What's inside the package?

I’m Isaac Saul, and this is Tangle: an independent, ad-free, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum — then “my take.” You can read Tangle for free or subscribe for Friday editions, and you can reach me anytime by replying to this email. If someone sent you this email, they’re asking you to sign up. You can do that by clicking here.

Today’s read: 13 minutes.

The coronavirus relief package agreement, a question about the wealth gap and the “new coronavirus strain.”

Correction.

On Thursday, I wrote that Pete Buttigieg would “be the first openly gay Cabinet secretary approved by the Senate,” and noted that “Richard Grenell, who is openly gay, is currently serving as the Acting Director of National Intelligence in the Trump administration.” In fact, Grenell stepped down from that position and John Ratcliffe, the former Texas representative, is serving as DNI. This, obviously, is not news to me — but old habits die hard. Hopefully, these corrections do, too.

This is the 25th Tangle correction in its 69-week existence and the first since December 17th. I track corrections in an effort to be transparent and plan to stop tracking them when I stop making very dumb errors like this one.

Quick hits.

- President Trump is no longer expected to announce a presidential run in 2024 before the inauguration, according to close aides.

- The Supreme Court dismissed a lawsuit against the Trump administration that was trying to block them from excluding undocumented immigrants in the final census count.

- Jared Kushner helped create a shell company through which the Trump campaign has spent $700 million since 2019, according to an exclusive Business Insider report.

- Leaked documents from Chinese Communist Party records reveal large numbers of CCP members who are employed in senior positions inside the U.S., British and Australian governments, and across the private sector globally.

- More than 1.3 million Georgians have already voted in the Senate runoffs, approaching the total early vote turnout in the general election.

- BONUS: Army four-star Gen. Gus Perna, the COO of Operation Warp Speed, has apologized for miscommunication with states that led to an outcry from governors who say they are getting smaller vaccine shipments than promised. “I failed,” Perna said in a frank statement to reporters. “I'm adjusting. I am fixing and we will move forward from there.”

What D.C. is talking about.

COVID-19 relief. After months of negotiations, Congress appears to have come to an agreement on another sweeping pandemic bill to address a myriad of woes caused by the coronavirus. The final agreement will cost roughly $900 billion and will include $300 of weekly enhanced unemployment benefits through March, $600 checks to most American adults, replenishment of the small business Paycheck Protection Program, funding for vaccine distribution and money for schools to reopen. The bill does not include money to close state or local government funding shortfalls, nor does it include liability protections for businesses (both were dropped from the bill as part of a compromise).

“At long last we have the bipartisan breakthrough the country has needed,” Senate Majority Leader Mitch McConnell (R-KY) said on the Senate floor. “Now we need to promptly finalize text, avoid any last-minute obstacles and cooperate to move this legislation through both chambers.”

