I'm Isaac Saul, and this is Tangle: an independent, nonpartisan, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

Are you new here? Get free emails to your inbox daily. Would you rather listen? You can find our podcast here.

Today’s read: 16 minutes.

If You're Taking Statins, Read This: A critical deficiency that standard blood tests miss—and what to do about it.

More than 92 million American adults are currently taking statin medications. If you're one of them—or if you're simply focused on maintaining healthy heart function, blood pressure, and cholesterol levels—there's something you should know.

Statins can lead to a significant nutritional deficiency that won't show up on standard blood work. This isn't about fear-mongering; it's about being informed.

The issue: While statins are effective at lowering cholesterol, they may also deplete a nutrient that's essential for heart health and cellular energy production.

What to watch for: There are five key warning signs that may indicate you're experiencing this deficiency. Understanding these signs could make a real difference in how you feel day-to-day and in your long-term health outcomes.

⇒ Learn about the 5 warning signs and what statin users need to know

My chat with Alex Thompson.

Before our recent live event in Irvine, California, I got the chance to sit down with Alex Thompson. I asked him about his best-selling book, Original Sin, on the cover-up of President Joe Biden’s mental decline; the lessons the press should learn from the scandal; and who he thinks will run for president in 2028. I was surprised by his candor, and fascinated by his answers. Check out the interview here.

Quick hits.

- The United Nations Security Council approved a resolution adopting President Donald Trump’s proposed peace plan for Gaza, establishing a legal mandate for an international stabilization force in the strip and transitional government. 13 of the 15 Security Council members voted for the resolution, and Russia and China abstained. (The resolution) Separately, Hamas released a statement saying it rejected two key terms of the peace plan that required its disarmament and abdication from governance. (The statement)

- President Trump announced that the United States will sell F-35 fighter jets to Saudi Arabia ahead of a meeting with Saudi Crown Prince Mohammed bin Salman at the White House. (The announcement)

- The Department of Homeland Security said it had arrested over 130 people across two days of immigration enforcement operations in Charlotte, North Carolina. The agency claimed that 44 of those people had criminal records and are suspected of being in the country illegally, though their identities have not been confirmed. (The raids)

- President Trump said he will sign the bill compelling the Justice Department to release all files related to Jeffrey Epstein if it passes Congress. The House is scheduled to vote on the bill on Tuesday. (The comments)

- Acting Federal Emergency Management Agency (FEMA) Administrator David Richardson resigned, saying he only planned to stay in the role until the end of hurricane season in the U.S. Richardson faced scrutiny for his handling of the federal response to the catastrophic flooding in Texas in July. FEMA Chief of Staff Karen Evans will replace Richardson on December 1. (The resignation)

Today’s topic.

The latest on the economy. In recent weeks, President Donald Trump has announced or proposed several measures to address the cost of living. These moves come against the backdrop of an uncertain economic outlook, as voters have expressed concern about rising prices and financial markets have experienced significant selloffs. While President Trump has maintained that the economy remains strong, some Republicans have called on him to refocus his agenda on affordability issues ahead of the 2026 midterms.

On Friday, Trump issued an executive order removing tariffs on a variety of agricultural products that are not produced in significant quantities in the United States, including coffee, cocoa, and bananas. In a fact sheet accompanying the executive order, the White House said Trump decided to lift the tariffs due to progress in trade negotiations with countries producing these goods. However, prices for many of the now-exempted goods have also risen since the tariffs were implemented, part of an overall rise in food prices.

Separately, President Trump and Treasury Secretary Scott Bessent have proposed sending $2,000 dividend payments derived from tariff revenues to a subset of Americans based on income. While the administration has not defined the core details of the plan, Trump said the dividends would be sent in mid-2026 and delivered via a tax rebate. On Sunday, Secretary Bessent acknowledged that the plan would require Congressional authorization.

