Plus, a question about income inequality.

I’m Isaac Saul, and this is Tangle: an independent, ad-free, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum — then “my take.” You can read Tangle for free or subscribe for Friday editions, and you can reach me anytime by replying to this email. If someone sent you this email, they’re asking you to sign up. You can do that by clicking here.

Today’s read: 13 minutes.

Joe Biden’s tax plan and the arguments over it. Plus, how do we solve income inequality?

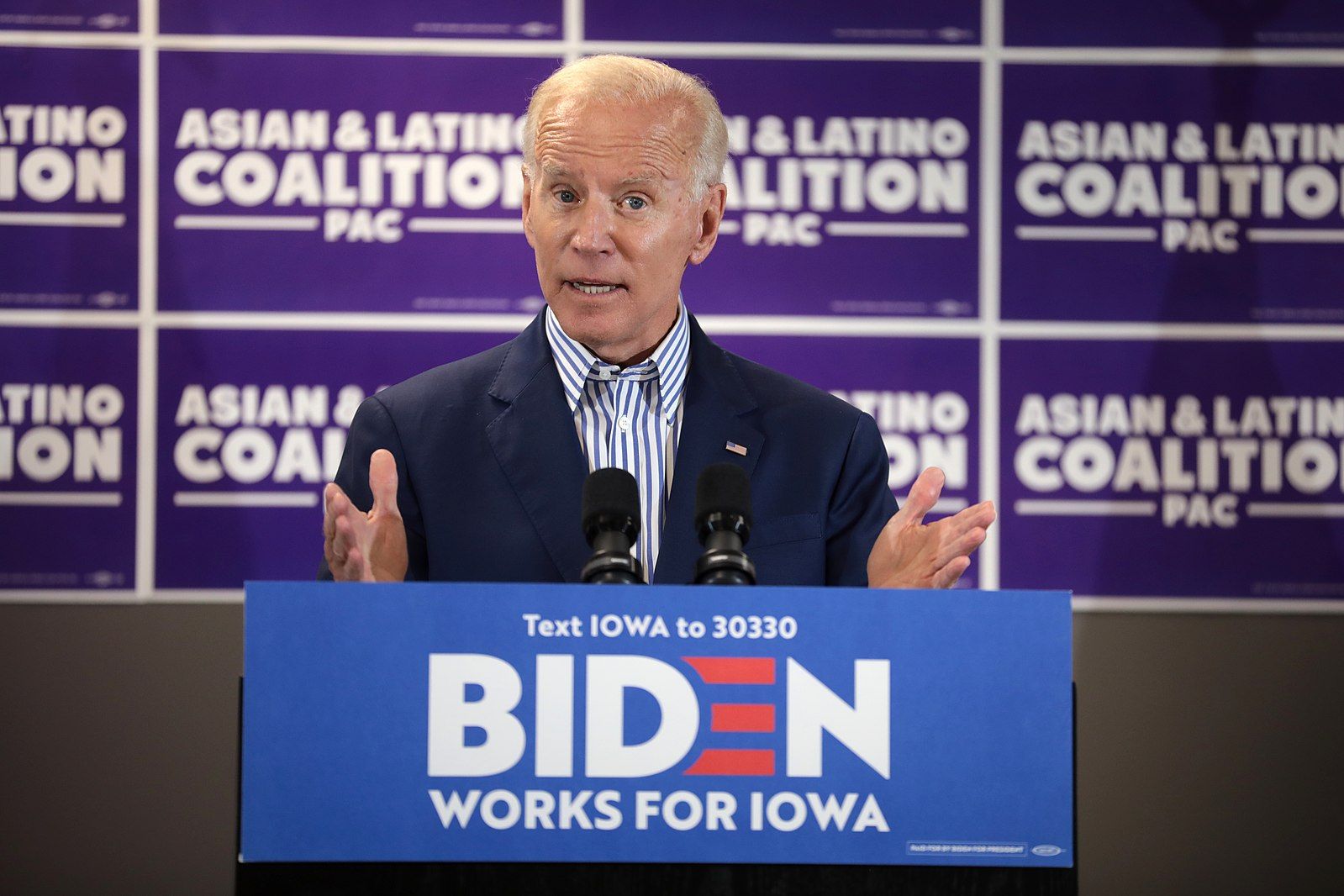

Photo: Gage Skidmore / Wikicommons

Quick hits.