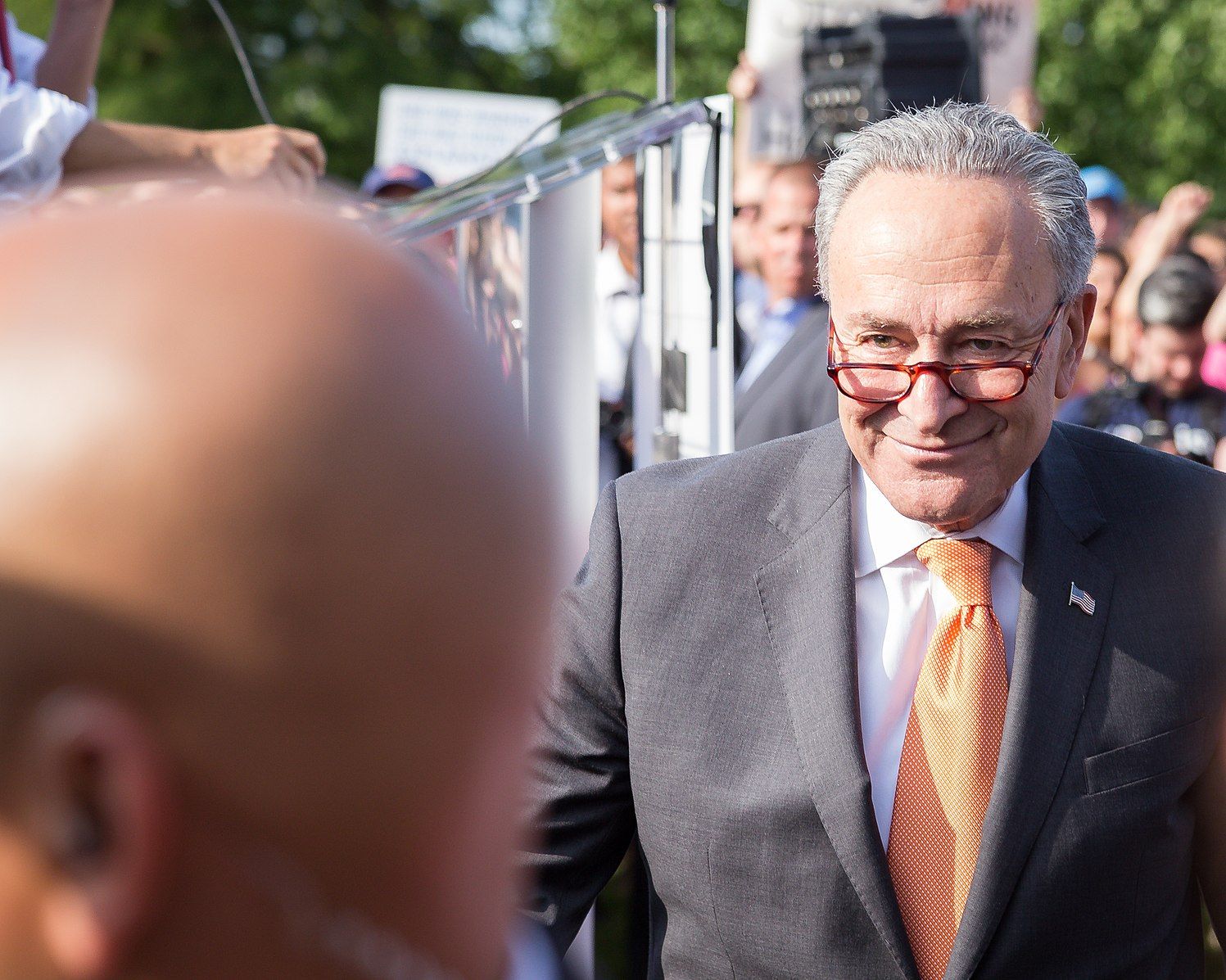

“This agreement is far from perfect,” Senate Minority Leader Chuck Schumer (D-NY) said. “But it will deliver emergency relief to a nation in the throes of a genuine emergency.”

What’s in it?

Reporters and members of Congress are still working off of draft bills being circulated. The text of the bill is still being written. That being said, we think we have a pretty good idea of what has been agreed to, assuming it all holds from verbal agreements to text. These numbers were sourced from The Wall Street Journal, The Washington Post, and press releases from members of Congress.

Stimulus checks: $600 checks per person (including children). So a family of three would receive $1,800. The checks go to everyone who earned less than $75,000 in the 2019 tax year, and decrease for earners of up to $99,000, at which point they disappear altogether. Dependents over the age of 16 don’t qualify, which means college students and adults with disabilities won’t receive checks. Cost: ~$166 billion.

Unemployment benefits: An additional $300 per week in unemployment benefits will be provided by the federal government. The benefits will kick in December 27th and run through March 14th. The unemployment program for gig and contract workers will also be extended. Cost: ~$120 billion.