Although prices have continued to rise across the economy, the latest inflation data showed more modest increases relative to economists’ expectations. According to the Consumer Price Index (CPI) report for September, the CPI rose 0.3% on a monthly basis and 3.0% on an annual basis. Rising gasoline prices were the biggest driver of the monthly increase, while other goods like food and shelter increased more modestly. Overall, the monthly CPI remains well below its five-year high in June 2022 but has increased steadily since April 2025.

On the heels of the CPI report, the Federal Open Market Committee (FOMC) voted to cut the federal funds rate by 0.25 percentage points to 3.75%–4.0% at its October meeting, the second reduction in 2025. While some analysts expect the FOMC to cut rates again at its December meeting, Federal Reserve policymakers have signaled that they may hold off, citing concerns about persistent inflation.

Some closely watched economic reports that were delayed by the government shutdown will be released in the coming weeks. The Bureau of Labor Statistics announced that it will publish the monthly jobs report for September on Thursday and the inflation-adjusted earnings report for September on Friday. Separately, White House Press Secretary Karoline Leavitt suggested that the CPI and jobs reports for October won’t be released due to disruption from the shutdown.

Today, we’ll share analysis from the right and left on the U.S. economy, followed by Managing Editor Ari Weitzman’s take.

What the right is saying.

- The right is mixed on Trump’s handling of the economy, with some saying he needs more time to let his policies play out.

- Others say the economy is showing real signs of weakness.

- Still others suggest Trump’s messaging on the economy must improve.

In USA Today, Nicole Russell wrote “Trump’s tariffs and trade policies will improve the economy. Give him time.”

“The economy is America’s engine, and it must run well. Trump promised to jump-start it again, the conservative way — trim federal government excess, boost free markets and deregulate so businesses can thrive. For the most part, this is happening, even though it’s a slow process,” Russell said. “Like many Republicans, I’m not entirely down on the economy. I think perspective matters, change is coming and patience is required. Trump’s reciprocal tariffs and new trade policies have fundamentally reshaped America’s economy, hopefully for the better.”

“When I look at the indicators of a strong economy, we have a lot of them: Inflation is hovering around 3%, which is a significant improvement from June 2022, when it was at 9.1%. This is yet another reason to avoid the tariff stimulus checks. The stock market remains at record highs. Unemployment remains relatively low. The growth rate for the gross domestic product in the second quarter is 3.8%. Wages are rising. Homeownership has only slightly declined,” Russell wrote. “Collectively, these data points make me question Democrats’ overall cynicism about the economy.”

The Washington Examiner editorial board said “happy talk won’t solve economic anxiety.”

“Asked by Laura Ingraham on Fox News, ‘Why are people saying they are anxious about the economy?’ Trump rejected the premise of the question. ‘I don’t think they are saying that, I think polls are fake,’ he said,” the board wrote. “Voters who buy increasingly expensive groceries and don’t like it will remember that Biden said the same thing right before Trump cantered to victory in the 2024 elections… If Trump wants Republicans to prevent the party from being pummeled in 2026, he needs to drop the happy talk and change course — particularly on tariffs — before it is too late.

“There are some narrow areas where the economy has greatly improved. The prices of eggs and gasoline are way down. But the prices of beef, coffee, auto repairs, and housing are all rising, and Trump’s responses either admit that tariffs are the problem or would make the situation worse,” the board said. “Trump’s $2,000 tariff dividend is also a terrible idea that will make the economy worse. How is it any different than the Biden stimulus payments that everyone agrees caused the worst inflation crisis in a generation?”

In The Federalist, Eddie Scarry argued “Trump should learn from J.D. Vance when it comes to talking about prices and affordability.”

“MAGA people are nearly in tears of rage this week for good reason after watching Trump repeatedly declare all is well on the home front while he gallivants around the White House grounds with foreign leaders, showing them his latest gold-trimmed renovations,” Scarry wrote. “The current president would be forgiven for the costs of basic needs not having dropped back to where they were in 2019 just one year into his second term. Getting even close to that is going to take time. But ‘I don’t want to hear about the affordability’ is unacceptable to everyone who put him in office precisely because the last president blew off the same problem.”

