I'm Isaac Saul, and this is Tangle: an independent, nonpartisan, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

Are you new here? Get free emails to your inbox daily. Would you rather listen? You can find our podcast here.

Today’s read: 13 minutes.

Don’t wait to become a victim. Take control of your identity.

Over 422 million people had their personal data exposed last year alone. And the easiest targets? People whose info is still floating around online.

Incogni tracks down and removes your personal details from over 420+ data broker sites, people-search pages, public records, and more—automatically.

They periodically check if your information appears on the data broker sites and remove it, so you get total peace of mind.

And with their Unlimited Plan, you can go even further. Google yourself and send them any link you find with your info on it. Their privacy team will assist you in getting it wiped.

Stop making it easy for identity thieves. Lock down your personal data before criminals take advantage of it.

Remove your data now—55% off with code TANGLE.

Correction.

In Monday’s edition on the arrest of the suspect in Charlie Kirk’s assassination, we referred to Sen. Chris Coons as a Democrat from Connecticut. Coons was born in Connecticut, but he is actually a Democratic senator from Delaware.

This is our 144th correction in Tangle's 319-week history and our first correction since August 7. We track corrections and place them at the top of the newsletter in an effort to maximize transparency with readers.

Addressing your feedback.

Last week, the assassination of Charlie Kirk drove a lot of very charged commentary and feedback. Our coverage of this story drew a mix of harsh criticism and high praise, and our edition the day after the shooting has more comments than any article in Tangle history. Many of you thought our coverage overlooked aspects of Charlie Kirk’s legacy, others questioned our bias, and others shared our emotional response and deep concern about political violence.

In tomorrow’s edition, we’re going to publish a lot of those responses (and respond to a few of them). Remember, Friday editions are available for paying members only. To read the entire edition — and every Friday edition — become a Tangle member here.

Quick hits.

- Three police officers were killed and two critically wounded in a shooting while serving a warrant in York County, Pennsylvania. The suspected gunman was killed by law enforcement; officials have not released information about the suspect’s identity or potential motive. (The shooting)

- ABC announced that it will stop airing Jimmy Kimmel’s late-night television show indefinitely in response to comments the host made about the political ideology of the suspect in Charlie Kirk’s assassination. The move follows Federal Communications Commission Chairman Brendan Carr’s comments that the agency would consider regulatory action against ABC over Kimmel’s remarks. (The announcement)

- Former Centers for Disease Control and Prevention Director Susan Monarez testified before the Senate Health Committee, telling lawmakers that Health and Human Services Secretary Robert F. Kennedy Jr. pressured her to change the childhood vaccine schedule. (The testimony)

- The House voted 214–213 to reject a measure brought by Rep. Nancy Mace (R-SC) to censure Rep. Ilhan Omar (D-MN) for reposting a video on social media that harshly criticized Charlie Kirk. Four Republicans joined all Democrats in voting to table the measure. (The vote)

- An immigration judge ordered activist Mahmoud Khalil to be deported to Algeria or Syria after finding that Khalil omitted key information on his green card application. Khalil’s legal team plans to challenge the order. (The order)

Today’s topic.

The Fed’s interest rate cut. On Wednesday, the Federal Reserve’s Federal Open Market Committee (FOMC) voted 11–1 to cut interest rates by 0.25% to 4%–4.25%, their first rate cut in nine months. The central bank’s policymakers cited the weakening labor market as the basis for the cut but noted that they are still concerned about potential inflation. However, the committee signaled that they are likely to approve two more rate cuts this year.

Stephen Miran, who was confirmed as a Federal Reserve governor on Monday, was the sole dissenter from the committee’s decision, arguing that the Fed’s interest rate should have been cut by 0.50%. Miran is currently taking a leave of absence as chair of the White House’s Council of Economic Advisers to serve as a Fed governor. The dot plot of FOMC members’ target ranges for the federal funds rate showed most board members targeted a rate between 3.50–3.75% and 4.25%–4.5% One outlier, believed to be Miran’s, set their target at 2.75%–3.00%.