- The OxyContin producer Purdue Pharma pleaded guilty to criminal charges and will pay $8.3 billion in a settlement with the Justice Department. It’s a major step in the federal government’s fight to hold drugmakers responsible for America’s opioid epidemic.

- Senate Democrats rejected Republicans’ slimmed-down $500 billion coronavirus aid bill. Nancy Pelosi and White House advisor Steve Mnuchin continue to negotiate a much larger package.

- Utah Republican Senator Mitt Romney told reporters that he did not vote for Donald Trump, but wouldn’t disclose who he cast a ballot for. Former New Jersey Gov. Chris Christie, who recently survived COVID-19, published a mea culpa op-ed saying he should have worn a mask to a White House event.

- Iran and Russia have both obtained American voter registration data and are sending threatening, fraudulent emails to voters, according to top national security officials.

- Former President Barack Obama delivered a blistering criticism of Donald Trump during a speech in Philadelphia yesterday. Obama said President Trump is “incapable of taking the job seriously" and has shown no interest in "helping anybody but himself and his friends."

- BONUS: The second and final presidential debate is tonight at 9pm Eastern. It will last 90 minutes, will be hosted by NBC’s Kristen Welker, and the topics will include “Fighting COVID-19," "American Families," "Race in America," "Climate Change," "National Security" and "Leadership." Each candidate will be muted during the other’s two-minute opening statements on topics.

What D.C. is talking about.

Joe Biden’s tax plan. In a bizarre twist of fate, both Joe Biden and Donald Trump have tried to get everyone to pay attention to this tax plan — a rare moment where a candidate and his opponent both seem to want the public focused on the same thing.

On the campaign trail, Biden has started to make his plan a feature of his pitch for how he is going to change America. In return, Republicans and Trump have also focused on it, saying it would undo many of the positive impacts ushered in by the major 2017 tax plan that Donald Trump and the Republican-controlled Senate passed. Biden’s tax plan has been gaining so much attention that it even caught the eye of famous rapper 50 Cent, who endorsed Donald Trump for president, saying he didn’t want to become “20 Cent.” Here was the president on Twitter just yesterday:

It is true that Biden’s plan will raise taxes on the wealthy and corporations, though he has pledged not to raise taxes on anyone earning less than $400,000 a year. Biden has repeatedly promised that no household making less than $400,000 would pay more in taxes, a claim The Wall Street Journal rated as “mostly right.” This means that less than 10% of taxpayers would see a direct increase on their taxes if his plan were to go into effect.

Biden’s plan raises the tax rate from 21% to 28% on corporations while also taxing foreign income. For individuals making more than $400,000 a year, his plan raises the top rate from 37% to 39.6%. The plan also raises the tax on capital gains (the money made when you sell off an asset) for households with income above $1 million from 23.8% to 39.6%. The plan also imposes a 12.4% Social Security payroll tax on wages above $400,000.

However, that does not mean his tax plan won’t affect anyone earning less than $400,000 a year. The reason Biden’s plan could impact non-wealthy Americans is “indirect taxes,” or the cost workers or consumers eventually bear when taxes are raised on corporations. This is because corporate tax increases often lead corporations to slow wage growth or cut wages. If you own stock in a company, it means that stock could grow at a slower rate than it has. To offset the tax, it could mean an increase in prices. Biden’s plan will also attempt to reinstate the individual health care mandate to buy health insurance, which Biden calls a “fee” but the Supreme Court recently ruled is actually a tax (a hotly debated subject).