PPP: Another wave of forgivable small-business loan funding, and an expansion of eligibility for the program to include nonprofits, faith-based organizations, churches and news outlets. A provision to allow businesses to deduct the costs covered by the loans from their taxes. A controversial provision allowing tax breaks for corporate meal expenses is also included. Cost: ~$300 billion.

Vaccine funding: The bill will cover the cost of purchasing and distributing vaccines, so that there will be no payment required for Americans to receive it. It will also spend $22 billion on contact tracing and testing. Cost: $52 billion.

Evictions and rental assistance: Eviction moratoriums were extended to January 31st, and the bill calls for $25 billion of rental assistance. Cost: ~$25 billion.

Schools: The bill will fund HVAC replacements at schools and colleges to reduce the risk of coronavirus spread. It will also spend $10 billion on child care services. Cost: $92 billion.

Transportation: Another wave of relief is coming for airlines, Amtrak, highways and intercity busses. Cost: ~$45 billion.

Save Our Stages: According Sen. Schumer, the bill will also include funding for music venues that have been shuttered since March due to the pandemic. Cost: ~$10 billion.

The agreement, in principle, ends months of tense negotiations that started when House Democrats passed a $3.5 trillion aid bill in May and then a pared down $2.2 trillion deal in October. Congress easily passed a $3 trillion first relief package in March, but has struggled to reach an agreement on a follow-up bill now that many of those programs are expiring or have already expired.

Agreed.

There’s been a consensus on the right and left that new funding was needed for months, though obviously the contours of that funding have been disputed. Now, though, there seems to be some common ground around frustration that it has taken Congress this long to pass a bill that generally looks very similar to what has been proposed for months — especially when the delay could be so costly to so many Americans.

What the left is saying.

The left isn’t particularly thrilled about the deal, but is settling into the idea that it’s good enough for now — especially with a Joe Biden administration on its way in.

The New York Times editorial board said the bill is a “necessary measure that will ease the suffering of millions of Americans. It will help unemployed workers to feed their families and to avoid eviction. It will help small businesses avoid bankruptcy. It will help to keep the trains and buses running in cities across the country.”

“Congress should have acted months ago, and the delay has caused a lot of unnecessary pain,” the board said. “Even now, Congress is not doing enough to meet the full measure of the need. But the relevant question is whether this agreement will help — and the clear answer is yes… The size of the deal approximates the 2009 stimulus act that Congress passed at the beginning of the Obama administration — and it sits on top of the much larger stimulus bill passed last spring. That highlights what is hopefully a lasting shift in fiscal policy. During the 2008 crisis, policymakers worried about the consequences of borrowing, and doubted the benefits of spending. The result was a slow recovery. This time around, the fearmongers have struggled to find an audience, and the extra aid is making a big difference.”

Paul Krugman also wrote supportively about the bill, though he criticized the limited price tag.

“Republicans appear willing to make a deal because they fear that complete stonewalling will hurt them in the Georgia Senate runoffs,” Krugman said. “But they are determined to keep the deal under a trillion dollars, hence the reported $900 billion price tag. That trillion-dollar cap, however, makes no sense. The amount we spend on emergency relief should be determined by how much aid is needed, not by the sense that $1 trillion is a scary number… Affordability isn’t a real issue right now. The U.S. government borrowed more than $3 trillion in the 2020 fiscal year; investors were happy to lend it that money, at remarkably low interest rates. In fact, the real interest rate on U.S. debt — the rate adjusted for inflation — has lately been consistently negative, which means that the additional debt won’t even create a major future burden.”

In The Washington Post, Catherine Rampell hit Republicans for not including state and local funding.

“Since February, state and local government have eliminated 1.3 million jobs — laying off teachers, first responders, utility workers, bus drivers, public hospital employees and others,” she said. “For context, these governments have already axed nearly twice as many jobs so far this year as they did in the entire five-year period following the Great Recession. And the overwhelming lesson of that era was that public-sector bloodletting made the private sector recover much more slowly… Take the deal, Congress. Then immediately start working on the next one.”