In a post-meeting statement, the FOMC said that “uncertainty about the economic outlook remains elevated,” but that the rate cut would support the Federal Reserve’s goal of maximum employment and a 2% inflation rate. “The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee's goals,” it added.

In separate post-meeting remarks, Federal Reserve Chairman Jerome Powell emphasized the committee’s concerns about the state of the labor market, saying, “The marked slowing in both the supply of and demand for workers is unusual in this less dynamic and somewhat softer labor market… The downside risks to employment appear to have risen.” Powell added that further rate cuts were not guaranteed, and that the bank was now in a “meeting-by-meeting situation.”

The Bureau of Labor Statistics’s (BLS) jobs report for August heightened unease about a stagnating labor market and raised expectations for the FOMC to cut rates at this month’s meeting. In their report, the BLS found that nonfarm payroll employment increased by 22,000 in August — lower than many economists’ expectations — and the unemployment rate rose from 4.2% to 4.3%, while the number of jobs added between March 2024 and March 2025 was revised down by 911,000.

The vote followed several contentious months for the Fed. President Donald Trump has repeatedly called on Chairman Powell to cut rates, suggesting that he would move to fire Powell if he did not do so soon. Congressional Republicans have also scrutinized Powell over renovations to the bank’s headquarters, though they have not taken any formal action against him. Separately, President Trump is attempting to fire Federal Reserve Governor Lisa Cook for alleged mortgage fraud, which Cook denies. On Monday, the U.S. Court of Appeals for the D.C. Circuit ruled that Trump cannot immediately fire Cook, allowing her to participate in this week’s FOMC meeting.

Today, we’ll share perspectives from the left and right on the Federal Reserve’s decision to cut rates. Then, my take.

What the left is saying.

- The left doesn’t oppose this cut but worries that Trump will try to force more in the near future.

- Some say this cut won’t bring down prices.

- Others argue that Trump’s policies limit the Fed’s ability to stave off economic decline.

In The Atlantic, Will Gottsegen suggested “the Fed rate cut won’t be enough to appease Trump.”

“This fairly standard rate cut is haunted by Trump’s repeated attacks on the Fed and its independence. If successful, the Trump administration’s attempt to fire Lisa Cook, a Biden appointee and the first Black woman to sit on the Fed board, would mark the only ousting of its kind since the institution’s establishment, in 1913,” Gottsegen wrote. “Another test of that commitment comes in the form of Stephen Miran… That Miran was the only dissenting vote on today’s rate cut (he pushed for a more drastic, 0.5 percent cut) certainly won’t quash speculation that he’s a mouthpiece for Trump.”

“A quarter-percent rate cut won’t fulfill Trump’s personal wish for a return to the era of easy money, which is to say that it will probably deepen the rift between Trump and Fed Chair Jerome Powell,” Gottsegen said. “In an apparent attempt to backtrack some of his more brazen moves, Trump told reporters yesterday that the Fed should remain independent — but also that it should listen to ‘smart people like me.’ If Trump eventually does somehow cow Fed officials into drastically lowering rates, the result would likely have lasting consequences: a boom in the near term and a bust in the long term.”

In Bloomberg, Jonathan Levin wrote “the bond market won’t like these Fed rate cuts.”

“Americans may be hoping that the easing will mean lower long-term interest rates for homebuyers, the government and a host of other corporate and household borrowers. Unfortunately, they may be sorely mistaken,” Levin said. “The central bank faces two-side risks to inflation and the labor market. Unemployment is generally low but seems to be trending in the wrong direction, while warm inflation readings are a thorn in policymakers’ side — indeed, the inflation outlook is modestly worse today than it was last September.”