It’s quite possible Biden’s plan could result in lower after-tax wages for middle-income workers, though just barely. The Penn Wharton Budget Model estimates that those earning less than $400,000 a year would see an average decrease of .9% in after-tax revenue while those earning more than $400,000 would see a decrease of 17.7%.

At the same time, Biden’s plan would increase federal revenue by $2 trillion to $3 trillion over a decade, according to estimates by both conservative and liberal-leaning tax analysts. This money, Biden says, would be used to invest in crumbling infrastructure, education, child care and the fight against climate change. One of the most important proposals in Biden’s plan is an expansion of the Child Tax Credit during the economic crisis. That’s a credit that families making less than $250,000 a year can claim. Right now, the credit is capped at $2,000 per child under the age of 17. Biden wants to expand that to $3,000 per child aged 6 to 17 and $3,600 for children under six. He is also proposing up to $8,000 in child care tax credits for low income and middle class families, expanding the existing tax credits by as much as $6,800 a year.

Here is what the right and left are saying about his plan.

What the left is saying.

The left generally supports the plan over Trump’s, arguing that it would not slow economic growth and would shore up government-funded programs, creating opportunities to invest in some of the major priorities across the country. Some think that it could go even further.

Harvard economist and former Obama economic adviser Jason Furman made the case for Biden’s plan in The Wall Street Journal, arguing that every four years a Democrat runs on higher taxes for the wealthy, and “every four years a group of people predicts that the sky will fall if those plans are implemented. Yet every time their plans have been implemented, the sky hasn’t fallen—if anything, economic growth and business investment have been stronger under Democratic than Republican presidents.”

“Over the longer run, the proposed tax increases would help pay for important measures to boost economic growth and ensure that it is shared more broadly,” Furman argued. “An allowance of at least $3,000 a child is a step that, if made permanent, would reduce child poverty and increase economic mobility. Expanded child care, a critical need exposed by the pandemic, would increase the labor supply. And investments in infrastructure and clean energy would dial up productivity growth. The three other estimates I am aware of for the complete Biden program, from the Penn-Wharton Budget Model, Oxford Economics and Moody’s Economy.com, also predict that it would add to overall economic growth.”

“There’s a widespread perception that Republicans are better than Democrats at managing the economy. But that’s not at all what the record says,” Paul Krugman argued in The New York Times. “Republicans also have a long history of claiming that progressive policies would lead to economic disaster. They’ve been wrong every time. They’ve been wrong about tax hikes: When Clinton raised taxes in 1993, Republicans confidently predicted recession, but what actually happened was a huge boom… They’ve also been wrong about social programs. Obamacare, the G.O.P. insisted, would destroy millions of jobs. One of the dozens of attempts to repeal the Affordable Care Act was actually called the ‘Repealing the Job-Killing Health Care Law Act.’ Yet in the six years after January 2014, when the act went into full effect, the economy added almost 15 million jobs.”

In The Washington Post, Jennifer Rubin argued that the Biden tax plan may be moderate and smart enough to attract some Republican support in the Senate. “No one expects the worst anti-government, demagogic Republicans to go along with anything that departs from supply-side plutocratic economics, but there are more than a few Republicans who have embraced pieces of this (e.g., Sens. Marco Rubio of Florida and Mike Lee of Utah on expansion of the child tax credit),” she said. “Moreover, given that many of these moderate policies poll extremely well, the Republican survivors of 2020 may look for issues on which they can show themselves not to be knee-jerk obstructionists.”

What the right is saying.

The right is generally opposed to the Biden tax plan. While some differ in how bad they say it would be for the economy (the Trump campaign has argued it’d be disastrous during a recovery, while others think it would have a moderately negative impact), there isn’t much support going around for it on the right.

