Plus, what do candidates do with leftover money?

I’m Isaac Saul, and this is Tangle: an independent, nonpartisan, subscriber-supported politics newsletter that summarizes the best arguments from across the political spectrum on the news of the day — then “my take.”

First time reading? Sign up here. Would you rather listen? You can find our podcast here.

Today's read: 11 minutes.

Correction.

In yesterday's newsletter, I wrote that "Democrats also won several key swing-state gubernatorial races, assuring executive control in Pennsylvania, Michigan, Wisconsin and Nevada." In fact, Democrats lost Nevada's gubernatorial race, in which incumbent governor Steve Sisolak was unseated by Republican Joe Lombardo.

This error is brought to you by a sleep-deprived election week in which I traveled to and from California and spent the weekend at a work conference in Palm Springs. I'm excited to get back on a normal schedule this week.

This is our 72nd correction in Tangle's 171-week history and our first correction since November 9th. I track corrections and place them at the top of the newsletter in an effort to maximize transparency with readers.

Quick hits.

- Former President Donald Trump is widely expected to announce a 2024 presidential run this evening. (The announcement)

- Katie Hobbs (D) defeated Kari Lake (R) in Arizona's race for governor. (The results)

- The suspect in a University of Virginia shooting who killed three people and injured two others has been arrested and charged with second degree murder. (The suspect)

- Amazon is expected to lay off more than 10,000 employees this week, according to several news reports. (The purge)

- An Iranian court has reportedly issued its first death sentence for anti-government protests, while sentencing five other defendants to up to 10 years in prison. (The sentence)

Our 'Quick Hits' section is created in partnership with Ground News, a website and app that rates the bias of news coverage and news outlets.

Today's topic.