“The bond market will have to contend with ongoing political noise — an influence that was present during the 2024 presidential campaign but not to the degree that it is today. In recent months, Trump has used his platform to aggressively lobby for 1%-ish interest rates that economists and market participants widely understand to be extremely unwise,” Levin wrote. “Trump may well get some more of the rate cuts that he’s so coveted since assuming the presidency, but the political and economic backdrop could make it hard to bring down the benchmark borrowing costs that matter most to the American people.”

In The American Prospect, Robert Kuttner said “the Federal Reserve is out of tricks.”

“Thanks to Trump’s perverse economic policies, the Fed has run out of ways to reconcile high employment with low inflation. Both indicators have been worsening. The most recent revision of the Consumer Price Index, released Thursday, shows rising inflation. It was up 0.4 percent in August, for an annual rate of 4.8 percent, or more than double the Fed’s target of 2 percent. Grocery prices were up at an annual rate of 7.2 percent,” Kuttner wrote. “Unemployment and wage indicators are also getting worse. The rising inflation rate has undermined real wages. A year ago, real inflation-adjusted wages were growing at an annual rate of 1.3 percent; the latest report cuts that almost in half, to 0.7 percent.”

“Normal monetary policy isn’t good enough in the face of Trump’s engineered stagflation. Tariffs are only one source of rising consumer prices. Extreme economic concentration facilitated by Trump combined with Trump’s war on immigrant workers continues to push up prices. Trump’s firing of federal workers, his clawback of federal grants and contracts, and his suspension of public projects all raise unemployment,” Kuttner said. “Trump has tried to alter reality by seeking to commandeer the Bureau of Labor Statistics. That hasn’t worked. Nor can Trump cure his own economic mess by trying to hijack the Fed.”

What the right is saying.

- The right also does not object to this cut, though some note that the economy is flashing warning signs.

- Others say the rate cut was overdue and criticize Powell for his approach.

- Still others suggest the Fed did not follow established economic principles in making the cut.

The Wall Street Journal editorial board wrote “it’s Trump’s Federal Reserve now.”

“President Trump wants lower interest rates, and on Wednesday he got his wish as the Federal Open Market Committee cut the overnight rate by a quarter point. The FOMC also delivered an implicit warning about what this might mean for the economy. Mr. Trump now owns that, too,” the board said. “Fed officials anticipate two more 25-point rate cuts this year and another in 2026. Yet the same SEP projections concede that inflation is proving more persistent than anticipated.”

“Coupled with those inflation projections, the message is that the Fed will tolerate higher inflation for longer to take pre-emptive action to shore up an economy that may or may not need the help… It may be that everything works out fine: inflation drifts downward after a brief price bump from tariffs, the economy booms despite tariffs and a looming labor shortage, the housing market enters a new golden age, and financial markets gallop happily off into the artificial-intelligence sunset,” the board wrote. “But if Mr. Trump is wrong, voters will notice sustained inflation and the lack of gains in real wages. Having staked so much on his political assault on the Fed, Mr. Trump owns the outcome now for good or ill.”

In Hot Air, Ed Morrissey said the Fed “finally” cut rates.

“What choice did they have? The Federal Reserve governors finally ran out of excuses after the jobs-market data turned out to be massively cooked over the last two years. Looking at an economy with nearly two million fewer jobs than they assumed and with investment stalling out, the Fed had no choice but to lower its prime lending rate,” Morrissey wrote. “Fed chair Jerome Powell didn't exactly instill confidence today, either. At his presser, Powell all but threw up his hands about what to do next.”

“The first thing to do might be to jettison the assumption that the economy is healthy. That's a leftover from the Biden administration, whose data brokers turned out to be gaslighting investors and policymakers on jobs data. Actual jobs growth has been stagnant for the past two years when Powell and the Fed assumed that job creation was robust,” Morrissey said. “Inflation has been largely under control for a while, which means that the Fed has pursued the wrong monetary policies for at least a year, and still hasn't shifted gears despite having those assumptions blown up.”

In Cato, Jai Kedia argued “economic data does not support a Fed rate cut.”