“Joe Biden’s tax plan is based on a deathless myth: that taxes are actually paid in economic terms by those upon whom they legally fall,” Kevin Williamson wrote in The National Review. “The obviousness of this nonsense is clear enough if you put the proposition into plain English: ‘Don’t you worry, now, we’re not going to raise taxes on you, Bubba — we’re just going to raise taxes on your employer, your customers, your vendors and business partners, the people who make and sell the things you buy and use, your bank, your Internet provider, the companies that build houses and commercial buildings, your landlord, gasoline distributors, all the companies your retirement account is invested in — oh, you won’t be affected at all!’”

“Biden’s tax plan is a lot like the Republicans’ health-care plan: He mainly is interested in undoing what was done under the last president, in this case partially repealing the 2017 tax bill put together by Paul Ryan, which, for some reason, we call the ‘Trump tax cuts,’” Williamson said. “But tax increases are generally unpopular, so Biden promises to raise taxes only on a despised and resented minority: People who make more money than most of the people he is trying to persuade to vote for him.”

The Wall Street Journal editorial board recently decried “The Cost of Bidenomics,” though it didn’t go the armageddon route some on the right have. “We are also not predicting a ‘depression,’ as Mr. Trump does, if Mr. Biden wins the election,” they wrote. “On dire economic predictions, Mr. Trump is the mirror image of Paul Krugman on the left. The data show that the U.S. economy is recovering from the pandemic shutdowns faster than most economists predicted. Democrats may attempt to portray the economy as a disaster that requires trillions of dollars in new spending, but Mr. Biden would inherit an economy with strong growth momentum.”

“The issue is whether Mr. Biden’s policies will nurture this strong recovery, or slow it down as Barack Obama’s policies did after the 2009 recession… Overall, the authors [of a Hoover Institute study] estimate that the Biden agenda, if fully implemented, would reduce full-time equivalent employment per person by about 3%, the capital stock per person by some 15%, and real GDP per capita by more than 8%. Compared to Congressional Budget Office estimates for these variables in 2030, this means there would be 4.9 million fewer working Americans, $2.6 trillion less in GDP, and $6,500 less in median household income.”

My take.

Tax policy is one of those things in American government that nearly all of us are impacted by. This makes it a lot easier to talk about in concrete terms, but it also makes it much more difficult to suss out what’s “good” or “right” because the impact is so different for so many people and manifests in so many different ways.

Take me, for example. I benefit from the Trump tax plan of 2017. I make a fairly modest salary (about $70,000 a year) which — as a younger, fairly irresponsible social person in New York City — essentially amounts to living paycheck to paycheck with a couple hundred bucks a month of savings. In the pre-pandemic world, I’m eating out once or twice a week, getting after-work drinks, spending money on some luxuries when I can. Some people support families on far less than my income in this city, which I am, of course, conscious of.

Fortunately, I have no more student debt, having lived as cheaply as I possibly could (I spent four years in a six-bedroom apartment) and getting an assist from my generous parents to climb out of that debt. When Trump’s tax bill passed, I brought home an additional $2,000-$3,000 a year. I also took money that was budgeted for my student debt and put it into the stock market, all of which has grown quickly over the last few years under the Obama/Trump economy (and is now recovering nicely after the COVID-19 crash).

So, on net, the changes Trump’s plan made to taxes were a positive for me in the short term. As far as I can tell, nothing in Joe Biden’s tax plan is going to impact those changes — save the possibility that raising the corporate tax rate reduces corporate profits and thus slows (or reverses) the growth of the stocks I now own.

Then there’s this newsletter. I’m trying to build a business here, with growth projections for next year breaking six figures (did I mention you can subscribe to Tangle to support this project?). My long term goal is to hire a small, 3-4 person full time team that runs a profitable newsletter, podcast and merchandise store. At some point, to protect myself and pay employees, I’ll have to file Tangle as an LLC. Depending on how I structure my taxes, I could pay a rate tied to the corporate tax rate, meaning a Biden bump from 21% to 28% on a corporate tax rate would directly impact my bottom line. Given that I already pay Substack (the platform hosting this newsletter) 10% of my revenue, plus 2.7% of fees on Stripe transactions (the platform that charges your subscription), and then would need to buy health insurance for me and/or my employees, you can see how my gross revenue evaporates right before my eyes.