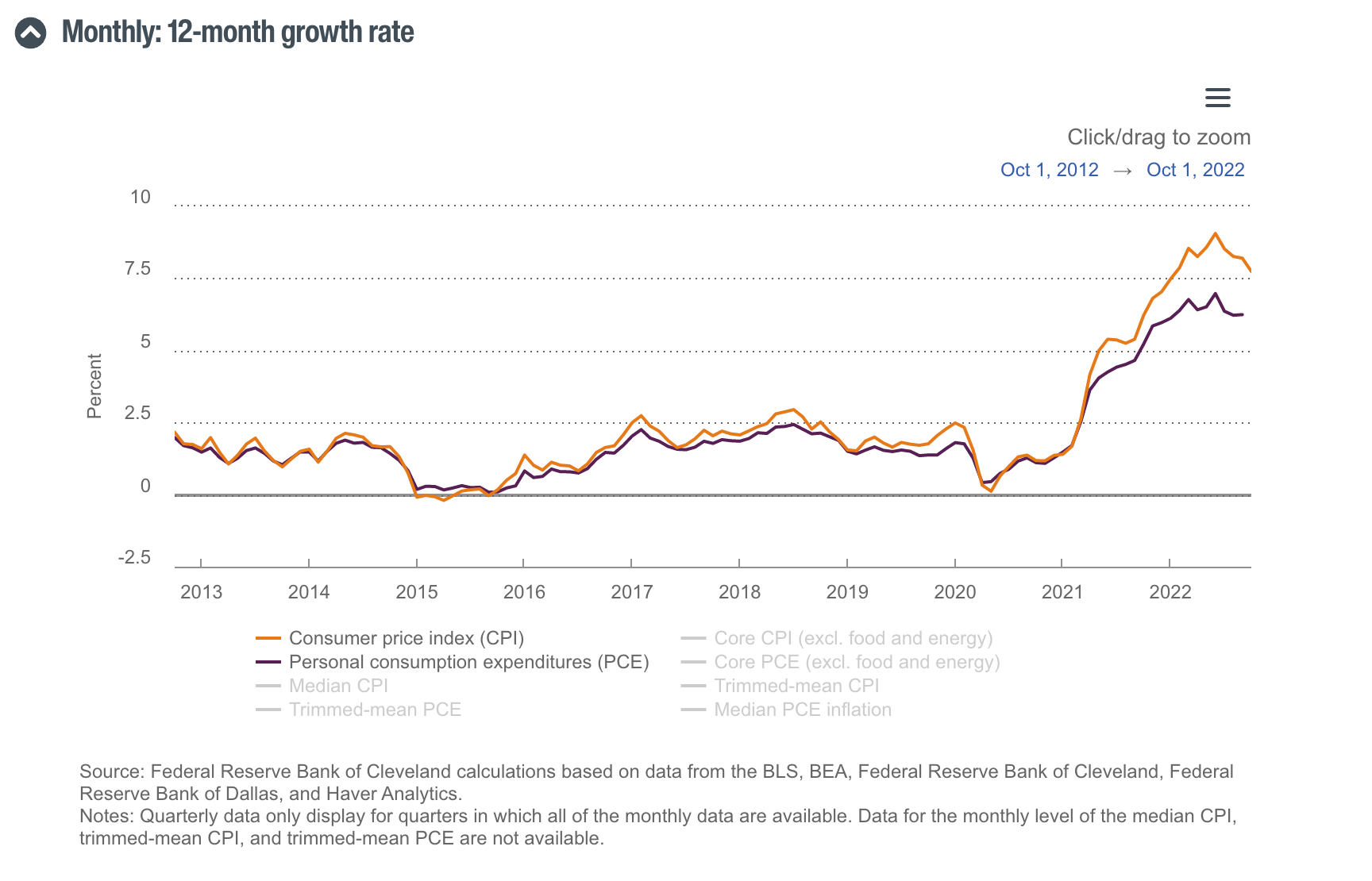

Inflation. We have been covering inflation and the latest Labor Department reports every month since May, since this year’s midterm voters continually pointed to it as their number one concern in the country. Reminder: Inflation is measured by the Consumer Price Index (CPI), which is designed by the Bureau of Labor Statistics to measure price fluctuations for urban buyers, who represent the vast majority of Americans. The CPI tracks 80,000 items in a fixed basket of goods and services, representing everything from gasoline to apples to the cost of a doctor's visit.

On Thursday, in the midst of a sea of news about the election results, the Labor Department released its latest inflation numbers. The CPI rose 7.7% annually in October, the first time annual inflation rates have fallen below 8% in eight months, giving the Federal Reserve its strongest signal yet that inflation may be slowing. Meanwhile, the CPI rose 0.4% in October after climbing by the same margin in September, which was below the 0.6% that economists had predicted.

Over half of the increase in CPI was driven by soaring rents, while gasoline prices ticked back up after three months of decreases. Food prices at the grocery store continued to skyrocket, up 12.4% on the year, while the cost of food at restaurants is up 8.6%.

Despite that, the encouraging signs spurred a major rally on Wall Street and sent U.S. Treasury yields tumbling (treasury yields are effectively the yearly interest rate the U.S. government pays on money it borrows to raise capital through selling Treasury bonds; when yields go up, banks usually have to respond by raising interest rates on the people they lend to).

Core CPI, the measure of inflation with more volatile food and energy prices removed, went up 6.3% annually, down from 6.6% in September. At a monthly rate, the core CPI climbed just 0.3%, down from the 0.6% it had risen between August and September.

“It’s pretty clear that inflation has definitely peaked and is rolling over," Mark Zandi, chief economist at Moody’s Analytics, said. "All the trend lines suggest that it will continue to moderate going forward, assuming that nothing goes off the rails.”

Others expressed more caution, noting that the rate is still well above the Fed's 2% target, while prices for rent and food continue to rise.

“One month of data does not a victory make, and I think it’s really important to be thoughtful that this is just one piece of positive information, but we’re looking at a whole set of information,” San Francisco Fed President Mary Daly said.

Today, we're going to take a look at some reactions from the left and right, then my take. You can find all our previous inflation coverage here.

What the right is saying.

- Many on the right are skeptical this is the end, but share some optimism about finally seeing reliably good numbers.

- Some warn that we've seen this before, and the dawn never came.

- Others say a Republican-controlled House could help slow inflation by reducing the Biden administration’s spending.

The Wall Street Journal called it a "modest reprieve" and warned that it might be temporary.

“An increase of 7.7% in the overall consumer-price index compared to a year ago remains unusually high, although it marks the fourth monthly decline in the inflation rate from a peak of 9.1% in June. Core inflation excluding food and energy was 6.3%, which is down from 6.6% in September but has yet to show a lasting downward trend," the board said. "Investors (desperately want to) believe this means inflation is coming under control. Some caveats are in order. Prices still are rising at an abnormally fast pace, and households will notice that a falling inflation rate is not a stable price level. Much of the disinflation comes via prices for goods, which declined 0.4% from September to October, notably for durables such as appliances. This is a result of a cooling housing market and is the kind of demand destruction the Fed says it wants to achieve.