“Just two weeks ago Vice President J.D. Vance was saying all the right things as they relate to the economy. ‘We’re nine months into this thing, we’ve done a lot of good,’ he said in an interview with the New York Post’s Miranda Devine. And then he asserted the administration’s proper ownership of the problem at hand,” Scarry said. “Obviously more is expected than just an acknowledgment that people continue taking on credit card debt and staking out second jobs just to keep up with their bills. But at a minimum, it’s demanded of the president to assure everyone that he isn’t just having a good time with dignitaries in his eternal quest to secure a Nobel Peace Prize.”

What the left is saying.

- The left says Trump is ignoring clear economic warning signs and denying his role in the problem.

- Some say Trump is overseeing an economy that works only for the top 1%.

- Others suggest Trump’s economic perception problems bear similarities to Biden’s.

In The Boston Globe, Renée Graham wrote “Trump believes affordability is ‘a con job by the Democrats.’ He’s wrong.”

“During the 2024 presidential campaign, Trump claimed, ‘When I win, I will immediately bring prices down, starting on day one.’ But it’s been the opposite. Prices have gone up since his return to the White House, with groceries about 2.7 percent higher in September than they were a year earlier,” Graham said. “That’s why White House advisers are talking to Trump about spending less time globetrotting and more time talking to American voters about what he’s doing to pull this nation out of an economic stupor exacerbated by the president’s reckless tariffs.”

“Similar cluelessness helped crush George H.W. Bush’s reelection chances in 1992. A New York Times story that said Bush was ‘amazed’ by a supermarket barcode scanner gave the impression that the then-president had never been in a grocery store before,” Graham wrote. “Trump generally seems to believe that if he repeats a lie often enough, repetition becomes fact. But here are the facts: Grocery prices are going up and people are hurting. If Trump believes his economy is ‘the greatest we’ve ever had,’ let him make that argument in a supermarket aisle where he’ll meet Americans who are hurting because he’s causing them pain.”

In The New Yorker, John Cassidy argued “Trump can’t dodge the costly K-shaped economy.”

“Even before his U-turn on food tariffs, Trump had been scrambling to roll out his own affordability proposals. He’s talked about creating fifty-year mortgages, depositing federal money directly into personal health savings accounts, and handing out a two-thousand-dollar tariff ‘dividend,’” Cassidy said. “In the past five years or so, rising prices have largely eaten up wage gains, leaving low- and middle-income Americans (many of whom voted for Trump) struggling to make ends meet. Simultaneously, a soaring stock market and rising real-estate prices have generated more than fifty trillion dollars in new wealth, much of which has accumulated among the richest ten per cent of American households.”

“This disjunction, which many observers refer to as the ‘K-shaped economy,’ predates Trump, but his policies, along with the A.I. bubble on Wall Street, have only accentuated it,” Cassidy said. “Try as he will, [Trump] can’t easily disassociate himself, or his party, from a costly K-shaped economy. Even after his reversal on beef and other foodstuff tariffs, most of his levies remain in place, and millions of Americans are facing a year-end leap in the cost of health insurance. None of the schemes he has recently floated are adequate to address the affordability challenge, and his health-care proposal could well make things a lot worse.”

In his Substack, Paul Krugman asked “why does a good economy sometimes feel bad?”

“Donald Trump continues to claim that grocery prices are ‘way down’. Yet anyone who does their own food shopping — unlike Trump — can tell you that Trump’s statement is false,” Krugman said. “That said, although the U.S. economy isn’t performing as well as Trump claims, there is a disconnect: by conventional measures it isn’t doing badly enough to justify the extremely negative views Americans currently hold. The last economic numbers available (delivered before the shutdown) showed unemployment at 4.3 percent and inflation at 3 percent. These are both decent numbers from a historical perspective.”

“Many observers have compared Trump’s predicament with the problems faced by the Biden administration, whose attempts to highlight good economic data alienated many voters who felt that their concerns weren’t being taken seriously. In one important way this is false equivalence: Biden and his officials were pointing to actual data that did indeed seem to paint a relatively positive picture of the economy. Trump and company, by contrast, are simply lying,” Krugman said. “We now have two presidencies in a row in which Americans are far more negative about the economy than the usual measures would have predicted.”

