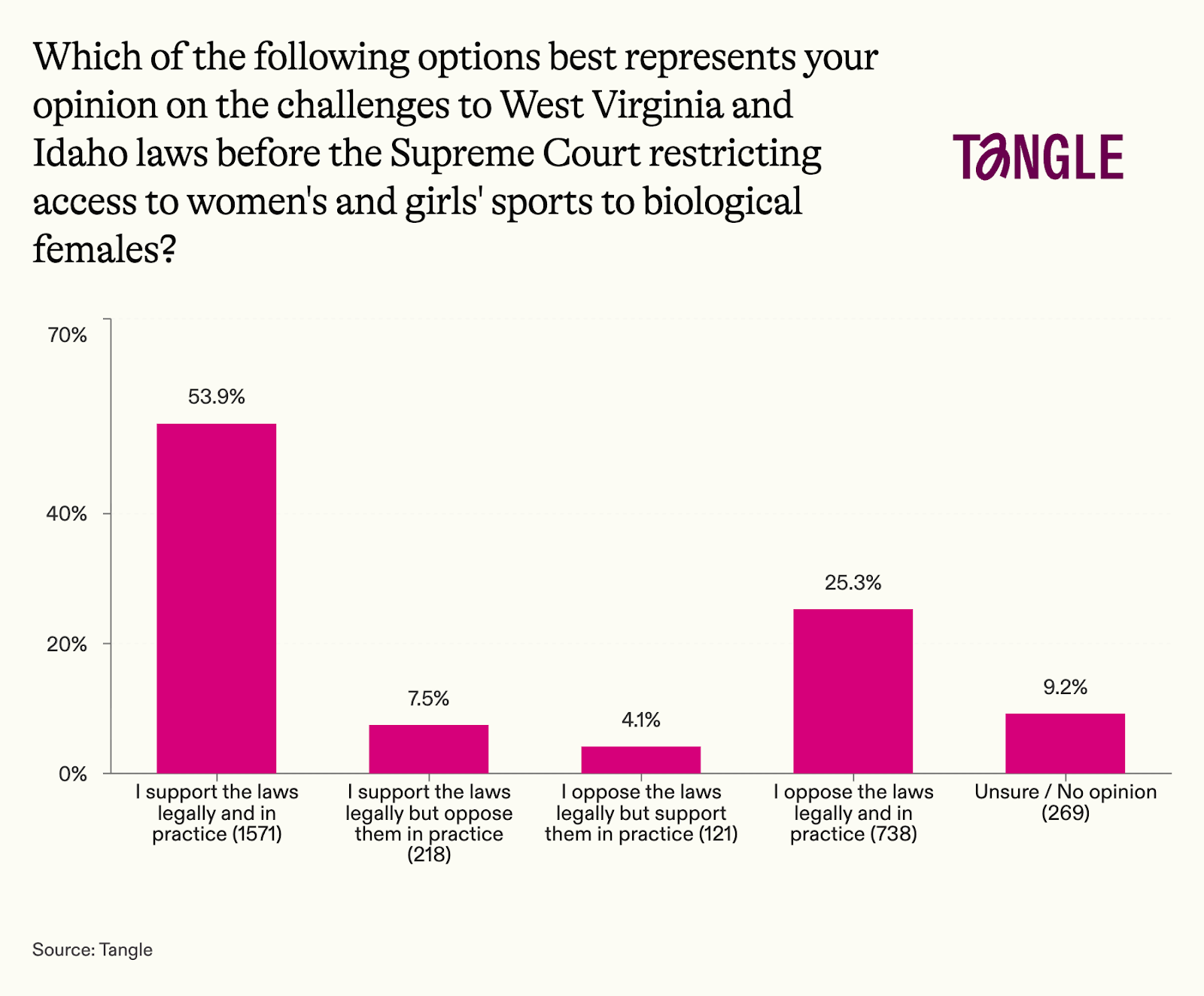

- Yesterday’s survey: 2,917 readers responded to our survey on the state laws restricting transgender women and girls from women’s and girls’ sports before the Supreme Court with 54% supporting the laws in theory and in practice. “You can’t erase biology; a natal male will be inherently stronger than a natal female. This issue, which affects a tiny minority, is taking too much oxygen,” one respondent said. “Allow individual institutions to make laws tailored to their needs. A NCAA ruling that could impact potentially hundreds of thousands of people should be different than a local rec league impacting dozens,” said another.

Have a nice day.

When Michael Welsh was a medical student, he met a 7-year-old patient suffering from cystic fibrosis (CF), a genetic disorder with a short life expectancy. She inspired Welsh to dedicate his life to studying the disease, and his research paved the way for a new CF treatment. Now, for the first time, CF patients’ life expectancy approaches general population levels. Welsh won the 2025 Lasker–Debakey Clinical Medical Research Award for his discoveries. “People with CF are now getting married, having children and living lives they could not have imagined a decade ago,” Welsh said. “Seeing that transformation has been incredibly moving.” The AMA has the story (and an interview with Welsh).

Member comments