“In isolation, a minor change to the [federal funds rate] will neither meaningfully help nor hurt the economy… Monetary policy is not as important as other market forces, and the Fed does not really control interest rates, let alone macroeconomic outcomes like inflation. In fact, mortgage rates fell last week, well before the upcoming FOMC meeting,” Kedia wrote. “Nor should people expect the Fed to save the economy from the negative effects of bad economic policy, especially supply shocks like tariffs that raise both inflation and unemployment, giving the Fed contrasting signals.”

“The latest inflation data support holding rates steady at best and may even support an increase. But the Fed’s statements, primarily in response to weakening labor market data, have all indicated a rate cut. The Fed must now choose between following the correct economic policy or risk surprising markets (and its credibility) by reversing its indicated course of action,” Kedia said. “This problem could also be fixed if the Fed set the target rate by following a rule. Since rules offer a direct arithmetic calculation that turns macro data into an interest rate target, they are the most effective form of forward guidance.”

My take.

Reminder: “My take” is a section where I give myself space to share my own personal opinion. If you have feedback, criticism or compliments, don't unsubscribe. Write in by replying to this email, or leave a comment.

- The Fed’s recent rate cut validates mainstream punditry.

- Another mainstream position is that the Fed’s autonomy is being threatened — and the mainstream is probably right.

- An independent Fed is crucial for our economic health, but Trump doesn’t seem to care.

Earlier this week, Isaac wrote about how heterodoxy is its own form of bias — how if you reflexively oppose the mainstream opinion, you often jump to the wrong conclusions. Typically, the mainstream position is mainstream for a reason.

The Fed’s decision yesterday provides a great example of this.

First, the vote went about as expected. Analysts have been predicting the Federal Reserve to cut their interest rates for months; the stagnant August jobs report just released led many economists to forecast a 25-basis-point rate cut in this month’s Federal Open Market Committee (FOMC) meeting. That mainstream prediction proved correct.

Second, President Trump’s dissatisfaction with Chairman Jerome Powell (who has been resisting rate cuts, citing concerns that tariffs may fuel inflation) led Trump to take the unprecedented step of appointing his own chairman of the Council of Economic Advisers, Steven Miran, to the Federal Reserve’s Board of Governors. It was no surprise that the Senate confirmed Miran, or that his conflict of interest would lead him to become the only governor to recommend a 50-basis-point rate cut.

Third, before the board convened to cast its vote, an appellate court voted to temporarily block Trump’s attempt to fire Governor Lisa Cook for alleged mortgage fraud. While documented mortgage fraud could provide a reasonable justification for Trump to fire Cook, many pundits in the mainstream did not think the existing evidence supported her dismissal for cause. We wrote that a judge would be right to block Cook’s dismissal, and that is exactly what happened — and Cook cast a vote that was exactly in line with how analysts expected the entire board to vote.

Today is a good day to hold a mainstream opinion. Unless you’d bought into heterodox arguments that Powell would dig in on his inflationary concerns, or that Miran would act cautiously once appointed, or that the courts would move in lockstep with Trump and boot Cook, then yesterday’s news didn’t come as much of a surprise.

Instead, the main story coming out of the FOMC’s rate-cut decision is the ongoing assault on the committee’s independence, which the recent (and expected) rate cut does not come close to resolving. Exhibit A is Lisa Cook. President Trump attempted to fire her, one of the governors in the majority who has not supported rate cuts so far, behind a mere allegation of mortgage fraud. Trump said she filed two properties as her primary residence but offered nothing to support the claim. However, when Cook fought her dismissal, she had the paperwork to rebut it. Her mortgage filings showed her second home was listed as a “vacation property.” If Trump eventually succeeds in ousting Cook, the board of governors would be composed of a majority of Trump appointees. Can you imagine the reaction if Biden or Obama, or even George W. Bush, had tried to fire someone from the Federal Reserve — without evidence and with obvious political gain — for a reason that was immediately undermined by evidence to the contrary?