“Prices for services, in contrast, rose 0.5% month-to-month, and food and energy prices rose by 0.6% and 1.8% respectively on a monthly basis. Inflation remains widespread across the economy and thus hard to tamp down. One consequence of leaning on the Fed to fight inflation on its own by suppressing demand is that households are left with few ways to boost their standard of living. Inflation-adjusted weekly earnings fell in October, and are now down 3.7% in the last 12 months,” the board said. “At this rate it will take a long time for households to recover the purchasing power they’ve lost during this inflationary bout, even if the inflation rate moderates. Congress and the Biden Administration could help with policies to stimulate productive investment to fuel new supply and real wage growth, but on Wednesday President Biden was still deploring ‘trickle-down’ policies. There’s only been falling real incomes on his economic watch.”

In The New York Post, Brian Riedl said a GOP-led House will help address inflation by stopping Biden's enormous spending.

“Yes, much of the inflation reflects an economic hangover from the pandemic. Yet President Biden and Democrats have actively driven prices higher through energy regulations, tariffs, buy America rules, tightened ethanol mandates, Davis-Bacon rules raising construction costs, and restrictions on new building. Most destructive of all has been the president’s historic spending spree, which has added $4.8 trillion to the 10-year budget deficit. The Federal Reserve calculates that the President’s $1.9 trillion American Rescue Plan was a major inflation contributor. The student loan bailout — if it survives legal challenges — will push inflation even higher. That will force the Federal Reserve to further rate-hike the economy into a likely recession, with significant job losses.

“And that is why it was so important for Tuesday’s voters to stage an intervention and take away President Biden’s credit card. While the results were less than expected, the current vote counts show that the majority of voters chose a Republican House, with inflation and the economy their top concerns,” Riedl wrote. “Republicans may not have produced a comprehensive anti-inflation agenda, but their most valuable weapon will be gridlock. While Biden has already enacted $4.8 trillion in new spending, he had proposed a staggering $11 trillion during his 2020 campaign. Any chance of enacting the final $6.2 trillion in remaining promises — digging the inflation and deficit ditch even deeper — is almost surely dead with a GOP House.”

In National Review, Andrew Stuttaford said there was "some progress."

“Much of the easing of pressure was seen on the goods side, a function, in part, of retailers that “over-ordered” during the supply-chain mess and are now dumping inventories, but also a sign that might suggest that squeezed consumers are spending less,” Stuttaford wrote. “It is also worth noting that used-car prices, which have been in sharp focus since we began emerging from the pandemic, also eased on a month-on-month basis, and, in the view of the Wall Street Journal’s Justin Lahart, ought to fall further. That seems reasonable. ‘Shelter,’ notes Lahart, is still pushing the headline number up, but that’s a lagging indicator.

“There are clear signs that rents have peaked, and house prices (which are reflected within this part of the index in a rather convoluted way) are clearly looking shaky. Shelter accounts for about a third of the index," Stuttaford said. "With the labor market still tight, I’d keep a[n] eye on wage pressure, which feeds, of course, into higher services prices. We’ve seen a false dawn before in this cycle, but there may be more reason this time to think that, absent an additional “external” shock, this may be the moment we have been waiting for. But even if this is the peak, we remain a long, long way from the 2 percent target (remember that?)."

What the left is saying.

- Some on the left are very optimistic about the numbers, and say Biden and the Fed are executing a good plan.

- Many argue that inflation has peaked.

- Others say the Fed cannot stop raising interest rates, and we need to be sure this is a consistent trend.

In Bloomberg, John Authers said reasons for optimism are adding up.

“The October consumer price inflation report proved to be better than the month before and much better than expected. Subsidiary statistical measures suggest that this peak in inflation, unlike several previous false dawns, may not prove to be illusory. An emphatically strong market reaction, with prices of both bonds and stocks rallying impressively, was justified," Authers said. "The headline year-on-year inflation rate dipped again and so — crucially — did the ‘core’ measure that includes the highly variable prices of food and fuel. The alarming and almost constant increases that started early last year have ended... The last time core inflation came in this far under the consensus expectation compiled by Bloomberg was in early 2020, just as the pandemic took hold.

“More important still, underlying metrics confirmed that this time might really be the peak, in a way they conspicuously failed to do earlier this year when core CPI last seemed to have started a descent. The chart [above] shows the ‘trimmed mean’ inflation produced by the Cleveland Fed that excludes the biggest outliers in either direction from the index’s components, and takes the average of the rest; and the ‘sticky’ inflation measure produced by the Atlanta Fed, which looks only at the goods and services whose prices are hardest to change,” Authers said. “In practice, when these measures rise, it’s taken as a sign that inflationary pressure is gaining strength; and so it’s good to see that while both remain very elevated, the trimmed mean has dipped slightly, while sticky price inflation is unchanged. This is consistent with the notion that the overall peak is in, although doesn’t prove it.”