What the right is saying.

The right is split about the bill. Some more traditional Republicans have worried about an economy that is resting on federal aid. Others, typically those in the pro-Trump camp, have expressed frustration a deal wasn’t struck before the election, and wanted more money to go to individual Americans rather than be funneled through government programs.

The Wall Street Journal editorial board said “with some exceptions, the main relief here is for the politicians who want to take credit for doling out more cash to constituents.” The board called the bill a “mix of good to awful.”

“Another $330 billion or so for the Paycheck Protection Program is warranted to aid small businesses until the pandemic eases,” the board wrote. “The National Restaurant Association reported this month that 500,000 restaurants are in free fall and 110,000 have permanently closed this year. Many are victims of ham-handed government diktats like California Gov. Gavin Newsom’s closure of outdoor dining… The biggest fiasco is another round of checks—this time $600—to most Americans who earn up to $100,000. This will have little or no economic impact since it won’t change incentives; it also isn’t focused on the neediest.

“Another blunder is three more months of $300 in federal enhanced weekly unemployment benefits. This plus-up will allow half or so of workers to earn more by not working and slow the labor market recovery once the vaccine rollout gets underway since they will have less incentive to find work. Many businesses, especially in construction and warehousing, are desperate to hire, and there were 6.7 million job openings in October, according to the Bureau of Labor Statistics.”

Robert Verbruggen wrote supportively of the bill, even though he says he’s “not a fan of deficit spending or of big government programs.”

“But the case for spending large during a pandemic is not hard to make,” Verbruggen said in National Review. “This has been a horrible year, with many businesses shut down and millions of workers put out of their jobs through no fault of their own. Even as we approach the end of the pandemic, we are fighting a third wave of infections, and unemployment claims are on the rise again. We need to keep the economy afloat in an emergency, and that is precisely when you should borrow. It will be much less painful to pay this money back later than it would be to suffer COVID-19’s full wrath all at once…

“The new bill helps both out-of-work laborers and damaged businesses. The former will get an extra $300 a week in unemployment benefits, and those receiving long-term benefits won’t see them expire later this month, as could have happened for millions. Both these provisions will expire after ten weeks or so, by which point the vaccines, God willing, should have seriously mitigated the pandemic.”

Marc A. Thiessen said Democrats had a chance to get state and local funding, but refused to protect businesses from frivolous lawsuits.

“Democrats, except for Sen. Joe Manchin III (D-WV), would not agree to even limited liability protection that would expire when the public health emergency was lifted — a time that will be determined by President-elect Joe Biden… The failure to include liability reform undermines the whole purpose of passing emergency economic relief. The billions spent keeping small businesses and nonprofits afloat will be for naught if they are ultimately shuttered trying to defend themselves from unfair lawsuits arising from a once-in-a-lifetime pandemic. If that happens, it will be because the Democratic Party is a wholly owned subsidiary of the trial lawyers’ bar.”

My take.

It’s incredible that it took this long — and maddening. Depending on how you look at it, both Republican and Democratic leadership failed miserably. Donald Trump has been totally checked out of the negotiations, obsessing instead over the pipe dream that he won’t be leaving office on January 20th. Republican members of Congress and the most pro-Trump reporters on Capitol Hill are in awe of his absence, and not a soul is even pretending that he’s responsible in any way for getting this bill across the finish line — which is rather remarkable if you spend more than three seconds thinking about it.

And yet, Sen. Mitch McConnell — who is responsible for where we are — has successfully infuriated much of the Trump base who just saved him the Senate. Trump wanted $2,000 direct payments to Americans included in the bill. He also seemed to favor bigger unemployment packages and wanted it done before the election. But he was bucked at every turn — by aides, Republicans in Congress and the right-wing press. Yet it’s clear from polling (and common sense) that another round of checks (presumably with Trump’s name on them) to inject some cash into the economy would have helped Senate Republicans, who seem to be realizing this a little late, as many now concede they need the bill to help them win the Georgia runoffs.