So what do I do to cover the difference? Pay my employees less? Pay myself less? Raise the subscription cost of Tangle? Hire fewer people? Just accept making less money? That’s a real-world example of how “raising taxes on the wealthy and corporations” can translate pretty directly to increased costs that may impact others.

Then the question becomes about the overall upside. It’s certainly easier to swallow paying more in taxes if those taxes are being used for things you care about. So far, no economic analysts outside of a small group tied closely to the Trump campaign have predicted doom and gloom from Biden’s tax plan. The American Enterprise Institute, a conservative tax policy group, could hardly muster a negative outlook stemming from the plan. That kind of silence speaks volumes to me.

In return, Biden is promising investment in job-creating programs like a massive infrastructure plan, which is something I supported under Trump (he walked out on those negotiations) and would support under Biden. He’s also promising to use that revenue to pay for an expansion of child tax credits, another idea I love, that would have a huge impact on low wage workers’ families. The CTC is currently up to $2,000 per child under the age of 17. Biden would expand that to $3,000 per child 6 to 17 and $3,600 for children under six. This is, in my opinion, the single most important part of his tax plan. Reducing the incredible, unfathomable, unconscionable income and wealth gap in America is an issue that I care deeply about. CTC expansions are a positive step toward lowering hardship for low-income Americans who need child care. Biden is also imposing a tax on corporations that send jobs overseas and then sell products back to Americans, a very Trumpian tax idea and one that I support (and would have supported if Trump had proposed it).

These are three major wins in Biden’s plan — things that, as an American taxpayer and potential business owner, can make a hit on my take-home revenue worth it for “the greater good” of helping so many, perhaps even my own employees. That’s a choice and a calculation other Americans are going to have to game out, but — if he can pull it off as he hopes to (a big if) — it’s a plan that I can get behind.

Your questions, answered.

Q: I think for me, the wealth inequalities and classism in the US is the single largest issue for me. Wages haven’t gone up, the middle class is shrinking. Tax cuts are only for the wealthy who are only concerned with getting wealthier. How will this be addressed? Who has a good mind to talk intelligently about it?

— Jennifer, Erlanger, Kentucky.

Tangle: This is a huge question and one that I don’t think I can properly address in a few hundred words. However, I’ll give it my best swing.

This is also one of the most important issues in America to me. Our class divide creates a world where we are totally disconnected from the reality so many millions face. 53 million workers, 44% of all workers aged 18 to 64, live on low wages. We’re talking median annual wages of $18,000 — and most in that group are in the “prime working age” of 24-54 years old.

Solving this problem requires improving social mobility. America tells itself the lie that upward opportunity abounds, which is directly refuted by the data today. We rank 27th in social mobility globally — social mobility being defined as how easy it is for someone to improve their economic standing across generations. The World Economic Forum estimates that, on average, it takes five generations for someone born into a low-income family in the U.S. to reach the mean income of their country. Five generations.

To me, the most obvious barrier is education. Higher education is simply not accessible for the poor unless they are incredibly strong performers in school (that’s less likely with financial troubles at home) or live in one of the few states that have launched programs to fully support a college education for all students. Promoting worker skills is also obvious, low-hanging fruit: You don’t have to get a liberal arts degree to make a good living (in fact, I would not recommend that!). We need to open pathways to trade schools that create career opportunities. In 2020, computer programming is booming, and as the next wave of technology comes in, education programs geared toward that market need to be expanded.