In The Washington Post, Jennifer Rubin celebrated the possibility of the so-called "soft landing."

“If the markets rallied because they were expecting Federal Reserve Chair Jerome H. Powell to curtail rate hikes, they have misjudged him. When announcing the last rate hike earlier this month, he warned, ‘It is very premature to be thinking about pausing. People when they hear “lags,” they think about a pause.’ He added... Caution is warranted,” Rubin wrote. “An early inflation hawk, Lawrence H. Summers, echoed that view on Thursday after the CPI number came out. ‘Encouraging CPI number. This is comparable on the low side to some of the earlier surprises on the high side,’ he tweeted. ‘Cannot make judgements on a single monthly number, but this is not one that can be dismissed.’

“The administration, meanwhile, will be constrained in new spending because of a closely divided Congress. If so, Biden’s deficit reduction total ($1.7 trillion so far) may increase. While politically frustrating for the administration, focusing on protecting and implementing its agenda rather than adding new spending items may prove economically advantageous," Rubin wrote. "Biden correctly claims the United States is in an enviable position internationally. Russia’s economy is collapsing; China has been stymied by the pandemic. Britain and the European Union face rocky economic times... The United States remains the most attractive venue to spend your money, the country most likely to come out of the post-pandemic turbulence in the best condition.”

In The New Republic, Timothy Noah said inflation is dwindling — and there's even a growing possibility we can avoid a recession.

"Inflation peaked five months ago: October was the fourth consecutive month during which the overall inflation rate fell," Noah wrote. "Between June and September, core inflation rose from 5.9 percent to the aforementioned 6.6 percent, and that was bad. Now it’s going down, and that’s good. The Fed’s preferred measure, the personal consumption expenditures, or PCE, price index, showed a much milder core-inflation increase between June and September than the CPI—0.1 percentage point—which perhaps deserved more attention than it got. We don’t yet know what happened to the PCE index in October, but probably, like the CPI, it went down.

"A week ago I wrote that ordinary Americans were worrying more about inflation than the Federal Reserve was, and that this struck me as excessive. But did they listen? Enough, perhaps, to avoid the predicted 'red wave'... Fifty-four percent of voters said they trusted Republicans more than Democrats to tackle inflation, even though the Republican answer to inflation, like the Republican answer to everything else, is to cut taxes—which would increase rather than reduce inflation," Noah wrote. "Of that 54 percent, a shocking 9 percent were people who voted Democratic! This might be a good moment to remind everybody that Paul Volcker, the Fed chairman widely celebrated for ending the Great Inflation of the 1970s by bringing on what was at that time the worst recession since the Great Depression, was a Democratic appointee. As I’ve written before, the economy consistently runs better under Democratic presidents, and that includes lower inflation."

My take.

Reminder: "My take" is a section where I give myself space to share my own personal opinion. It is meant to be one perspective amid many others. If you have feedback, criticism, or compliments, you can reply to this email and write in. If you're a paying subscriber, you can also leave a comment.

- It's hard to be optimistic, given how many times we've gotten some encouraging signs.

- This does seem a little different, in that many commentators on the right are also hopeful.

- The reasons to be skeptical now are different than they were three or four months ago.

Look, I'm hopeful. But we've also seen this before.

As I've previously noted, over the course of the last year, the commentators considered "on the right" have been the ones who've mostly gotten their calls about inflation right. Whether that's due to their own negative bias toward Biden or not, every time we've had some light at the end of the tunnel it has instead been an oncoming train. I was encouraged to see some conservative economists and pundits, this time, saying yes, this really might be a good sign. But my optimism is cautious given what we've seen.

The last time we were truly optimistic about inflation was in September, when Biden was heralding “zero” inflation but there were major caveats that the core CPI was still rising. Back then, the optimism was very one-sided, and many economists and pundits with center or right-wing views warned that the report wasn’t as good as the White House was making it out to be. They were right. This time, economists from across the board seem moderately optimistic, and if there is a reason for concern, it’s different from why we were worried in September.

The biggest caveat that I've found to these numbers came from Jonathan Levin in Bloomberg, who wrote a very informative piece about how the pricing of healthcare is being skewed by a methodology quirk. The short version is that health insurance inflation rate data is updated once a year and spread out over 12 months, and the latest batch of data is being pulled down by a misleading drop in costs. Similar to how housing inflation is a lagging indicator (because leases are often signed for a year), healthcare costs may be showing deflationary numbers because they're comparing last year's health costs to this year's economy. Healthcare costs could be rising, but we don't see those figures yet.