Exhibit B is Stephen Miran’s presence on the board. Remember, to participate in the latest vote, Miran only took a leave of absence from his White House position; he did not step down (though he is serving out the remainder of a term that ends in 2026, and has said he’d leave his advisory role if he is confirmed to a full term). As he made his way from Pennsylvania Avenue to the Fed to cast his vote, the implication was pretty clear: Miran was not voting as an independent governor but as a representative of the White House.

Those two exhibits should be enough, but lest we forget and should we need it, Exhibit C is Trump’s pressure campaign on Powell. The “Too Late” nickname and the insults and the loudly expressed public opinions are one thing, but trying to pull the rug out from under a congressionally approved and well underway Federal Reserve renovation is quite another. The first is bark, the second is bite.

It all fits a pattern: If you’re in the government, the president would very much like you to do what he wants. And if you don’t, he’s going to make your life difficult.

The opinion that Trump has been overreaching his executive power is another one of those mainstream stances, and if you’ve been swimming against the current throughout his second term, you should remember quiet moments like this that could otherwise slip away. The Fed drops interest rates a quarter point, no big deal. But taken together with other boring and mainstream stances that are being validated right now, like tariffs will cause inflation or we need reliable economic data, they should provide plenty of reason to consider that maybe the current in the mainstream is so strong for a reason.

I have to concede, too, that I really do admire the deliberative process of the Fed board; I’m a bit of a fanboy. The way their decisions sit at the intersection of the coldly rational and the borderline priestly has always been fascinating to me. When Powell stands up to announce the board’s decision, markets move not just based on that decision but on the manner in which he delivers it — if he isn’t projecting confidence or hinting at the appropriate amount of caution, investors get spooked, mortgage rates flinch, and people lose jobs.

The Fed has to carefully balance its dual mandate of stimulating economic growth while containing inflation, and it simply can’t do that if it’s under the gun of the administration — any presidential administration — which will always be pushing for more immediate economic growth however they can get it. To do their job well, the Fed needs political independence. Board members casting votes under the shadow of potential dismissals erodes that independence; even the simple fact that financial outlets like CNBC now run graphics of Federal Reserve Board members with red and blue bars underneath their pictures tells us the poison of partisanship has spread to the central bank.

Simply put, for our economic system — the strongest the world has ever seen — to continue to flourish, it needs an independent Federal Reserve. This latest rate cut shows that we still have it, but the president is showing us that he doesn’t care if we lose it.

Take the survey: How many more times do you think the FOMC should cut interest rates this year? Let us know.

Disagree? That's okay. Tangle's opinion is just one of many. Write in and let us know why, and we'll consider publishing your feedback.

Your questions, answered.

Q: A question that keeps coming up for me that I don’t see explained well in most sources is “Why do all pundits speak as though China is an enemy of the United States?” The rhetoric is that they are this existential threat. Yet, have they even chosen to expand their territory in their own region? What are the places where thinking of China as a threat are valid and invalid?

— Brent from California

Tangle: Just recently, some of our staff were discussing how joining our allies in Europe to isolate Russia on the global stage presented an opportunity to strengthen ties with China. Furthermore, as a country that continues to invest in new technologies and grow an enormous consumer market, there’s a good economic reason for us to pursue good relations with the Asian superpower.

However, like you said, China is seeking to rival us as a geopolitical leader — investing in foreign aid in Africa and backing infrastructure projects in Latin America. At the same time, we’re dependent on them for many of the components in our supply chain — for both consumer goods and critical materials — and as buyers of U.S debt. As a rival for global influence, they represent a dependency and therefore a huge risk for our economy. That doesn’t necessarily mean China is an existential threat to the United States, but there are a couple reasons why they could be seen as an enemy.