It’s also obvious to me that we need to raise the minimum wage, whether federally or by corporate commitment. Talk to any American boomer and they’ll lovingly recall the days when working 40-50 hours a week at a minimum wage job could support a life — maybe even give you enough money to buy a house. Those days are long gone.

You might be thinking, “gee Isaac, you really sound like a lib who wants to kill capitalism.” So let me pause to point out that the richest CEOs in America now recognize this reality. In 2019, a group of those CEOs updated how they view the responsibility of corporations both to their employees, and in a broader, societal context, and abandoned the single top priority of “maximizing shareholder profits.” Was it an empty PR scheme? Perhaps. But it’s also a good first step.

Those corporations recognize that when their CEOs are making hundreds of millions of dollars a year, it’s unacceptable that an employee at their company can work 40 hours a week and be food insecure or totally incapable of paying for their health care. Now, they’re trying to act accordingly. It’d be great if the government didn’t need to impose its will on these companies to force them to pay a living wage, but if the corporations don’t fulfill their new promises, then it should.

When Jamie Dimon, the CEO of JP Morgan, and Elizabeth Warren and Bernie Sanders are sounding the same alarm and calling for similar steps toward a more equitable country, I hope that’s enough for the rest of us to pay closer attention. There are a dozen other things to consider: access to affordable housing and improving the social safety net among them. I’d certainly suggest Warren and the Brookings Institute as good places to start for intelligent voices on solving this problem. Conservatives like Alex Muresianu have also called on the right to produce and support solutions.

A story that matters.

The Federal Reserve has kept the economy afloat during the COVID-19 pandemic, but ProPublica reports that its actions could be “unintentionally worsening economic inequality by providing the most help to Americans who are least in need of it. And it’s also putting stress on the middle class’ most important asset: retirement benefits.” As the Federal Reserve buys up corporate debt, it is hurting prudent savers who put their money in Treasury securities and other no-risk investments like bank certificates of deposits to make a smaller amount of interest. That could drive those savers into the stock market, where their money is at much greater risk.

Numbers.

- 3. The percentage lead for Joe Biden over Donald Trump in Iowa, according to a Siena College poll.

- 9. The percentage point victory Donald Trump scored in Iowa during the 2016 election.

- 4th. Joe Biden’s finish in the Iowa state caucus during the Democratic primaries.

- 59-40. Joe Biden’s lead amongst under-35 voters in Texas, according to a SurveyMonkey poll.

- 39,000. The number of people currently in the hospital suffering from COVID-19.

- 52-40. Joe Biden’s lead over Donald Trump in Michigan, according to a new Fox News poll.

- 50-45. Joe Biden’s lead over Donald Trump in Pennsylvania, according to a new Fox News poll.

- 48-45. Donald Trump’s lead over Joe Biden in Ohio, according to a new Fox News poll.

- +35. Joe Biden’s lead over Donald Trump among suburban women in Michigan, according to a new Fox News poll.

- 12. The number of days until election day.

See you tomorrow?

If you’re on the free list for Tangle, you receive the newsletter Monday-Thursday. But if you become a paying subscriber, you also get Friday editions. These newsletters are more experimental, include deep dives on one subject, personal essays, fully transcribed interviews with interesting people in politics or special coverage of major events. Tomorrow’s newsletter will either be an interview with a pollster who thinks Trump is going to win (if he returns my call in time) or coverage of tonight’s debate. You can subscribe below!

Have a nice day.

In Texas, a farm is connecting special needs kids with injured animals. Jamie Wallace-Griner started her animal sanctuary, Safe in Austin, which takes in animals who have been victims of abuse or neglect, or have other special needs. More than 150 animals live at the sanctuary. When the sanctuary got off the ground, Wallace-Griner noticed an unexpected interest from parents who had special needs children. Oftentimes, the kids would connect with animals that had similar disabilities to their own — and Wallace-Griner embraced the new purpose of her farm. The Washington Post wrote up some of the incredible stories of human-animal friendships that have occured here.