Democratic leadership is not much better. Nancy Pelosi, in what is supposed to be her infinite wisdom and ability to see into the future, turned down a $1.8 trillion offer from the White House before the election. Now she’s getting half that, which is also about one-quarter of the bill House Democrats passed in May. Manu Raju pressed Pelosi yesterday on why this bill was more acceptable than the one that had twice the money and twice the things she wanted a month ago, and she wouldn’t answer him.

Would McConnell have passed that $1.8 trillion bill? It’s unlikely. But forcing a “no” vote from him and other Republicans would have — worst-case scenario — made the point to the country about who was holding up this package. Now, the text of the bill will be released about the same time you’re getting this newsletter. Then Congress is likely to pass it by midnight, presumably before many members even finish reading it.

Would I vote for the bill? Of course. It’s an immediate lifeline to the millions of restaurant workers out of a job, it beefs up funding for vaccines, it replenishes the remarkably effective small business loan program, it increases the chances schools can safely reopen everywhere this spring and it even (finally) offers targeted relief for the music and entertainment industries.

Even though it doesn’t include state and local funding technically, it does include money for local transit, feeding the hungry and distributing the vaccine — all of which will go through local and state coffers. And it’s probably a good thing Democrats didn’t fold on liability protections. The arguments to include them have dwindled quickly, most obviously because we’re 10 months into the pandemic and there hasn’t been a wave of frivolous lawsuits. Why would it happen in the next three months if it hasn’t happened already? The last people we need to be removing protections from now are the working-class folks who could be forced into dangerous workplaces this spring.

But I’m sure in the coming days we’ll find plenty of clever text to bail out corporate donors and benefit the top one percent, a reality that will rightfully enrage Americans and leave us once again wondering why we aren’t better served by our representatives. In this case the overarching consensus is frustratingly accurate regardless of where you stand — the bill is late, it’s deeply flawed, and there’s nothing to do but support it wholeheartedly anyway.

Your questions, answered.

Q: Could you help me understand why the pandemic has been so good for the billionaires of the world? Obviously Jeff Bezos and Mark Zuckerberg head companies that people relied on when they couldn’t leave their homes (for products and social interaction respectively) so that makes sense, but is there anything else to it? And do you think there is a way to incentivize more of the world’s wealthiest to give more of their wealth to worthy causes? I understand vanity and status by having so much money, but these people could probably solve issues like climate change and homelessness and still have more money than they could ever spend in a lifetime.

— Sara, New York, New York

Tangle: The way the super-wealthy have made out during the pandemic is a good indication in many people’s eyes of how broken our economy is — and how difficult it will be to improve the wealth gap here. In October, the Swiss bank UBS reported that billionaires increased their wealth by 27.5% just from April to July, watching their collective fortunes grow to $10.2 trillion.

Most of the reason for this meteoric rise is simple: when the stock market tanked because of COVID-19, billionaires everywhere bought up shares in whatever they could, betting on a rebound. The stock market should not be thought of as the economy, but instead as a predictor of what’s to come in the economy. So while all these stocks crashed on news of lockdowns and COVID-19 spread, people who had money on hand simply bought shares of companies at a discount. When those companies rallied, as many people expected, the shares grew in value and a lot of people cashed in on their investments.

This disparity in who could spend on the market when it tanked and who couldn’t is basically the difference here. The wealthiest 1% of Americans owned $14 trillion in stocks in the second quarter, and the bottom 50% owned just $160 billion worth. For others it’s even simpler: their wealth has climbed because the companies they own are doing well. Elon Musk has perhaps made out better than anyone, with his net worth rising from $76 billion to $104 billion — while Tesla’s value has skyrocketed.