First and foremost, their government, as an autocratic communist system, is ideologically opposed to ours. We’re far from the Cold War “Domino Theory” era of fighting wars to prevent communist expansion, but similar governments naturally align their interests with one another. China, Russia and Iran are on the outside of the Western democratic alliance, which puts them in a position to be our natural geopolitical opposition. And the documented cases of internal human rights abuses in each of those countries also provide good reason to oppose them (this is most prominent in China with the Uyghur genocide, but is also seen in the free-speech repression in Hong Kong after its transfer to Chinese rule).

There are also the issues of intellectual property and espionage: China has a long history of spying on the U.S., and vice versa, as well as stealing intellectual property from U.S. companies. Chinese hackers have targeted U.S. businesses, governments and infrastructure, which is particularly dangerous given the economic leverage described above.

Most pressingly, China is threatening the sovereignty of a democratic regional ally (whom we depend on for microprocessors) in Taiwan. China’s territorial aspirations there present a threat to our supply chain, a challenge to the projection of U.S. influence, and potentially a direct threat to the U.S. military. In fact, this existing tension is so pervasive that some pundits have likened the relationship between China and the U.S. to a second Cold War.

Does that make China an existential threat? Probably not. But they aren’t particularly close to being an ally, either.

Want to have a question answered in the newsletter? You can reply to this email (it goes straight to our inbox) or fill out this form.

Under the radar.

In the days after conservative activist Charlie Kirk was assassinated, the Justice Department removed a study from its website that found far-right extremists were responsible for more ideologically motivated homicides than far-left extremists. The study assessed that, since 1990, far-right attackers were responsible for 227 violent events that claimed over 520 lives, while far-left attackers were responsible for 42 violent events that claimed 78 lives. The Justice Department has not explained why the study was removed, but said it is “reviewing its websites… in accordance with recent Executive Orders.” The Hill has the story.

422 Million People Got Their Data Stolen Last Year

Don't be next. Incogni automatically scrubs your personal info from 420+ data broker sites and people-search pages before identity thieves find it.

Their Unlimited Plan even removes data from any site you discover yourself.

Lock down your data—55% off with code TANGLE.

Numbers.

- 1. The number of Federal Open Market Committee (FOMC) members who set their target for the federal funds rate at 4.25–4.50% at the committee’s September meeting.

- 6. The number of FOMC members who set their target rate at 4.00–4.25%.

- 2. The number of FOMC members who set their target rate at 3.75–4.00%.

- 9. The number of FOMC members who set their target rate at 3.50–3.75%.

- 1. The number of FOMC members who set their target rate at 2.75–3.00%.

- 2.25%–2.50%. President Donald Trump’s stated target for the federal funds rate.

- +1.6%. The median expectation for U.S. gross domestic product growth in 2025 among Federal Reserve board members and bank presidents.

- 4.5%. The median expectation for the U.S. unemployment rate by the end of 2025 among Federal Reserve board members and bank presidents.

The extras.

- One year ago today we covered a report on Supreme Court Chief Justice John Roberts.

- The most clicked link in yesterday’s newsletter was the map of each state’s favorite Halloween candy.

- Nothing to do with politics: A meme generator that uses a library of medieval cat pictures.