My take.

Reminder: “My take” is a section where I give myself space to share my own personal opinion. If you have feedback, criticism or compliments, don't unsubscribe. Write in by replying to this email, or leave a comment.

- Traditional indicators don’t tell the whole story when inflation continues to outpace wage growth.

- Trump is pursuing an affordability built on reputation, tariffs, and ad hoc populism.

- So far, it isn’t working — and the government should adjust before the market does.

Managing Editor Ari Weitzman: Last week, Donald Trump said that prices are way down and that “affordability” is a scam made up by Democrats.

To be clear: Prices aren’t down — but I can appreciate his frustration. Right now, based on some larger traditional indicators, the economy isn’t in bad shape. The latest economic numbers, released before the government shutdown, showed 3% inflation as measured by the Consumer Price Index and 2.7% as measured by the the Personal Consumption Expenditures Index. Historically, those numbers are pretty decent — just over the 20-year average of 2.6%. Meanwhile, the August unemployment rate was 4.3% (under the 20-year average) and Q3 GDP growth was an estimated 3.8% (above the 2019 economy). Even the Fed’s decision to cut interest rates, which would spur even more growth, is a healthy sign; yes, Powell hedged over December’s decision, but if the bank’s policymakers were that concerned about inflation they wouldn’t have cut rates at all.

And yet, consumer sentiment is at 50. 50. That’s lower than it was during the 2008 financial crash and when inflation was at its highest peak under Biden.

The parallel to President Biden invites itself: Despite overseeing pretty good economies relative to our global peers (and historical benchmarks), the public is not satisfied with the current economic state of affairs. The vibes are off. Could Trump be experiencing the dreaded ‘vibecession’ that haunted Biden? Maybe the economy is actually running well, and the public is just dissatisfied with something that’s impossible to define.

But the public’s dissatisfaction is possible to define, and these historical indicators don’t tell the whole story: Wage growth has not caught up to inflation in the four years since the pandemic. The story could really be that simple. According to a study from Bankrate, wages have lagged behind inflation by 1.2 percentage points since prices first started to surge. Brookings finds that annualized pay growth since the start of 2021 is down 0.46%. That could explain why the University of Michigan’s consumer sentiment index dipped below 80 after the pandemic and has never really recovered since.

All the healthy historic indicators in the world won’t make a difference to people when they are just sending more money out of their households than they’re taking in, and have been doing so year after year. Add in some recent news and the outlook gets worse: SNAP funds temporarily lapsed for struggling households during the government shutdown. The nation’s largest employers — Amazon, Walmart, the federal government — are either warning of coming layoffs or aggressively making cuts. Meanwhile, healthcare costs continue to run away, car insurance is through the roof, energy costs are spiking, and dangling over all of our heads is the shoe that we’re still waiting to drop: tariff-induced inflation.

On Suspension of the Rules last week, Isaac said that Trump doesn’t really have an answer to affordability concerns, and that Democrats showed that at the ballot box. My response was that Trump does have an answer, it just hasn’t been working (yet). And I think I can sum it up in three points.

First is the power of his record. Trump ran on the pre-pandemic economy, and he was reelected in no small part for that success: GDP growth was humming along at 2.9% in 2018 (and 2.3% in 2019). Unemployment was at a 50-year low. Inflation-adjusted median household income was at an all-time high.

Trump’s reelection brought the promise of a return to this not-too-distant past, and some early indicators reflected that optimism: The market spiked in January, as did consumer sentiment. If the vibecession were truly only vibes, that could have been the end of it. But with persistent inflation and tepid wage growth, economic woes continued — and the same record that got Trump back to the White House is now a millstone around his neck, weighing him down with expectations he may not be able to match.