And, to your point about putting their wealth to good use, many of those billionaires have tried to act. “Our research has identified 209 billionaires who have publicly committed a total equivalent to $7.2bn from March to June 2020,” the report said. “They have reacted quickly, in a way that’s akin to disaster relief, providing unrestricted grants to allow grantees to decide how best to use funds.”

As far as encouraging more of that behavior, I actually think what’s happening now is helping. We already give tax breaks as incentivizes to donate. There’s public pressure and public praise when the super-wealthy donate, and I think that has a positive impact that makes these philanthropic efforts more common. Of course, there will always be the cynics — if Jeff Bezos donates $10 billion, the question is why didn’t he donate $20 billion? — but it actually feels to me as if we’re a step closer every day to billionaires contributing more and more of their wealth to society, even though wealth disparity keeps growing.

When it comes to sweeping fixes like “ending homelessness,” there are a couple of things to consider. On one hand, it’s estimated that $657 million could house all of Los Angeles’s homeless population for a year (23,000 people, at about $28,565 a person). If you extrapolate that to the entire homeless population in America (approximately 550,000 people) it comes out to $15.7 billion. In other words, Musk could do it alone by donating about 15% of his net worth to the cause.

But that’s part of the issue: a lot of his money is wealth, not liquid cash. When you’re worth a billion dollars, you’re worth that money because you own very valuable assets — not because you have one billion dollars sitting in your bank account. That makes it a bit more complicated, and it also means spending that money in bulk requires putting a program or organization you trust in place to use it wisely. On top of all that, you’d be spending the money knowing that you’re not actually “fixing” any of the underlying issues that cause homelessness, just offering temporary relief.

Do I think that’s a good reason not to act? No, not really. Billionaires could give a lot more than they do to programs that feed the hungry or keep people off the streets, but without a really targeted, informed, systemic approach I’m not sure that money would really fix anything, so much as it would obscure it.

A story that matters.

Countries across Europe are banning travel from the United Kingdom right now after scientists identified a new strain of the coronavirus that’s spreading 70% faster than earlier variants. Before you panic, there are a few things to keep in mind: One, we always expected this. All viruses mutate, and there was no reason to expect COVID-19 to be any different. Two, there’s still a lot we don’t know. While “new scary strain” makes for an eye-catching headline, scientists on the ground say they’re still learning about the strain and they’re not even sure yet if it’s actually more contagious. Three, while a new strain and mutations may cause setbacks, there’s no reason (yet) to believe the vaccines we just developed won’t be effective against a new strain, too.

Numbers.

- 31. The median age of homeowners in 1981 in the United States.

- 47. The median age of homeowners in 2019 in the United States.

- 24 million. The number of nursing home residents and health care workers who are scheduled to get the first wave of the coronavirus vaccines.

- 20 million. The number of Americans over the age of 75 who are scheduled to get the second wave of the coronavirus vaccines.

- 30 million. The number of frontline workers — from firefighters to teachers to grocery store workers — who are scheduled to get a second wave of vaccines along with Americans over the age of 75.

- 30 million. The number of people aged 65 to 74 who are expected to get the coronavirus vaccine after those first three groups.

- 100 million. The total number of people expected to be vaccinated by the end of February.

- 556,000.The estimated number of Americans who have already been vaccinated.

Subscribers only.

On Friday, I spoke with election security expert David Becker. I asked him all the questions about the 2020 election that readers have asked me and prodded him about a few things I was interested in hearing, too. The feedback on this Friday edition was some of the most positive ever, but you have to be a Tangle subscriber to read it. You can check it out by clicking below:

Have a nice day.

During the pandemic, local businesses have struggled to keep up with their goliath counterparts like Amazon and Walmart. But a new small-business advocate has come up with a compelling solution: a browser extension that suggests local alternatives to items you’re about to buy on Amazon. The extension, called Sook, can give you suggestions on a product for sale near you, but also gives you alternative purchasing choices when you’re browsing Amazon or another major retailer. The extension now works in 20 American cities and is launching in Canada.