Is this a small asterisk or a big one? I'm comfortable saying I truly don't know. Economists can't even seem to agree.

Either way, Thursday's report is just one data point, and we'll need a few more before we can really call deflation a trend. When it comes to practical implications, there is no reason the Fed should let up (yet) on raising interest rates. If it's working, keep doing it. If it isn't working (or if this does prove to be only a blip), they'll be much happier in a month if they don't let up now. The cost of food, gas and shelter were all up last month, and those are the costs that the broadest swathe of Americans feel most acutely.

Of course, politically, Biden can celebrate a strong week: Unexpected success in the midterms, a report on inflation that even his critics are welcoming, and a highly-anticipated meeting with China's President Xi that points to the potential for bilateral relations between China and the U.S. improving. More than anything else, the last seven days are yet another reminder of just how quickly political fortunes can change.

Your questions, answered.

Q: How do candidates use excess campaign funds? What limitations are applied to these funds and who polices the use of these funds?

— Ellis from Blythewood, South Carolina

Tangle: Great question. The vague, unsatisfying answer is that it depends a little bit on what state, what type of election, and who or where the money came from (or what it went to — a candidate directly, or a Super PAC).

That being said, generally speaking, the leftover money cannot be used for any personal purposes or stowed away. The Federal Election Commission (FEC) is the organization that polices these rules.

The funds have to be used on donations to charities, other candidates running for office, transfers to political parties, or future races for the same candidate. So, for instance, Blake Masters (who lost in Arizona's Senate race) could keep any leftover money that was donated and then use it to run again in a few years. Or he could donate it to the RNC. Or he could donate it to other candidates. Some candidates will create slush funds, where they start "leadership" PACs and then use that money to advance a certain political agenda or other candidates.

The big no-no with political donations is basically anything that is personal. For instance, you are violating the law if you take that leftover money and go buy a home. You also can't just hire a bunch of friends and family members to some bogus position and pay them — they need to prove that they are doing actual political work for an actual campaign, otherwise you are violating campaign finance rules.

Typically, the most unspent money you'll see is sitting in a super PAC, which — by the letter of the law — isn't allowed to coordinate with campaigns. So when they have money left over, what they usually do is support that same candidate at a future date or other candidates of the same party. Every now and then, Super PACs will even reimburse donors for money spent on a losing campaign.

Investopedia has a great, simple article about the basics on this.

Want to have a question answered in the newsletter? You can reply to this email and write in (it goes straight to my inbox) or fill out this form.

Under the radar.

In the United States last year, 41.4 million Adderall prescriptions were dispensed, up 10% from 2020. The drug, which is commonly used to treat ADHD or hyperactivity disorder, is in such high demand that there is now a shortage in the U.S. Some regular users are experiencing stimulant withdrawal, while others are turning to unregulated dealers or illegal drugs as substitutes. Earlier this month, the U.S. Food and Drug Administration (FDA) announced a nationwide shortage. Whether Adderall is overprescribed in the U.S. is a question worth asking, but in the immediate term the issue at hand is what will happen (and is already happening) to Americans cut off from a stimulant they have been prescribed and regularly taken for years. WIRED has the story.

Numbers.

- 8 billion. The estimated population of earth, as of today, according to projections from the United Nations.

- Triple. The global population size today compared to 1950.

- 0.6%. The drop in medical care services costs over the last month, according to the latest BLS report.

- 2.4%. The drop in used vehicle prices over the last month, according to the latest BLS report.

- 0.8%. The rise in shelter costs over the last month, according to the latest BLS report.

- 0.6%. The rise in food costs over the last month, according to the latest BLS report.

Have a nice day.

Salt Lake City's city council is going to test an innovative idea to address homelessness. The council voted last week to build a community of "tiny homes" for people experiencing chronic homelessness in a project they hope can become a model for other cities. The Other Side Village is the organization behind the project, which plans to provide permanent housing to the homeless and specifically target those with mental illness or addiction issues. Along with 60 fully equipped homes, the neighborhood will have stores and employment opportunities for residents to encourage them to spend time in the village. NPR has the story, along with advice from the organizers about how the broader issue of homelessness might be better addressed.

Dear readers,

Here are some ways to help...

💵 If you like our newsletter, drop some love in our tip jar.

📣 Share Tangle on Twitter here, Facebook here, or LinkedIn here.

😄 Share https://readtangle.com/give and every time someone signs up at that URL, we'll donate $1 to charity.

📫 Forward this to a friend and tell them to subscribe (hint: it's here).

🎧 Rather listen? Check out our podcast here.

🛍 Love clothes, stickers and mugs? Go to our merch store!