Second is his tax policy — or, simply, tariffs. Trump sees a way to get the best of both worlds by making his first-term tax cuts permanent while maintaining federal spending on Social Security and the military. Without making any meaningful cuts to the above, he wants to balance the budget by trimming what he sees as fat (a Consumer Financial Protection Bureau here, a USAID there — perhaps a cut to an entitlement program in housing or nutrition or healthcare) and dialing up federal revenues through tariffs.

“The most beautiful word in the dictionary is ‘tariff,’” Trump said on the campaign trail. He wants to increase taxes on imports to raise revenue and spur domestic manufacturing; to mitigate inflationary concerns, he’s pushing importers to eat the costs. And if our trading partners cry foul, he simply uses tariff rates as a bargaining tool to negotiate for more investment in U.S. industries. His big bet is that he can use tariffs to spur enough investment (and replace enough taxation revenue) to grow the economy back to 2019 levels, outpacing both inflation and the courts along the way.

The data so far shows that tariffs are hurting us more than they’re helping. Yes, the tariff shoe hasn’t dropped in the form of a giant inflationary spike, but inflation has remained elevated month after month after month. Yes, Trump has secured some trade deals, but the uncertainty created by shifting tax policy has arguably done more to disrupt manufacturing investment than tariffs have done to encourage it. Yes, the annualized boost of $195 billion in tariff revenue is substantial, but that benefit doesn’t outweigh the cost to importers and to consumers (and will be hard to replicate as the courts are poised to strike down some of his implementation methods).

Third, and finally, is Trump’s grab bag of populist policies. Right now, the administration’s headline suggestions are the 50-year mortgage and the $2,000 dividend checks. Some in the Treasury Department and White House have poured cold water on the 50-year mortgage plan, which is great — it’s a terrible idea. It would have pushed housing prices even higher and trapped people in debt for longer, and the less we have to talk about it the better. As for the $2,000 checks, the idea makes marginally more sense. Marginally.

Trump’s popularity spiked when he cut checks to U.S. citizens as a pandemic stimulus. But that was at the start of the pandemic, when the economy had ground to a halt. Sending a $2,000 dividend makes little sense when inflation is a concern — and when the government is on its way to another deficit of over $1 trillion in the current fiscal year and counting on that tariff revenue to offset spending.

So, how are those three planks of the Trump economic platform holding up? Not very well. The rosy post-inauguration feeling is gone, tariffs look to be doing more harm than good, and the populist policies are ill-timed. Energy, housing, and healthcare costs remain high and show no signs of dropping on their own. The Trump response to affordability desperately needs to pivot.

For starters, the president needs to admit that consumer prices are a real concern — something his predecessor failed to do, but that his vice president is doing aptly. Then, the White House needs to develop a more cohesive plan than checks, tariffs, and “trust me.” If the government doesn’t provide a course correction, the market will — and policy corrections are typically much friendlier than market corrections.

Take the survey: Do you think Trump should pivot on affordability? Let us know.

Disagree? That's okay. Our take is just one of many. Write in and let us know why, and we'll consider publishing your feedback.

Your questions, answered.

Q: I haven’t seen very much reporting on Trump’s decision to fire anti-election interference departments within CISA. What are your thoughts on this and how it could impact future elections?

— Elliott from Austin, TX

Tangle: CISA, or the Cybersecurity and Infrastructure Security Agency, is a division of the Department of Homeland Security (DHS) that focuses on protecting cybersecurity and infrastructure across all levels of government. CISA oversees multiple election-security teams responsible for a range of tasks, from helping states and localities protect polling places from physical and cyber threats to sharing information to counter election mis- and disinformation.

President Trump has been reforming and downsizing the agency so far in his term. During the first months of Trump’s presidency, CISA’s workforce was cut by about one-third through a combination of targeted layoffs and employees taking a DHS buyout offer. The administration has also cut CISA’s election programs or frozen them for review, and in March, the agency said it will not release the results of the review.