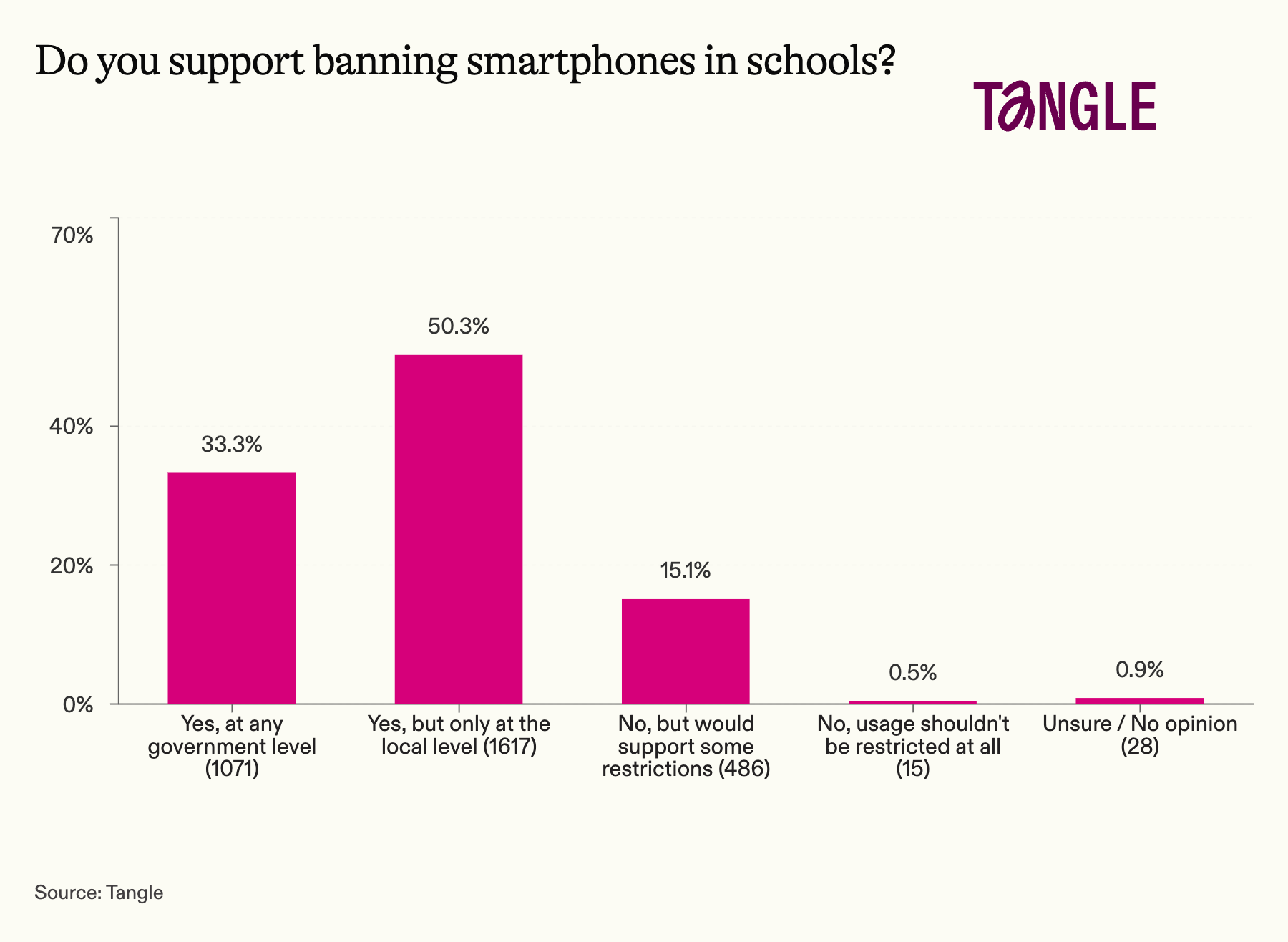

- Yesterday’s survey: 3,217 readers responded to our survey on banning phones in schools with 84% supporting some kind of ban. “Teachers have a hard enough job to do without having to compete with phones,” one respondent said.

Have a nice day.

A team of researchers at the University of Bristol and the UK Atomic Energy Authority (UKAEA) announced that they have successfully created the world’s first battery to run on an unusual fuel source: carbon. By capturing a slightly radioactive isotope known as carbon-14 in a diamond structure, researchers found they could harvest the low levels of energy emitted by the isotope’s natural radioactive decay. Though its energy output is small, a carbon-14 battery could last thousands of years and has potential use cases of powering pacemakers, hearing aids, or ocular implants. “Diamond batteries offer a safe, sustainable way to provide continuous microwatt levels of power,” Sarah Clark, Director of Tritium Fuel Cycle at UKAEA, said. The University of Bristol has the story.

Member comments