CISA’s internal report, according to then-acting CISA Director Bridget Bean, will “focus on three goals: streamlining the election security services that CISA offers to state and local governments, ensuring that its activities align with its new ‘mandate to refocus’ on its core mission, and removing ‘all personnel, contracts, grants, programs, products, services, and activities’ that conflict with Trump’s anti-censorship directive or exceed CISA’s authorities.”

The cuts to CISA could put future elections more at risk of sophisticated cyber attacks. Additionally, some tasks previously overseen by CISA, like election-center assessments, could be pushed to local authorities. Other potential cuts, like real-time incident responses and information sharing, would open up vulnerabilities to election tampering. The lack of public detail from CISA makes giving an informed opinion on the cuts difficult — which is part of the problem. CISA’s restructuring could certainly create wide vulnerabilities, and in the absence of communication from the government, we’re concerned about the motivations for and consequences of these actions.

Want to have a question answered in the newsletter? You can reply to this email (it goes straight to our inbox) or fill out this form.

Under the radar.

In August, Federal Reserve Board Governor Adriana Kugler abruptly resigned from her role without giving a reason, opening up a seat on the Federal Open Market Committee (FOMC) for President Trump to fill. Now, more details behind Kugler’s departure are beginning to come to light. According to a report by the U.S. Office of Government Ethics released Saturday, Kugler broke the Federal Reserve’s rules on trading individual stocks and executing financial transactions close to FOMC meetings. In the weeks leading up to her resignation, Kugler reportedly requested a waiver on a disclosure form that showed she had impermissible holdings, but Fed Chairman Jerome Powell denied the request. Kugler then missed the FOMC’s July meeting and announced her departure days later. A Federal Reserve official said concerns about Kugler and her husband’s trading activity date back to at least September 2024. CNBC has the story.

What Your Doctor May Not Tell You About Statins.

More than 92 million Americans take statins. While effective at lowering cholesterol, they may deplete a nutrient essential for heart health and cellular energy—a deficiency that won't show up on standard blood work.

There are five key warning signs that may indicate you're experiencing this issue.

Understanding them could make a real difference in how you feel day-to-day and your long-term health outcomes.

Numbers.

- 0.2%. The percent monthly increase in food prices in September, according to the Bureau of Labor Statistics.

- 3.1%. The percent annual increase in food prices between September 2024 and September 2025.

- 1.5%. The percent monthly increase in energy prices in September.

- 2.8%. The percent annual increase in energy prices between September 2024 and September 2025.

- 47%. The percentage of U.S. adults who say the economy and cost of living are the most important issues facing the United States, according to an October 2025 CNN/SSRS poll.

- 28% and 72%. The percentage of U.S. adults who say economic conditions in the U.S. are good and poor, respectively.

- 28% and 72%. The percentage of U.S. adults who said economic conditions in the U.S. were good and poor, respectively, in January 2025.

- –29.9%. The change in consumer sentiment between November 2024 and November 2025, according to the University of Michigan’s index of consumer sentiment.

The extras.

- One year ago today we wrote about Trump nominating RFK Jr. to lead HHS.

- The most clicked link in yesterday’s newsletter was our Friday mailbag edition.

- Nothing to do with politics: How $750 can allow you to pilfer data from satellites.

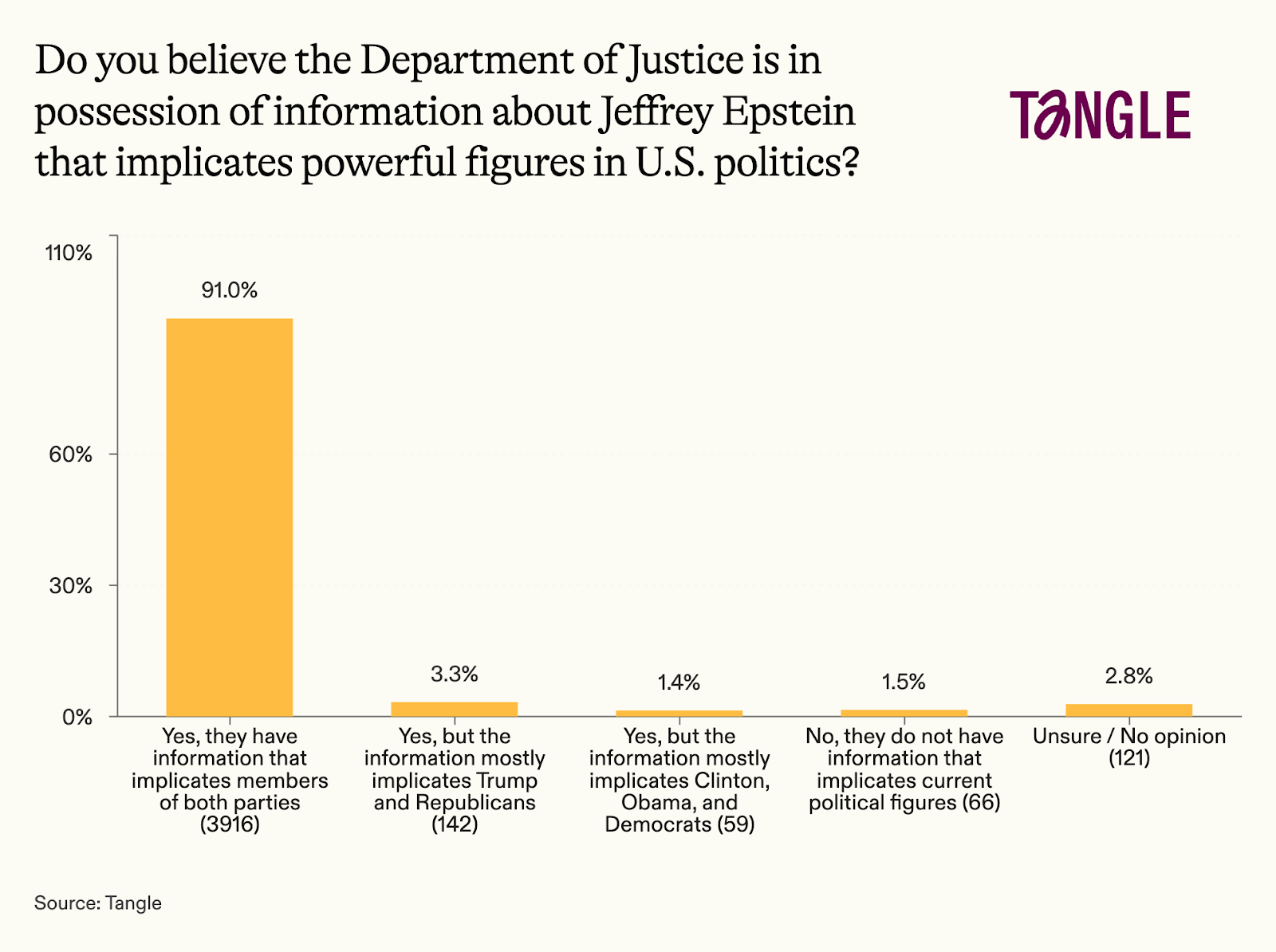

- Yesterday’s survey: 4,304 readers responded to our survey on what the Justice Department knows about Jeffrey Epstein with 91% saying the government has incriminating information on members of both parties. “All documents should be released with the exception of any that would endanger or expose a victim without their prior consent,” one respondent said. “If there was anything implicating candidate Trump, it would have been front page news long ago,” said another.

Have a nice day.

Tens of thousands of satellites and other man-made objects orbit Earth, meaning that objects occasionally end up on course to collide. A single collision could damage or destroy the involved satellites or even cause a catastrophic chain reaction. Historically, when a U.S. satellite and a Chinese satellite are on course for a collision, NASA has reached out to China and offered to conduct evasion maneuvers. But in early October, for the first time, the Chinese National Space Agency reached out to NASA about a potential collision and coordinated the avoidance maneuver itself. At a time when both the U.S. and China are expanding the number of satellites in orbit, the development signals China’s advancing capabilities and willingness to cooperate in outer space. Space.com has the story.

Member comments